If I remember correctly, I’m in the darned seventh year of my stock market career.But don’t worry: I’m not thinking about quitting for a long time. On the contrary, it’s time to report on my most important learnings, which may help one or the other reader to avoid the typical beginner’s mistakes and to learn from others. Here are my seven most important learnings so far.

Take the investment into your own hands

Those who take their finances into their own hands make themselves independent of others and can go through life far more worry-free than most. Who relies on complicated financial products of his house bank, binds himself in the long term to it and loses on account of the high costs in the long term yield, which will make it later whether one will receive a good pension. In addition, one does not rely on the state. It is questionable whether my generation will still receive anything from the pension system, even though it pays in month after month for others. Those who create assets for themselves are not dependent on pension payments later on or even defy inflation. Wealth creates a kind of freedom.

End the dream of quick money and think long-term

Admittedly: When I took my first steps on the stock market, I was lured by the fast money. I imagined how I could become a millionaire virtually overnight with little effort. Surely this may also be possible on the stock exchange, but it is only possible with a lot of risk and luck, the short-term fluctuations can go in both directions and mean high losses. However, if you stay on the ball for the long term and are satisfied with the average market return in the form of broadly diversified ETFs, you will certainly become wealthy over the decades, and at least you won’t have to worry about your pension.

Only invest in solid companies whose business model you understand

At the same time, you should say goodbye to the idea of discovering the next Amazon or Netflix for yourself early on. Those who were among the first to invest in these companies were able to reap a high return in just a few years and may have become multi-millionaires with an investment of just 5,000 euros. It will be difficult to do this again, or even to emulate it. The probability is high that the 5,000 Euro investment could have become 0 Euro. Although it is quite legitimate to make such speculations with play money and small sums, in the long term one should only invest in companies that have already been able to prove over the years that their business model works and that they can handle money in economic terms, since they have been able to steadily increase sales and profits. A look at the company’s key figures and business model is a basic requirement when investing in individual shares!

Getting emotions under control

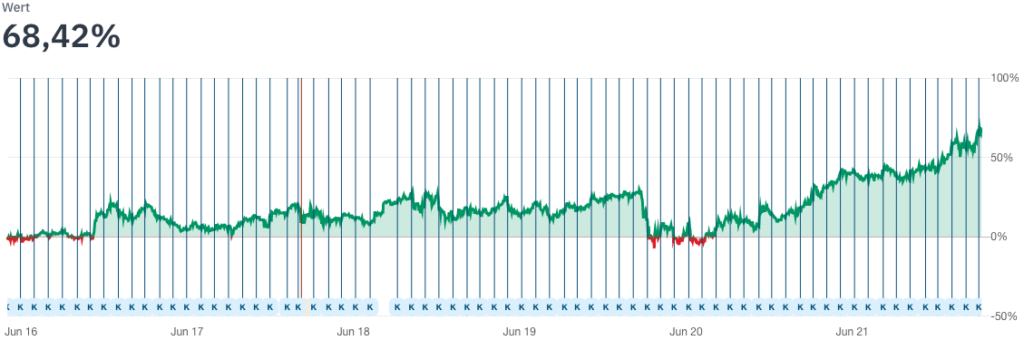

Even during my rather short time as an investor of about seven years, I have already experienced one or the other, stronger setback on the stock market up to a crash with strong price losses within a few hours – be it the Corona crisis or the start of Russia’s war of aggression against Ukraine. On the other hand, I sometimes participated in one of the fastest recoveries, which was almost V-shaped in the chart. So I had lost a lot of money quickly, but just as quickly got it back.

All this evokes emotions – be it euphoria and greed during rising market phases or fear during falling prices. Although there are some psychological tricks for both market phases to get through the time more easily, you still have to get your emotions under control.

Be sure to set up a savings plan

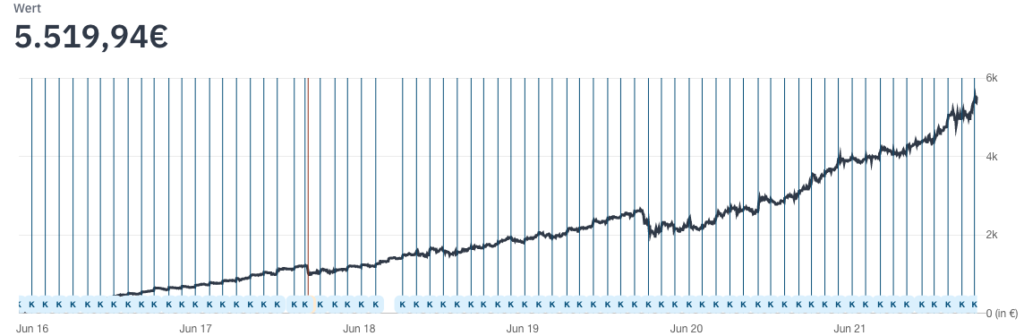

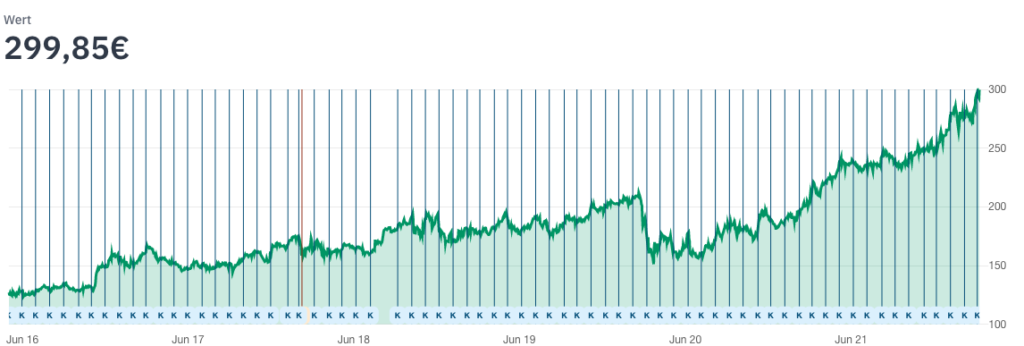

Those who invest for the long term and, above all, on a regular basis, find it significantly easier. Those who invest monthly via a savings plan, spread as widely as possible with a high degree of diversification, buy the average over the long term and sometimes have the greatest chance of ending their investment career with a good return. Statistics prove this time and again. Since the beginning, I have been putting 50 euros a month into Berkshire Hathaway, Warren Buffet’s investment holding company. Over the seven years, it has become quite a nice position, currently scratching the 6,000-euro mark. In bad times there were more shares for the money, in better times I was well in the plus, but also had to buy more expensive. In addition, the strategy can be automated, which tricks the emotions.

Pay attention to low fees

Over decades, not only the returns accumulate to a nice little sum, but also the fees. Even from supposedly small fee rates, quite a bit of money can accumulate over the years. Money that would be in better hands in our long-term asset accumulation than with a bank or the fund provider. A 3.5% front-end load or a performance fee of only 1.5% may not seem like much at first glance, but they cost quite a bit in terms of returns, especially with an investment horizon of several decades, as we have already calculated in detail in this blog.

Favorable financial products are the be-all and end-all for all those who want to take their finances into their own hands and not rely on others. The same applies to investment advisors. Most banks sell their in-house products on commission, which leads to a conflict of interest and, on top of that, causes unnecessary additional fees.

Those who have money in the crisis benefit

However, a very large leverage can only be achieved if you invest when everyone else is leaving the markets. Then you can buy more shares at a lower price, which will bring you back into the profit zone more quickly in the event of a subsequent correction. However, since no one knows when the correction will occur and it can theoretically go lower tomorrow, timing is difficult, which is why we return to automated savings plan investing here. If the recession lasts longer, only those who are still able to put money aside can consider themselves lucky. Job losses are greatest in such economic phases.

Therefore, only those who have money and can save during crises can benefit from this leverage. A nest egg is indispensable.