To quickly advance long-term wealth accumulation and financial security, one must be extremely disciplined and demonstrate staying power. However, two levers have a particularly strong influence on the plan: The savings rate and income. If you always keep an eye on your spending, continuously monitor it and check for further savings potential, you can put more money aside and optimize your savings rate to get closer to your financial goals.

Spending and income are the levers

However, this only works up to a point. At some point, monthly expenses can’t be squeezed any further, especially since you have no control over some anyway, such as rent, insurance or the old used car out front. At some point, one would have arrived at an absolute minimum, and the quality of life would suffer. For this reason, while we always recommend reviewing expenses for unnecessary and expensive items, we advocate a good middle ground.

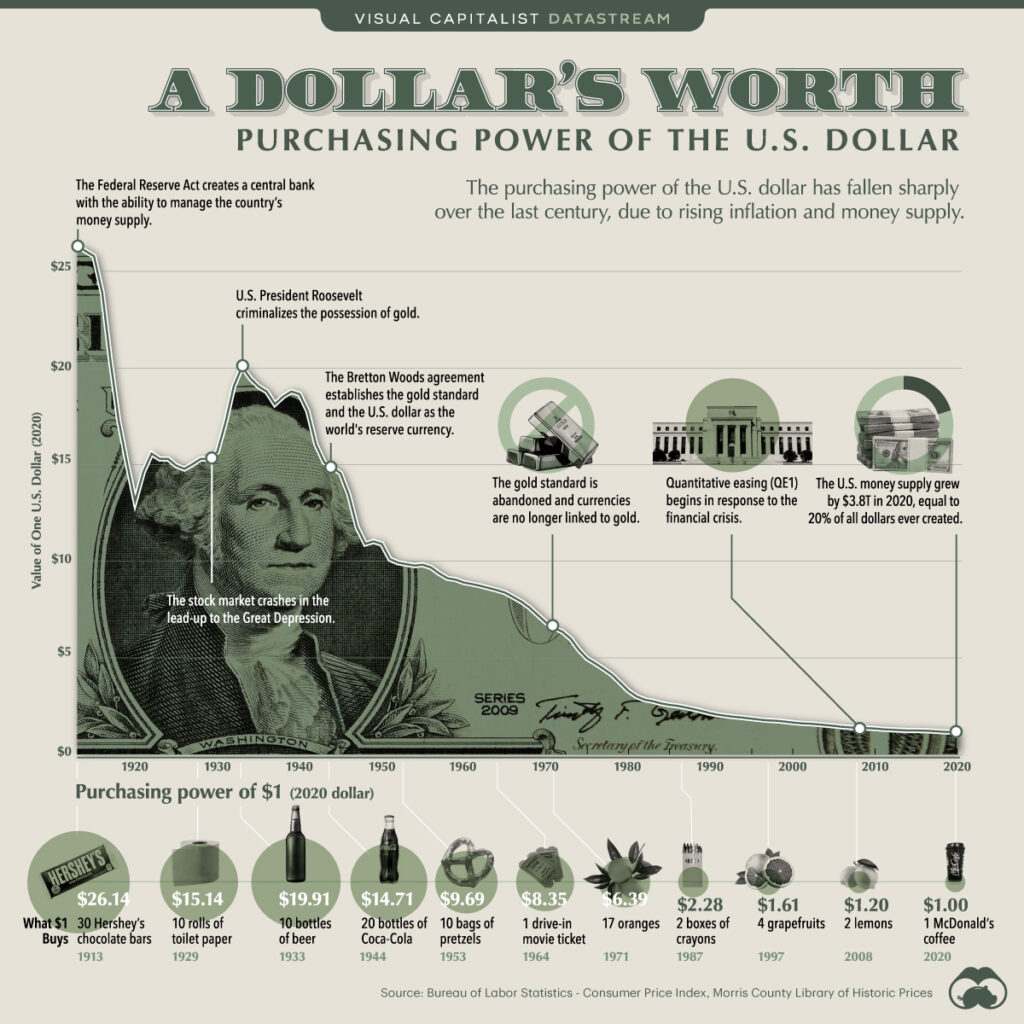

The situation is aggravated when expenses increase significantly due to a strong inflationary phase and thus eat up the savings sum. People are virtually forced to pay more for the same goods and services without any real added value, which has a negative impact on the savings rate for the same income.

Personal inflation rate mostly higher

According to the German Federal Statistical Office, the inflation rate in March 2022 was 7.3% and thus increased once again on a monthly basis. Since this value is determined using a fixed and rarely changing basket of goods, every household has its own personal inflation rate. Those who mainly consume services and goods whose prices have risen less sharply and cut out products whose prices have risen particularly sharply may end up below this figure.

Since it is mainly food and energy costs that have risen sharply, households with comparatively low incomes in particular are likely to be hit harder. Of course, those who have only reduced their spending to the bare essentials will also feel the impact particularly strongly. Energy prices alone rose by 39.5% year-on-year in March 2022. Prices for light heating oil even more than doubled. Fuels and natural gas also became significantly more expensive, by 47.4% and 41.8% respectively. Electricity prices climbed by 17.7%.

At the beginning of the year, people were still paying around 99 cents for a bottle of Coca Cola. Now it is usually 1.19 euros, 19% more than before. The bag of milk climbed from also 0.99 euros to now 1.29 euros and thus even by almost 30%. But also with meat and poultry as well as with baked goods clear increase rates of over 30% are to be determined and thus clearly further away than from the statistically determined value for the inflation rate of the Federal Office.

Those who do not take countermeasures will notice it in their wallets and will have to adjust their savings rate, if they can still have one at all. Low earners in particular will have a hard time with high inflation figures.

300 euro energy subsidy is too little

The ministry of finance of the traffic light government wants to provide relief for the citizens just because of the clearly risen energy costs. All salary earners are to receive a one-time subsidy of 300 euros. This is to be paid out over the employer and the gross salary. Anyone who regularly earns 2,500 euros gross will receive 2,800 euros gross for one month. On average, this will increase the net salary from about 1,726 euros to 1,896 euros.

The 300 euros thus become about 170 euros, which on average means an effective increase of just under 10% in the wallet. But since energy costs have just risen sharply, this is more of a nice gesture than actual help. You won’t be able to catch up with the personal inflation rate.

Everyone gets closer to the minimum wage

There’s another reason why employees should especially knock on their employer’s door these days and ask for an adjustment to their salary: The minimum wage. After an increase on July 1 from 9.82 euros to 10.45 euros, this is expected to rise to 12 euros in October, an increase of more than 20%. For those affected, this is certainly a good thing. However, those who, as non-minimum wage earners, do not bother to have their wages adjusted will ensure that, socially speaking, they come a little closer to the minimum wage.

Anyone who currently earns around 15 euros per hour currently has a gap of just under 5 euros. Without further salary adjustments, the lead will melt down to just 3 euros from October. In view of the responsibilities in the job, you should question for yourself whether your own salary still justifies this.

Inflation and minimum wage are not arguments

Even if it doesn’t sound outlandish to call a salary negotiation due to increased costs, inflation and minimum wage should not be a basis of argument for salary adjustments at the employer. After all, both also affect the employer. He, too, has to deal with increased energy costs and higher expenses for material purchases as well as increased wage costs due to the minimum wage. Rather, one should consider other reasons for a renegotiation – even if it is only a reference to a payment that is customary in the industry. If you point to additional tasks you have taken on, mention particularly good performance and have improved your qualifications in recent months, you have a very good basis for arguing with your employer and your plans.

In addition, one should not only make monetary demands, but also suggest additional benefits that are more favorable to the employer than a salary increase. These could include a rail card that can also be used privately, a gas voucher, a company bicycle or a subsidy for public transportation or office equipment. Employers and employees always pull together!