In just a few hours, it will be “Cheers, New Year” again. For many, this is the time to review the events of the past twelve months or make resolutions for the new year. We’re not big fans of this. New ideas and resolutions can simply be implemented immediately without having to wait for the next turn of the year. As we already took a look back at the year in our Christmas greetings, we will now limit ourselves to the developments on this blog.

TradingForFuture.de celebrated its second birthday this year. Not only have over 100 articles been published on our pages in the meantime, but the focus has also shifted somewhat in recent weeks and has increasingly shifted to political topics or included many articles on cryptocurrencies, especially Bitcoin. Nevertheless, we have continued to focus our content on the long term.

We showed why historical prices should not necessarily contribute to the purchase decision, calculated what would have happened to 10,000 euros in different asset classes over the last ten years, presented a great dividend calendar and gave a few tips on how to better arm yourself against inflation and rising prices. We also compared the advantages and disadvantages of a savings plan versus a one-off purchase, showed that average returns merely compensate for price fluctuations and introduced great service providers such as Curve, Blockpit and Relai.

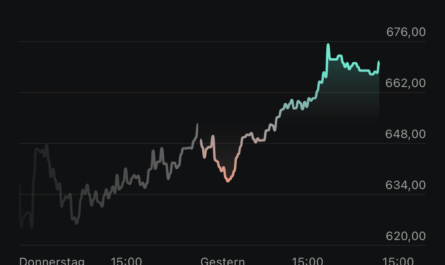

Unexpectedly good year for investors

At the beginning of 2023, hardly any investor would have expected this year to be quite a good year on the stock markets. Just before the end of the year, the stock markets rose sharply once again, in some cases resulting in double-digit percentage gains for shares – despite Russia’s war of aggression in Ukraine, the terrorist attack on Israel by Hamas and rising costs and high inflation. The crypto markets have also been on fire, with the Bitcoin price recently reaching one new annual high after another, pulling the prices of some altcoins up with it. It seems as if the bear market has come to an end.

The signs are not bad that it could stay that way. The next halving is due in April, the first spot ETF could be launched in the US in January and tradable coins on the exchanges are becoming increasingly scarce. Even for investors in traditional assets, 2024 could be a good year. The turnaround in interest rates by major central banks and an economic upturn in Europe could herald a turnaround on the equity and bond markets.

Growing readership

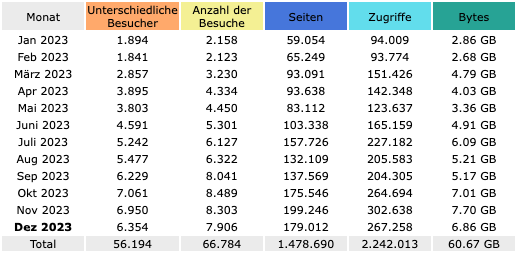

After a slight decline in the number of visitors to TradingForFuture.de last year, this figure rose again significantly, particularly in the summer. While just under 2,000 readers a month visited us in January and February, the number climbed to over 5,000 in the summer months, more than doubling. In October, there were even over 7,000 different visitors. According to our internal server tools, we delivered 60.67 GB of traffic and over 1,475,000 page views in 2023 (as of 28.12.2023).

On average, readers stayed on our pages for just over 4.5 minutes. Over 88% of them come via Google, with only a very small proportion visiting the blog regularly via direct visits.

The most popular articles

According to Google Analytics, these are the ten most popular articles of 2023 on TradingForuFuture.de:

Happy New Year!

With all these ups and downs, we wish our readers and supporters a happy new year and thank you for your support. Good returns at all times!