We continued to build up our assets this year. The strategy remained largely identical, new investments were added in some cases and a few were swapped for others. Individual positions were increased more strongly, while others were significantly reduced. The focus naturally remained on the dividend strategy and increasing the monthly cash flow via regular savings plans. All of these changes are discussed in more detail in this article.

Identical strategy, new securities

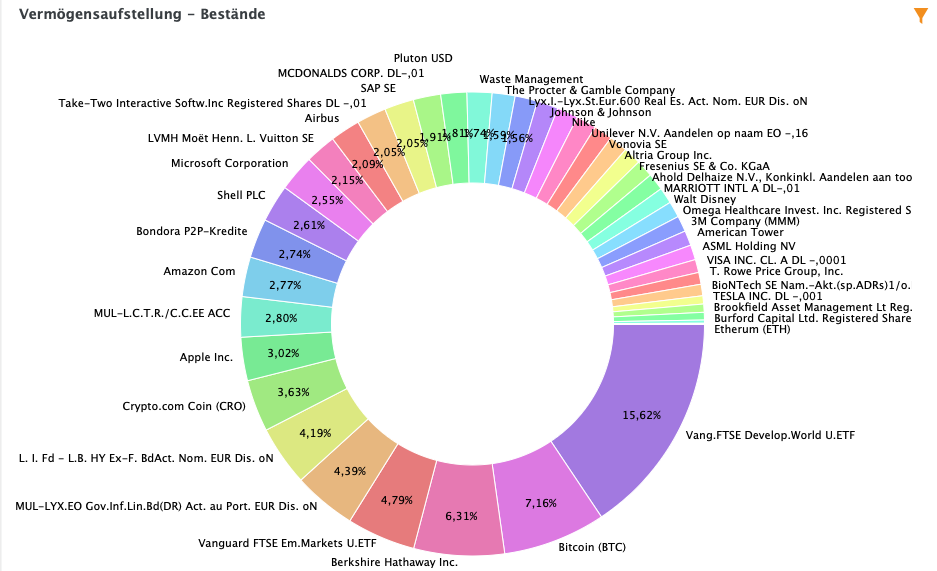

As already mentioned, the basic strategy has not changed. In 2023, we continued to invest primarily via monthly savings plans in two different investment strategies: Once in a broadly diversified global portfolio consisting of several ETFs and ETCs that invest in shares, bonds, commodities and real estate, and once in several individual shares that predominantly pay a regular dividend. One strategy represents long-term retirement provision to close the pension gap, while the other is intended to enable earlier retirement.

Of course, the absolute basics of investing are always taken into account: All securities cover different sectors, currency areas and continents, but also include companies of different sizes and, of course, different business models. In addition, investments continue to be made in P2P loans and cryptocurrencies and some of the liquid reserves are held in call and fixed-term deposit accounts as a nest egg.

The latter has been significantly reduced in the last year due to external circumstances, which will force me to spend less money on shares, ETFs and cryptocurrencies in the coming months in order to have a real nest egg that I feel comfortable with. In order to remain as flexible as possible, these funds are almost exclusively with Scalable Capital*, where the Prime+ subscription offers 2.6% interest* on credit balances.

Probably the biggest change was initiated in November and only implemented shortly after the turn of the year, but it had the biggest impact on my investment. Until now, I had kept my ETF portfolio with comdirect* and recently moved all my share savings plans to Scalable Capital. Due to a bonus promotion, better conditions and central availability, I decided to transfer my entire custody account to Neobroker.

As a result, I had to swap my Nestlé position for Koninklijke Ahold Delhaize and sell the Wirecard position, which was supposed to remain as a memorial. Due to the takeover of Activision Blizzard by Microsoft, which gave me a nice sum of money with a good return, Take-Two Interactive replaced the gaming sector. Other new additions were Burford Capital and Brookfield Asset Management. There were a few exchanges of ETFs into equivalent funds due to liquidations.

The portfolio therefore contains 36 positions, of which 26 are usually held regularly. Those that are not eligible for savings plans were topped up via smaller individual purchases when sufficient dividend payments were received.

My global portfolio of ETFs and ETCs:

- 39,2 % Vanguard FTSE Developed World (WKN: A12CX1)

- 16,8 % Vanguard FTSE Emerging Markets (WKN: A1JX51)

- 15 % Staatsanleihen (WKN: LYX042)

- 15 % Unternehmensleihen (WKN: LYX0YX)

- 7 % Rohstoffe (LYX0Z2)

- 7 % Immobilien (LYX0Y0)

My equity positions are as follows:

- 3M Company

- Ahold Delhaize

- Airbus SE

- Altria Group Inc.

- Amazon.com Inc.

- American Tower Crop.

- Apple Inc.

- ASML Holding N.V.

- Berkshire Hathaway Inc.

- Biontech SE

- Brookfield Asset management

- Burford Capital Ltd.

- Fresenius SE & Co. KGaA

- Johnson & Johnson

- LVMH Moet Hennessy Louis Vuitton SE

- Marriott Intl. Inc

- McDonald’s Corp.

- Microsoft Corp.

- Nike Inc.

- Omega Healthcare Investors Inc.

- Royal Dutch Shell PLC

- SAP SE

- Take-Two Interactive Software Inc.

- T. Rowe Price Group Inc.

- Tesla Inc.

- The Procter & Gamble Co.

- Unilever PLC

- Visa

- Vonovia SE

- The Walt Disney Company Co.

- Waste Management Inc.

Equities and ETFs good, cryptos excellent

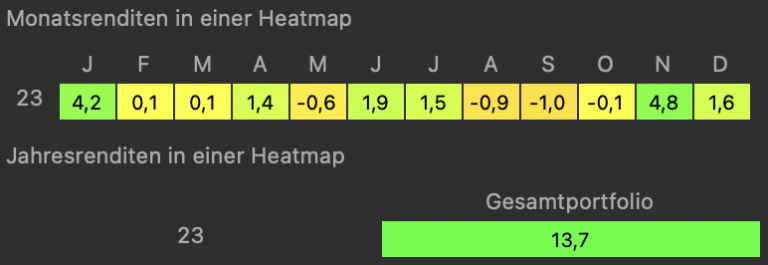

My equity portfolio generated a return of 15.8 % for 2023 as a whole, while the ETF portfolio did not increase quite as much at 9.7 %. Nevertheless, the development is more than pleasing, as there was still a negative return in 2022.

The trend in crypto investments is even clearer. After suffering a severe loss in value of 66.3 % last year, crypto investments saw an impressive 73.5 % increase in 2023, although this still did not fully compensate for the loss. Another total loss can be seen at Hi.com, while Plutus was increased to a new reward level and Crypto.com no longer recorded any purchases or cashbacks due to the recent significant reduction in rewards.

In general, the 2023 crypto portfolio developed into a “Bitcoin-only” portfolio. The majority of the Ethereum position has now been exchanged for Bitcoin, and all other coins with the exception of Plutus will also be exchanged for Bitcoin in the coming months as soon as market sentiment turns positive. I am convinced that Bitcoin will have a positive impact on society and will be the next big thing for humanity after the internet. This is one reason why I now run a full node and have several miners actively supporting the world’s most secure network with the scarcest commodity. The advantages of Bitcoin outweigh the disadvantages.

Of course, all coins and tokens are largely decentralized and stored securely on a Ledger Nano X. The fiscal organization is handled by Blockbit.

All in all, the year was quite successful. The overall portfolio recorded an increase of 13.7%, although it was not possible to beat benchmarks such as the S&P 500 or the German benchmark index DAX. Nevertheless, this target was achieved in individual sub-segments.

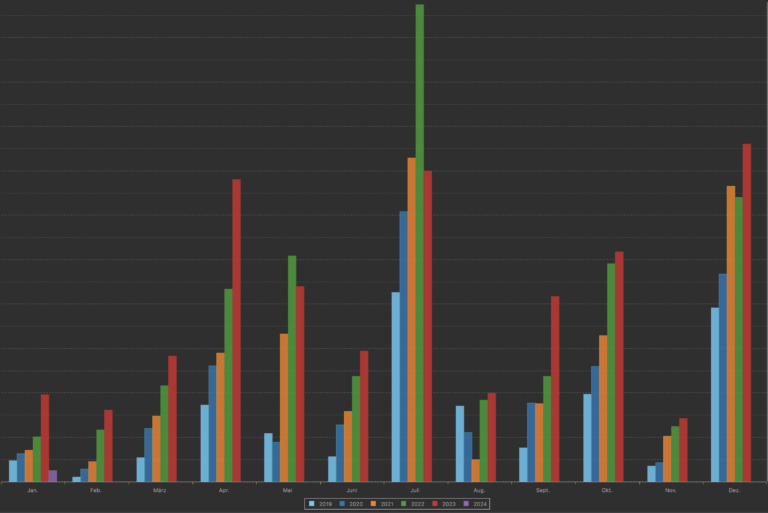

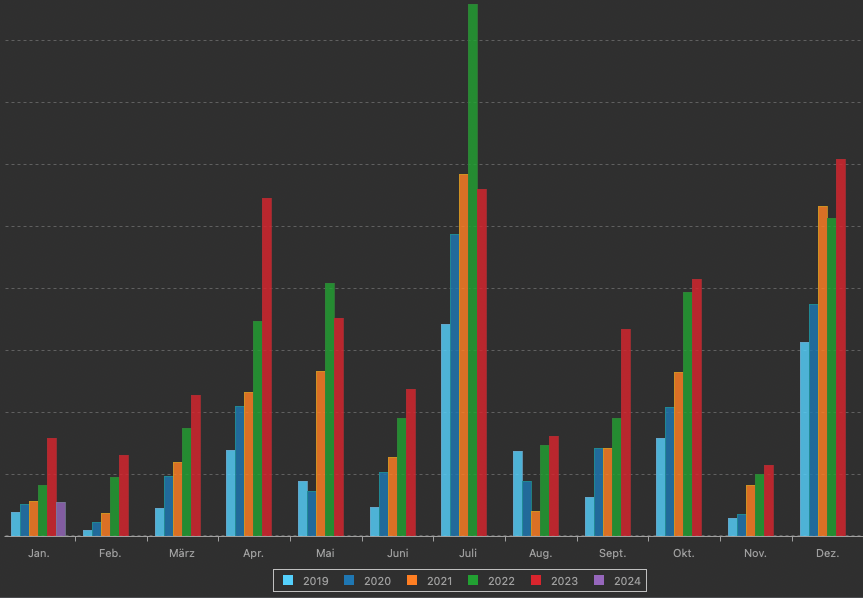

Record dividend distributions

Due to regular savings rates and the resulting steady stream of new and additional purchases, the shares of all positions have continued to grow. In conjunction with a further increase in dividend payments, this brought me a new record for distributions, although the increase was not as significant as it was from 2022 to 2023. There was an increase of around 14%. I was therefore able to mark a few more days in the dividend calendar. I expect to set new records again in 2024.

Positive outlook

I remain positive for the year 2024. The crypto market in particular – especially Bitcoin – could see significant value growth again in the coming months. The ETF approval, which has already been completed, will bring institutional and new money into the market, while the halving, which is expected to take place in April, should further reduce the freely tradable stocks of Bitcoin and thus ensure the next bull run. On the stock markets, indices are already climbing from one all-time high to the next, which is keeping sentiment high. The positive sentiment is somewhat dampened by the crises in Ukraine and Isreal and, of course, the still high inflation.

Be that as it may, I’m going ahead and stocking up!