If you want to continuously increase your savings rate in order to make faster progress with your wealth accumulation, there are actually only two levers you can pull: Income and expenditure. The latter are finite, while the former are much easier to scale.

At some point, you will no longer be able to save any more of your income, as the fixed and variable costs cannot be completely reduced. The landlord would not be at all happy if you were to cut the rent yourself for providing his property. Furthermore, you cannot completely do without food or personal hygiene. The savings potential on your own income will be exhausted at some point. By then at the latest, you will have to pull the second lever and increase your income.

You have several options here: You can make a good case to your existing employer about a salary adjustment or take on a part-time job, for example to earn some extra money at the weekend or after work. The latter in particular is a good way to quickly achieve a substantial increase in income. Employers do not always play along and add several hundred euros net on top. However, they must always agree to your secondary employment and this must never have a negative impact on the actual employment relationship.

Significantly lower taxes with a mini-job

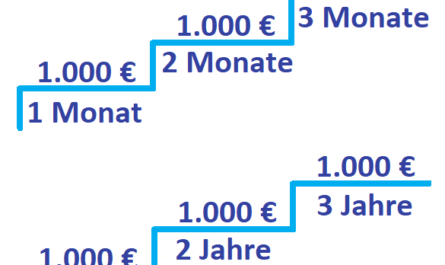

Since January 2024, every employee can earn up to 538 euros per month through a mini-job. Employees do not have to pay health insurance, unemployment insurance or long-term care insurance contributions and no taxes are deducted from their wages. Taxes are usually paid at a flat rate by the second employer and at the end of the year via the wage tax adjustment. In fact, there are considerable differences here.

A 30-year-old non-denominational employee in Bavaria without children in income tax class 1 with a gross salary of 3,000 euros has around 2,050 euros net after all taxes and social security deductions. With a part-time job, he can increase this income to a good 2,588 euros. If the employer had to add this amount from the full-time employment relationship, he would have to pay considerably more.

A gross salary of around 3,975 euros would be required, an increase of no less than 975 euros! But even that is only half the truth: employers and employees share some of the taxes between them. With an employee’s gross salary of 3,000 euros, the actual personnel costs amount to around 3,615 euros. After the salary increase to 3,975 euros, this figure rises to an impressive 4,790 euros!

Significantly higher employer’s gross salary

If you wanted your employer to compensate you for the additional earnings via a separate mini-job, you would expect them to add €1,175 on top for you. This would correspond to a salary increase of over 30% and is therefore not realistic, even in times when trade unions like to demand unattainable maximum demands without compromise.

| Regular salary | Salary with mini-job replacement | |

|---|---|---|

| Gross employee salary | 3,000.00 euros | 3,975.00 euros |

| Income tax | 317.08 euros | 549.25 euros |

| Employee’s share of pension insurance | 279.00 euros | 369.68 euros |

| Employer’s share of pension insurance | 279.00 euros | 369.68 euros |

| Employee’s share of social security contributions | 631.50 euros | 836.74 euros |

| Employer’s share of social security contributions | 613.50 euros | 812.91 euros |

| Employer’s gross amount | 3,613.50 euros | 4,787.91 euros |

| Net amount paid out | 2,051.42 euros | 2,589.01 euros |

Hourly pay plays a significant role

Increasing your income through a mini-job can pay off for you in many ways. You can try to turn your hobby into money (like I did through this blog), learn something completely new and add real value to society by doing something social. You can expand your own network or socialize more. The possibilities are virtually endless. On top of that, you solve the problem of work blindness in everyday life and perhaps also create added value for your actual employer. You can apply what you have learned directly and contribute your new experience.

However, you should not forget that there is also a lever here: The hourly wage. If you start your new mini-job at minimum wage, you will have to spend 43.3 hours a month on it, which means it is not enough to simply give up every Saturday of the week. You should make sure that you negotiate the best possible hourly wage.

- New

- Mint Condition

- Dispatch same day for order received before 12 noon

- Guaranteed packaging

- No quibbles returns

Letzte Aktualisierung am 2024-07-26 at 07:44 / Affiliate Links / Bilder von der Amazon Product Advertising API