Whereas in recent years you could count yourself lucky with 0.01% overnight interest rates, in times of sharply rising consumer prices and the associated end of the low interest rate policy, there are once again significantly more attractive interest rates. At the moment, banks seem to be bidding up their interest rates on a regular basis and are tempting customers week after week with new high bids on overnight and fixed-term deposits.

Not so long ago, we recommended to the readers of this blog to remain patient and not to jump on every new interest offer. If you regularly move smaller tranches of your nest egg and build an interest rate staircase, you can be relaxed about the entire development and still benefit from rising interest rates and a high degree of flexibility.

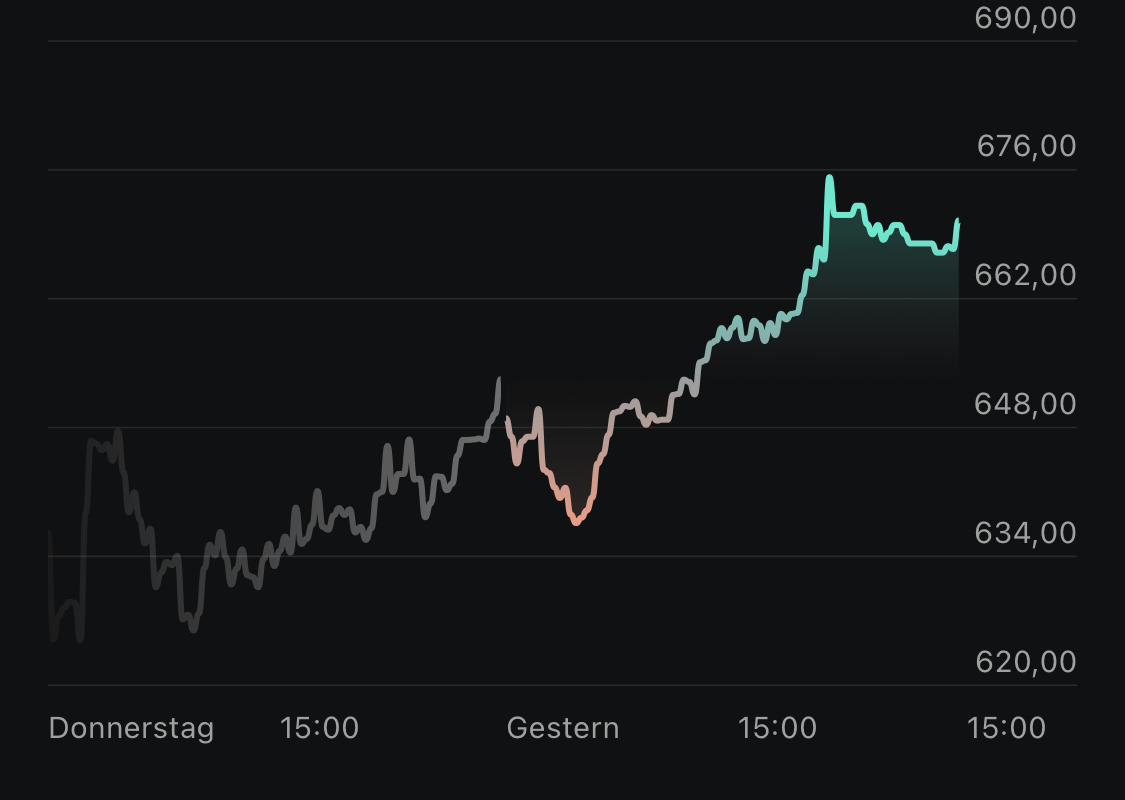

With Trade Republic* and Scalable Capital*, two popular neobrokers for stock and ETF savings plans have now joined the trend and offer but immediately for balances in their clearing accounts a high interest rate. While there is 2% per year at Trade Republic*, customers of Scalable Capital* can even collect 2.3% annually. In the end, however, it is not quite that simple, as a closer comparison shows, because the two offers could not be more different.

Once a little less, once only a subscription

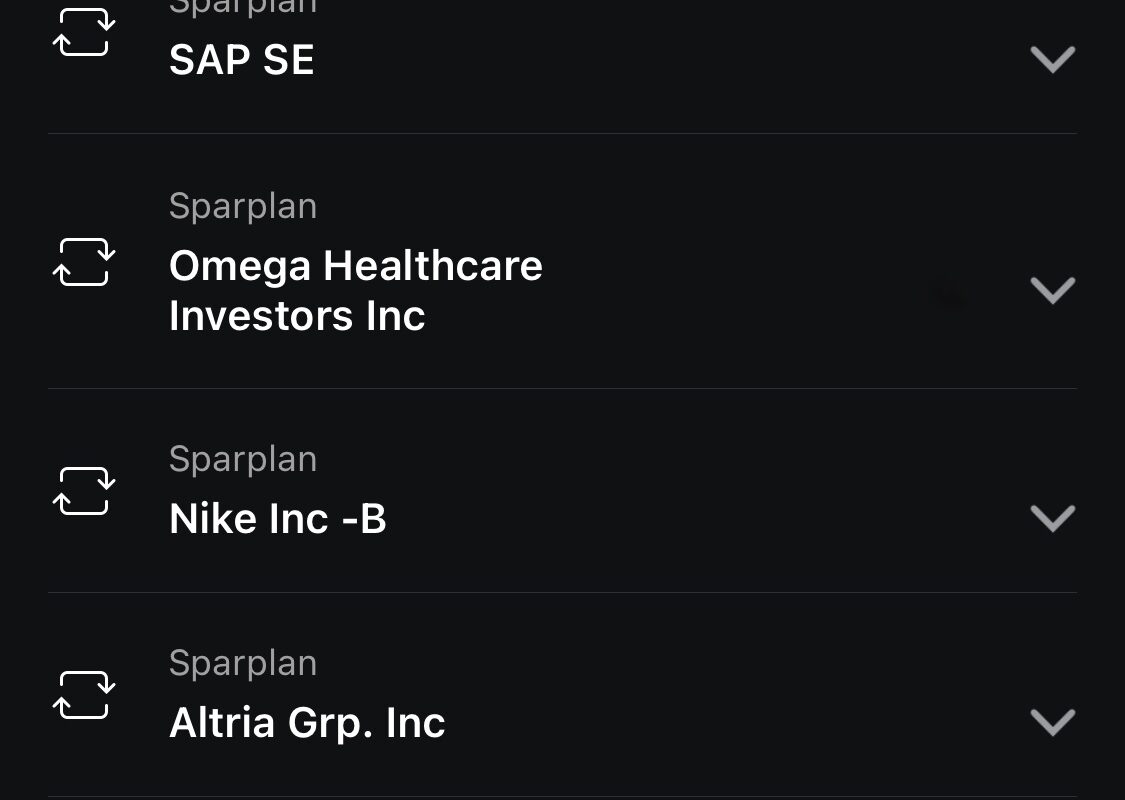

With Trade Republic*, things are actually quite simple: Here, you receive – whether you are an existing or new customer – 2.0% interest per year on all your deposits in the clearing account, which is paid out at the end of each month up to an invested capital of 50,000 euros. The remaining conditions remain identical to the previous offer, whereby one pays 1 euro for each share purchase and can execute as many savings plans as desired free of charge.

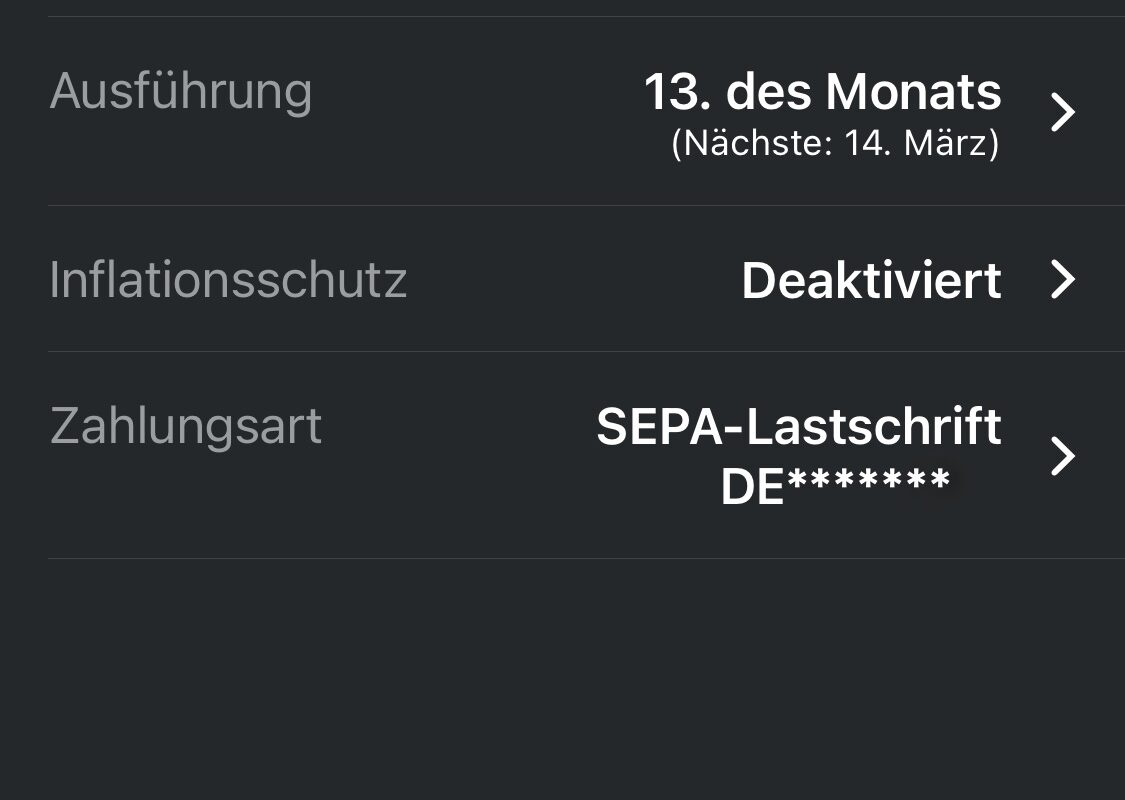

With the competitor Scalable there is even 2,3% interest per year, which gives it however only for customers of the new Prime+ program, which strikes monthly with 4,99 euro to account, but for it also free of charge share purchases and savings plans over the stock exchange Munich makes possible. However, interest is only paid on a quarterly basis. In addition, the interest rate even applies to uninvested capital in an amount of up to 100,000 euros and thus for twice the amount as with Trade Republic*.

“For the price of just 4.99 euros, PRIME+ gives you everything from A for shares to Z for interest. In addition to the highest interest rates, it offers trading without order fees and unlimited savings plans.” says Erik Podzuweit, founder and co-CEO of Scalable Capital*. “We make PRIME+ membership so attractive that it’s virtually irresponsible not to become a member.”

So if you want to benefit from Scalable’s high overnight interest rates, you either have to be a frequent trader or invest at least 2,600 euros to recoup the monthly fee via interest payments. Existing customers of the previous prime broker must pay about 2 euros more per month for the upgrade and thus have at least 1,000 euros in the overnight deposit.

In any case, customers of both providers do not need to worry about their deposits. With both Neobrokern the European deposit protection takes effect up to a total deposit of 100,00 euro. Shares and funds are regarded as special assets anyway.

Hope for more turnover

The intention behind the high interest rates is clear: Trade Republic* and Scalable Capital* try to bring with their offers also those closer to shares and the stock exchange, which start first only with the daily money account. The attractive interest rates have a certain marketing effect for both brokers and should certainly attract one or the other new customer, who could then also bring some turnover via stock market trading.

At Scalable Capital*, however, the new account model could also serve to sound out the pain thresholds of customers when it comes to alternative earning opportunities for its own business model, because payment via so-called refunds is on the brink in Germany – and thus actually the business basis of an entire industry. But that is another topic…