The stock market year 2023 was extremely successful for Germany’s largest benchmark index. While the DAX was still below 14,000 points at times in January, it closed at an impressive 16,864 points at 2 p.m. on the last trading day of the year, only slightly below its all-time high, which it had regularly reached in the weeks before. In mid-December, the index was at times well above 17,000 points.

Nevertheless, this year was also characterized by a number of crises that had to be overcome. In March, the collapse of Silicon Valley Bank (SVB), which caused difficulties for several regional banks in the USA alone, brought back memories of the financial crisis of 2008 and 2009. Only rapid intervention by the central banks prevented worse, although Europe was not entirely spared. In Switzerland, the SNB had to initiate a takeover of Credit Suisse by its competitor UBS at short notice in order to calm the markets and investors.

Ups and downs on the markets

However, the worries were quickly dispelled, as the losses were recouped in the same month, albeit during highly volatile phases. After that, the upward trend was slow but steady. Time and again, concerns about the global economy depressed sentiment and renewed interest rate worries returned. After hitting an interim low in July, however, Germany’s largest leading index reached a new record high, only to dive again over the next three months.

In October, the war between Israel and the terrorist organization Hamas threatened to escalate, while fighting in Ukraine continued unabated due to Russia’s war of aggression. The DAX fell to below 14,600 points and threatened to give up all its gains for the year. In the end, things turned out quite differently: in the last two months, the stock market barometer really picked up speed and went into a veritable rally, which culminated in new all-time highs on several days in December and ultimately gave the Dax a whopping annual gain of almost 20 %.

The USA and Bitcoin also performed well

Even on American Wall Street, which repeatedly set the pace in the afternoon, calm only returned on the last day of trading. The day before, the Dow Jones Industrial had forced its way to a new record high and ended 2023 with a gain of almost 14% at around 37,700 points. The S&P, which has a broader market with over 500 US companies, even rose by an impressive 24% and closed at not quite 4,800 points – also close to its all-time high.

The winner of the year was once again Bitcoin – even if investors had to endure a wild rollercoaster ride at times with some wild price fluctuations. The price of the most important cryptocurrency rose by over 160% to around USD 43,000 in 2023. At the start of the year, the price was around USD 16,500 when the bear market was still in full swing. At that time, the scandal surrounding FTX and Sam Bankman-Fried, which actually had nothing to do with Bitcoin at all, caused the price to plummet and the entire crypto market to tremble.

Since then, the longest bear market to date for the asset, which is just 15 years old, appears to be over. Bitcoin has climbed to one new annual high after another. With the ETF approval and the halving event in April, the outlook remains excellent. This is one of the reasons why we have been looking at Bitcoin in more detail this year, including supporting the network with our own full node or even one or two miners.

Bitcoin is more than just a speculative asset.

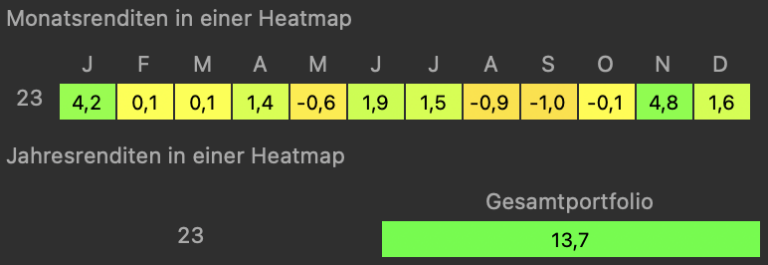

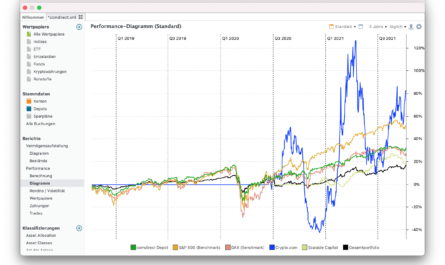

Our personal return

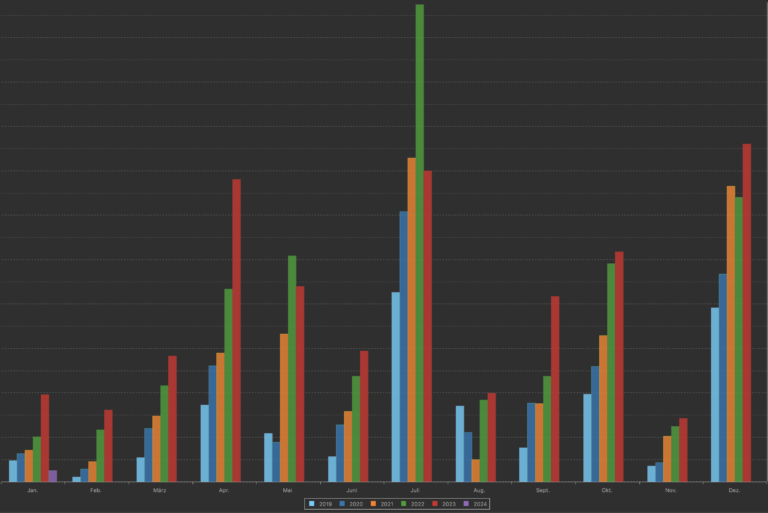

After suffering heavy losses of 22.9% last year, the jump in share prices this year was a real blessing. Although our portfolio was unable to match the performance of the market, it also achieved a significant gain of 13.7 %. In some cases, we celebrated individual months with price gains of more than 4%.

A look at our monthly dividend payments is also very pleasing. With the exception of two months, we were able to record new highs every month, which means that we can now mark a number of days in our freedom calendar. The monthly cash flow from passive income now covers our fixed costs for around two months. Thanks to the higher tax-free allowance, we also had to pay slightly less taxes, although this is still used up quite early in the year.

However, we are almost indifferent to share price developments: when share prices reach new highs, we are happy about our steadily growing assets, and when prices fall, we accumulate more shares at a lower price – for decades, automated investment via a savings plan is the most powerful tool and will always smooth out the over- and underperformance of the market.

We will of course stay on the ball and look forward to the next experiences we are allowed to make! Good returns at all times!