A little more than a year ago, I first provided an insight into my personal investment and published the performance to date. Since then, not only the return or the monthly cash flow has changed, but also the composition. I would now like to take a closer look at these changes.

Identische Strategie, neue Titel

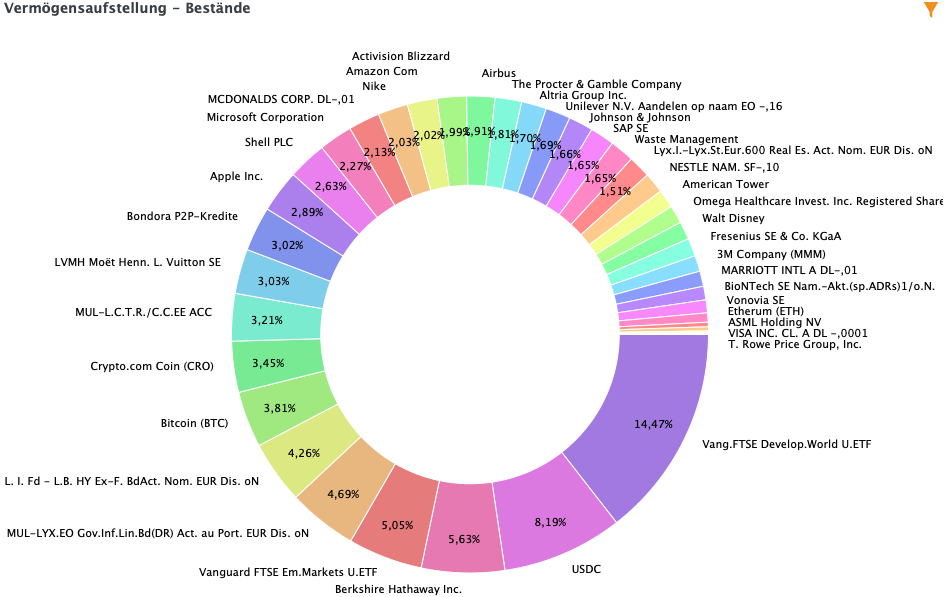

Nothing has changed in my basic strategy. I continue to invest primarily via monthly savings plans in two different investment strategies: once for my retirement provision in a broadly diversified ETF and ETC portfolio that replicates a kind of world portfolio with stocks, bonds, commodities and real estate, and once in a dividend stock portfolio in order to be able to retire perhaps a few years earlier. Of course, all my individual stocks are also broadly diversified and thus cover different industries, currency areas and continents, but also include different sized companies in terms of market capitalization. On top of that, I invest in P2P loans, cryptocurrencies and, of course, have part of my reserves in various overnight and fixed deposit accounts.

I park the latter in other European countries via Zinspilot* and Weltsparen*, but I have now also stashed a large part of it with Scalable Capital*, which offers an impressive 2.3% interest rate on the Prime+ subscription. With the exception of mergers, nothing has changed in my ETF portfolio, which I hold at comdirect. Here, I have been stubbornly putting my usual savings rate into my six stocks month after month. On the other hand, there were one or two additional purchases in the individual stocks. Biontech and Marriott were each added to the portfolio as one-time purchases; Tesla, Visa, ASML and T. Rowe Price Group were added to the savings plan. My single stock portfolio now has 32 positions, 26 of which are regularly invested in each month.

My world portfolio of ETFs and ETCs:

- 39,2 % Vanguard FTSE Developed World (WKN: A12CX1)

- 16,8 % Vanguard FTSE Emerging Markets (WKN: A1JX51)

- 15 % Staatsanleihen (WKN: LYX042)

- 15 % Unternehmensleihen (WKN: LYX0YX)

- 7 % Rohstoffe (ETF090)

- 7 % Immobilien (LYX0Y0)

My stock positions are as follows:

- 3M Company

- Activision Blizzard Inc.

- Airbus SE

- Altria Group Inc.

- Amazon.com Inc.

- American Tower Crop.

- Apple Inc.

- ASML Holding N.V.

- Biontech SE

- Berkshire Hathaway Inc.

- Fresenius SE & Co. KGaA

- Johnson & Johnson

- LVMH Moet Hennessy Louis Vuitton SE

- Marriott Intl. Inc

- McDonald’s Corp.

- Microsoft Corp.

- Nestle Inc.

- Nike Inc.

- Omega Healthcare Investors Inc.

- Royal Dutch Shell PLC

- SAP SE

- T. Rowe Price Group Inc.

- Tesla Inc.

- The Procter & Gamble Co.

- Unilever PLC

- Visa

- Vonovia SE

- The Walt Disney Company Co.

- Waste Management Inc.

- Wirecard AG (tote Position)

Equities and ETFs passable, cryptos bad

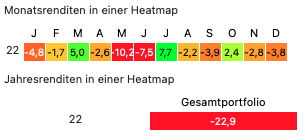

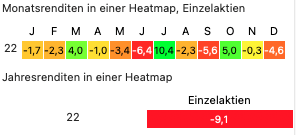

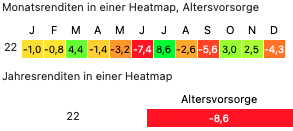

My stock portfolio gave me a negative return of 9.1% for 2022 as a whole, while the ETF portfolio was not quite as bad, down 8.6%. Roughly speaking, little happened despite the regular deposits.

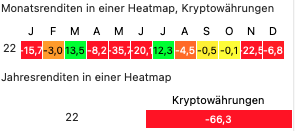

More significant were the losses in the crypto market. Here, I lost 66.3% compared to the previous year, but most recently I bought more Bitcoin and Ethereum or participated in other exciting projects such as Plutus or Hi.com. The reason for the strong setback was not only the end of the bull run and thus the change into the bear market, but also that I had lost almost my entire position in the TerraLUNA crash and the FTX bankruptcy.

Precisely because more and more exchanges were wobbling, I therefore said goodbye to staking for the most part this year and parked my coins and tokens decentrally and securely on a Ledger Nano X under my own responsibility. Should a large exchange such as Crypto.com wobble again, my coins are safe.

All in all, it was a losing year. My overall portfolio was down 22.9%, which means that my personal return lagged behind the market development. The S&P 500 and even Germany’s leading index, the DAX, did not fall quite as much as my investments. After all, if I had only had my comdirect* and Scalable portfolio*, I would have beaten the overall market.

Record dividend payouts

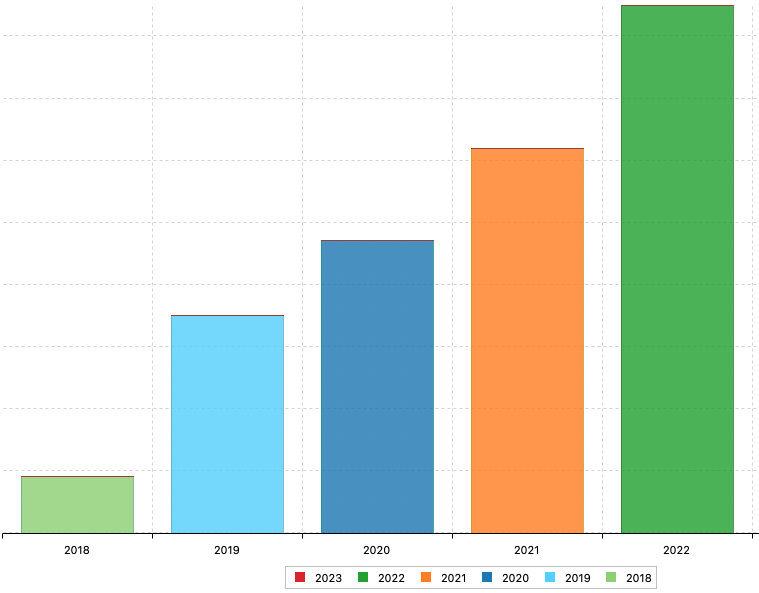

However, falling yields also mean that you can get more shares through your steady new purchases via a savings plan and thus, in the long run, lower your cost price and increase your dividend yield. In fact, in 2022 I received more dividends than ever before, allowing me to mark off a few extra days on my freedom calendar. My dividend payouts increased by a whopping 28%.

This positive trend seems to be continuing in the new year, because in January alone I was able to almost double my distributions year-on-year in absolute terms. For February and March it looks no different. It’s a good thing that the politicians have increased the saver’s allowance a bit… 😉