During our journey to long-term wealth accumulation, we have to contend not only with price fluctuations but also with one opponent in particular: fees. These no longer include the transaction costs for purchasing our shares or the costs charged by the broker for managing the securities account. It is above all the ongoing costs, which play a major role in actively managed funds and passive ETFs in particular, that have a significant impact over the years. If you buy shares, you generally do not have any annual holding fees, but you cannot diversify as widely as you can with a fund.

Each fund and ETF not only costs money when purchased, but also incurs holding costs, which are usually settled once a year and/or are due via an issue surcharge when purchased. In times when new fintechs come onto the market seemingly every month that advertise low or even no transaction costs, the purchases are no longer a major issue. Our securities account calculator also shows this. As a rule, there are no longer any costs for managing a securities account, and individual securities can be purchased for as little as one euro. Only a few years ago, at least 10 euros were due here, with expensive custodian banks was even settled on a percentage basis, with which with larger turnovers three-digit amounts could be called up.

The fee structure can be very creative

It is rather the hidden fees, or at least the fees that appear to be low, that give us a hard time when it comes to long-term investments. Even small amounts can add up to a considerable sum over a period of several decades. This is not only true for one’s own return and compound interest, but also for the fees and thus for the banks, salespeople and investment advisors who finance themselves through them.

If you take a look at the fund facts of a global, actively managed equity fund of DWS Investment GmbH, one of the largest asset managers in Germany, whose products are gladly sold by large banks and investment advisors, you will find numerous costs in the data sheet. Thus one pays for the “DWS Concept DJE global shares” an issue premium at a value of 5.00%. Thus already once with the deposit 5% go to the fund manager. An annual fee of 1.65% is charged, plus a fee for securities lending. Depending on the fund, a performance fee may even be charged – the fund managers are quite creative when it comes to the fee structure of their products. After all, small fry also make crap.

Comparison of holding costs

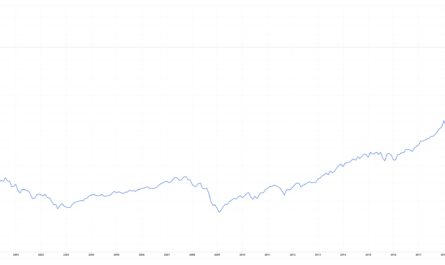

In order to clearly show the actual costs in practice over a long-term period, we have kept the fee structure as simple as possible and simply assume that we only have to pay a holding fee and have chosen two case studies with an average annual fee of 2.5% and 0.5% for this purpose. The money is invested via a monthly savings plan with a deposit of 300 euros per month. The annual return is an average of 6% per year. Taxes and other fees were waived here.

| Investment period | Funds with average costs of 2.5% p.a | Funds with average costs of 0.5 % p.a. |

|---|---|---|

| after 1 year | 3.665,82 Euro | 3,705,87 Euro |

| after 5 years | 19.615,72 Euro | 20.671,96 Euro |

| after 10 years | 42.792,53 Euro | 47.655,82 Euro |

| after 15 years | 70.176,92 Euro | 82.878,82 Euro |

| after 20 years | 102.532,75 Euro | 128.856,67 Euro |

| after 25 years | 140.762,54 Euro | 188.873,21 Euro |

| after 30 years | 185.932,66 Euro | 267.214,97 Euro |

| Payments | 108.000,00 Euro | 108.000,00 Euro |

| Absolute return | 77.932,66 Euro | 159.214,97 Euro |

While the difference between the two examples is just around 40 euros in the first year, after ten years it is already just over 4,800 euros. If you pay 300 euros a month into a fund with average costs of 2.5% per year for 30 years and achieve an average return of 6% with your product, you will end up with an impressive 185,932.66 euros in your securities account. Over the term 108,000 euros were paid in, resulting in an absolute return of 77,932.66 euros. Surely, no bad result and not exactly little for the old age.

However, anyone who calls a low-cost fund (such as an ETF) with an annual holding fee of 0.5% on average their own, with otherwise the same conditions, has a handsome 267,214.97 euros in the portfolio and thus a return of 159,214.97 euros.

That corresponds to more than double and that although only two percentage points lie between the two case studies!

Keyfacts:

- the fee structure is often opaque

- not only transaction costs are important

- a few percentage points make quite a difference in the long run