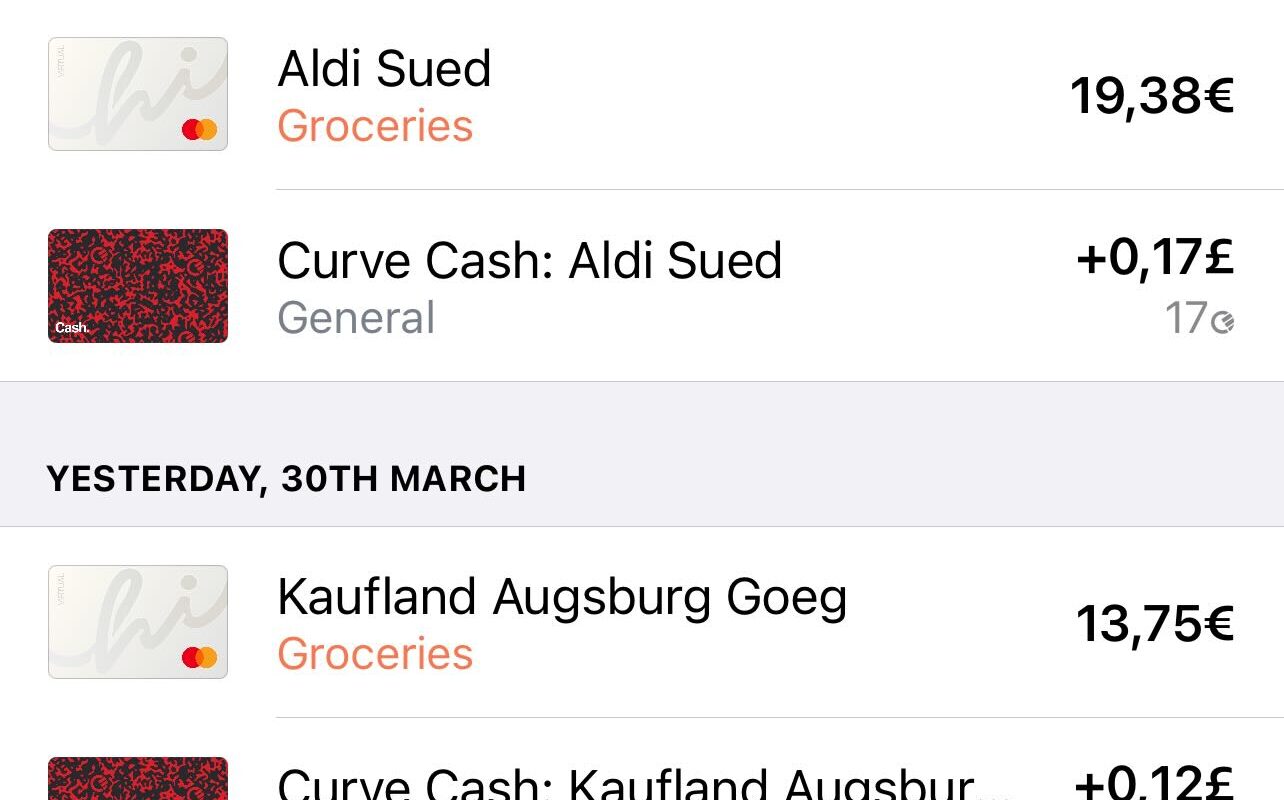

Since there is currently only a virtual version of the Hi card with attractive crypto cashback that we recently recommended, it can currently only be used online. For everyday spending at the supermarket, customers of the startup will have to wait until the physical card is released. But there is a trick to use the Hi card already today everywhere where debit cards from Mastercard and Visa are accepted. And it has a number of other advantages, which are likely to please owners of multiple credit and debit cards in particular, but which will also benefit those who frequently spend time abroad: Payment service provider Curve*.

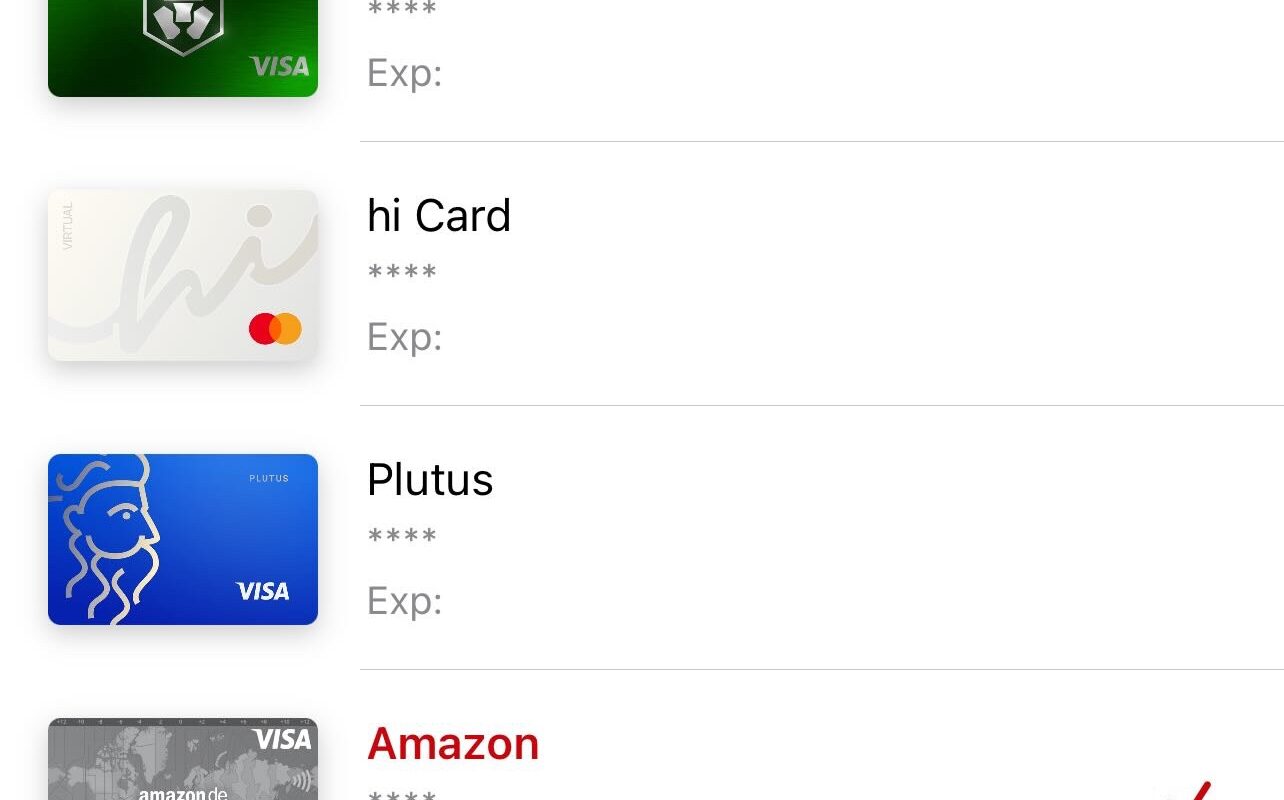

Curve* offers a debit card from Mastercard, but without any checking account. The twist is that a smartphone app, available for iOS and Android devices, can be used to deposit numerous different credit and debit cards from other banks and service providers. Curve then passes the payment to the selected card via online transaction.

Not only are all Visa cards and cards from Mastercard supported, but even cards from Diners Club or Discover. Only cards from American Express cannot be stored at present. Instead, loyalty and points cards from PayBack, DeutschlandCard, Starbucks, Subway and Lego are supported.

More space in the wallet, many functions in the app

This even allows virtual cards to be used and, above all, makes the wallet lighter, since the cards deposited in the Curve app* can theoretically remain in the drawer at home. If a payment is ever rejected by the deposited card, the anti-embarrassment mode automatically kicks in and Curve debits from the previously designated backup card – without the risk of an embarrassing situation at the supermarket checkout.

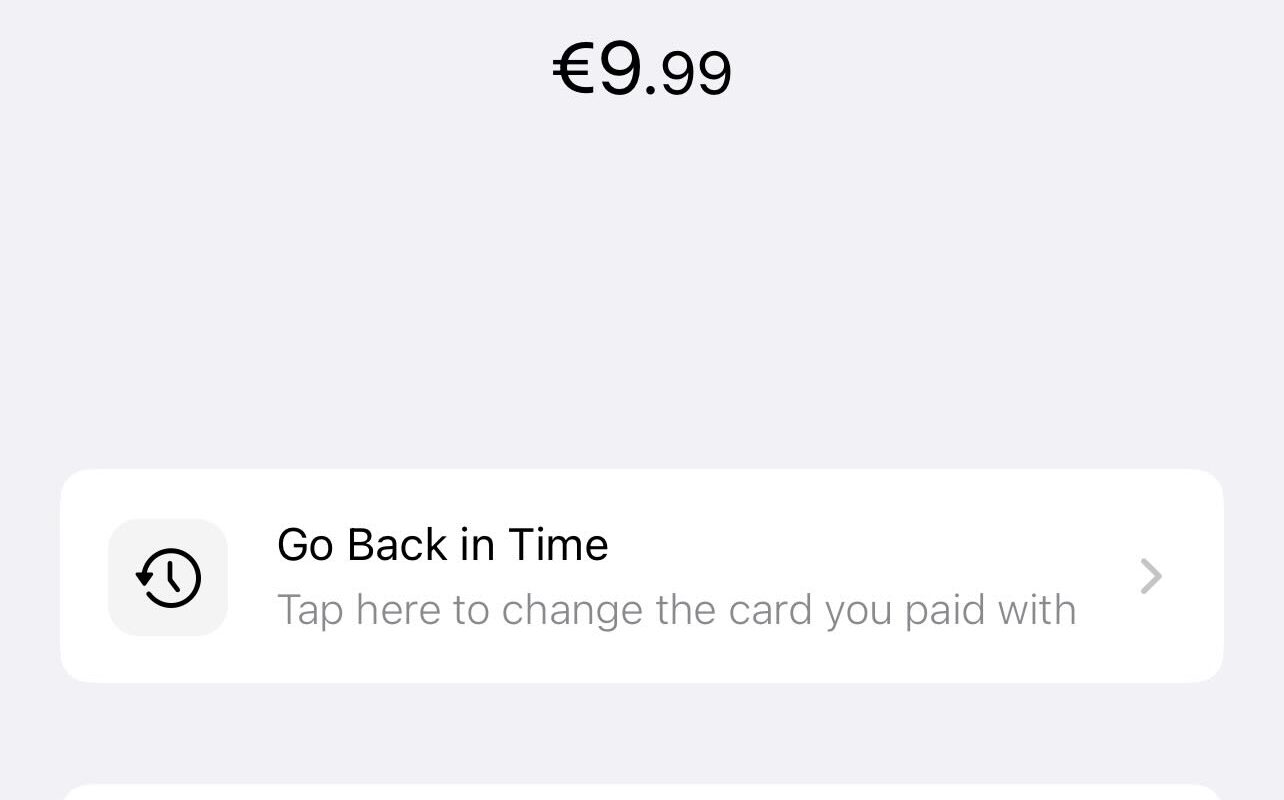

The best thing about it is that the payment can be postponed to another card at a later date. Then the previously made debit is cancelled, the money is credited again and collected from the other card. In theory, this means you can delay your credit line.

But these are by no means all the advantages of Curve*. Expensive transaction fees or charges can also be saved abroad, since Curve does not charge them, at least during the week, and always uses Mastercard’s interbank rate, which promises particularly good conversion rates. In addition, money can be withdrawn free of charge via a credit card that would actually call up a fee for this service. Depending on the account level, there is even additional cashback of 1% at up to six pre-selected merchants, which is collected in a separate account and can be offset against any payment.

Furthermore, there are various insurance packages such as worldwide health insurance abroad or insurance for the smartphone and rental car. Even a discounted lounge access at the airport can be redeemed. Of course, the Curve card can be deposited with Apple Pay and Google Pay, which makes it possible to pay conveniently with the smartphone – even if the card actually deposited does not support the services.

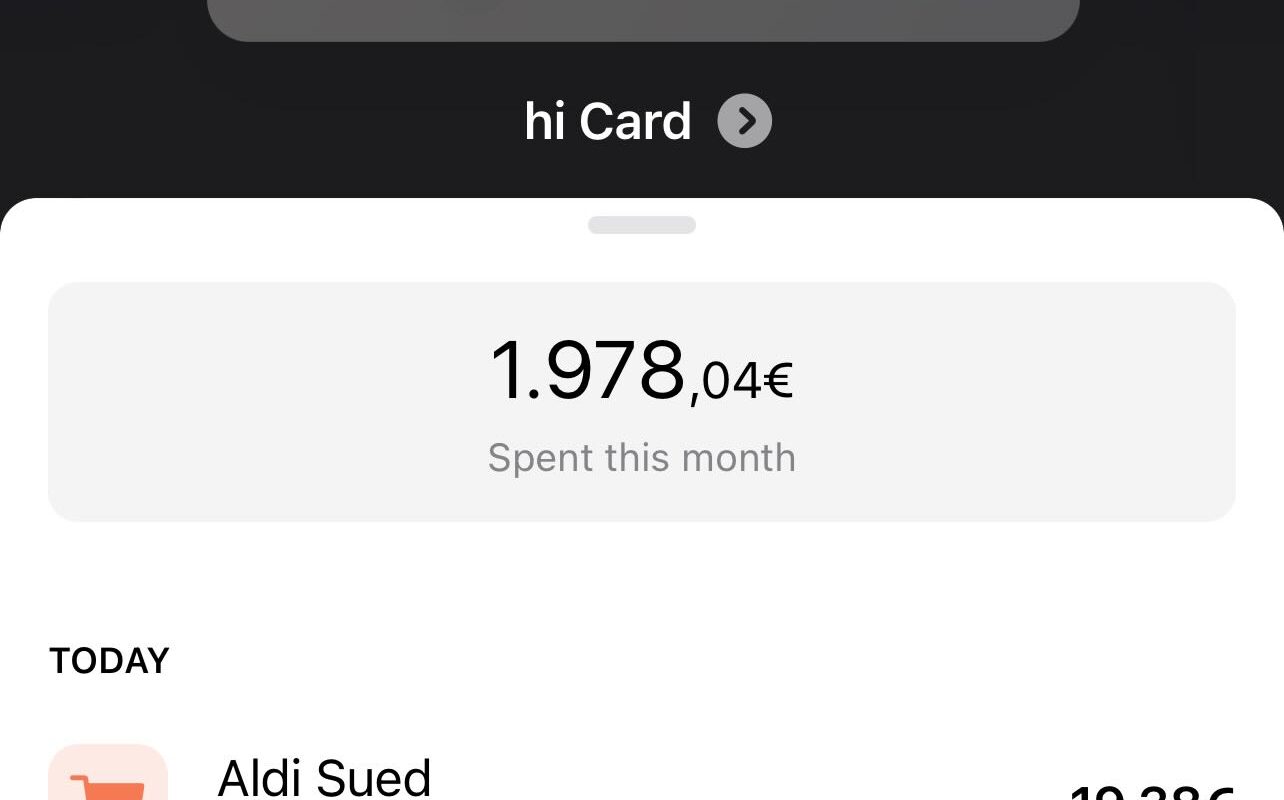

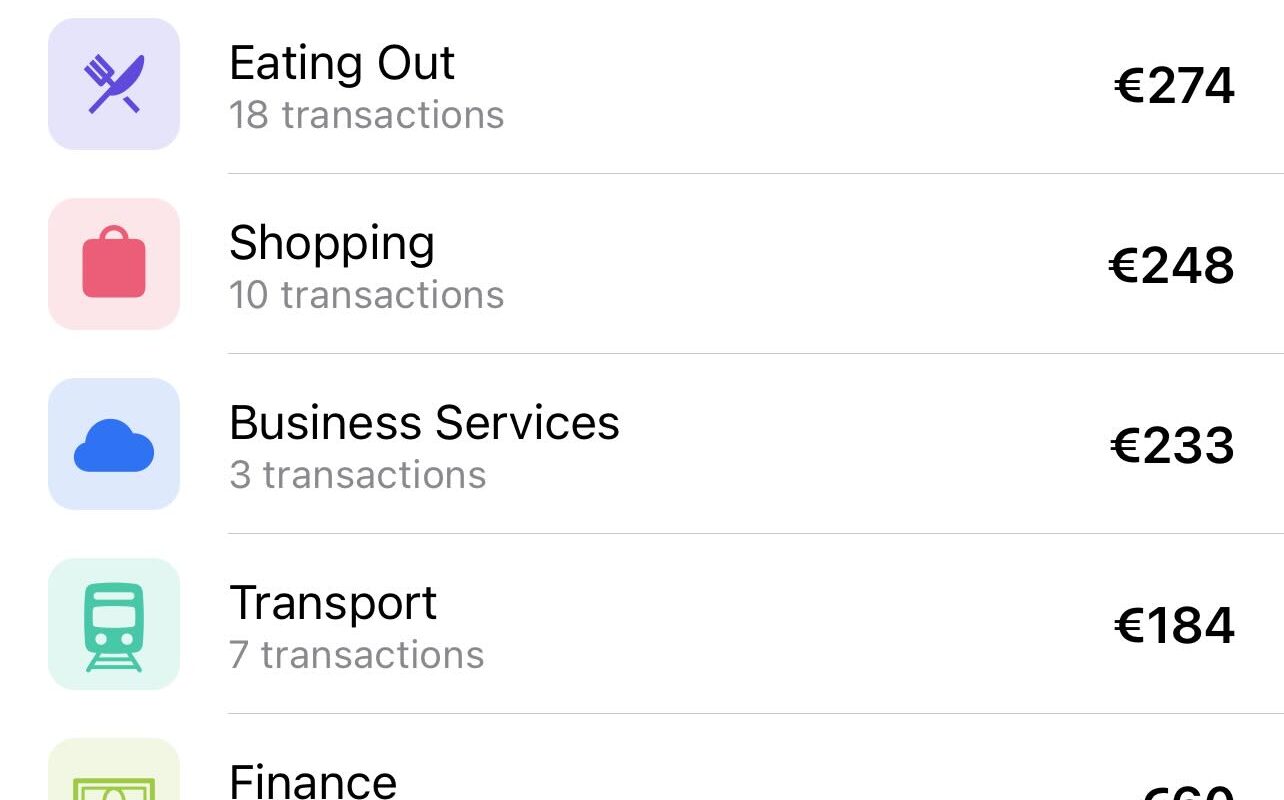

Otherwise, the app offers clear spending overviews, categorizes each transaction fully automatically into different categories, and provides interesting statistics on spending behavior.

Different account levels

Curve’s* standard plan is initially free of charge, and only requires a shipping fee of around 5 euros for issuing the user’s own debit card. Then up to two payment cards can be stored in the app, you can make transactions abroad of up to 1,000 euros per month free of charge, and withdraw a maximum of 200 euros per month. In the “Curve X” model, up to five cards can be stored and the limits abroad as well as for the “Go Back in Time” feature are further increased, although you have to pay 4.99 euros per month for this plan.

With Curve-Black for 9.99 euros a month, any number of cards can be deposited in the app, cash withdrawals are doubled, and the limit for fee-free foreign transactions is completely removed. On top of that, three merchants offer the cashback mentioned above. If you spend a lot of money with them each month, you can practically pay for the subscription. A foreign health insurance is also included.

The Metal plan for 14.99 euros a month is Curve’s most expensive subscription model. It offers all the benefits of Curve Black plus increased limits for cash withdrawals or the go-back-in-time function, cashback at six selected retailers, and additional insurance services. As the name suggests, it includes a high-quality, 18-gram metal card in a variety of colors.

If you want to give Curve a try, you can currently use our link* (or the code "KNVV3J5N") to get a starting credit of 5 euros, which theoretically saves you the shipping costs for the Curve card in the Free plan. We use the card all the time and love it!