Even if inflation has risen more slowly recently, it is still making itself felt in many people’s wallets in everyday life, especially when it comes to food or energy costs. At the end of the month, there is less and less money left over – a reason why a salary adjustment is currently more important than ever. But there are also other tricks to defy the price increases at least to some extent, or to reduce the monthly burden somewhat. A few of them will be presented in this article.

Use of cashback cards

Using payment cards with a cashback or points system can reduce the cost of regular spending. Instead of simply paying for purchases with cash or the checking card from the savings bank, it is better to whip out a corresponding card that gives you a cashback for every transaction.

Probably the best-known card of this type is the one from American Express*. Here, for every transaction, depending on the amount, you receive a credit in so-called Membership Rewards, which can then be exchanged for hotel stays, vouchers or air travel. However, there is also the PayBack variant*, in which PayBack points are given instead of reward points, which can then be paid out to one’s own account. As a rule, this gives you a refund of 0.5%. Unfortunately, the Amazon credit card is no longer available to new customers. Here, you also receive 0.5% of your sales back in the form of Amazon points, which you can then offset against your next Amazon order*. If you pay directly at Amazon, you even get 3% back.

However, debit cards from providers such as Crypto.com, Hi.com or Plutus.it* are the most profitable. Here, crypto tokens are issued after each transaction made with the MasterCard or Visa card, some of which can be sold immediately or after 45 days and exchanged for euros. For this, you usually have to exchange a certain amount of euros initially and hold it in front of the provider in order to be able to receive between 1 and 8% cash back, depending on the amount. If you sell the tokens as quickly as possible after your purchases, you can counteract the price increases a good bit.

Use of bonus programs

Large supermarket chains such as Kaufland, Lidl, Rewe and Netto offer their own bonus programs for their customers. These programs allow customers to regularly purchase selected promotional items at low prices or collect points that can then be converted into non-cash assets or transferred back to their own accounts. PayBack in particular is a very worthwhile option here, because what many people don’t know: The collected points can be transferred directly to one’s own account via www.payback.de/bargeld, whereby one point corresponds to the equivalent of one cent. This way, you can avoid the sometimes not really worthwhile redemption options for things you don’t need anyway.

What’s more, there are always attractive coupons to speed up the collection of points. Particularly at Rewe and DM, there are coupons every now and then that give you 10 or even 15 times the amount of PayBack points. What’s more, the codes are not always personalized or limited to individual regions. There are numerous groups on Facebook where these are published, which can then be brought directly to the smartphone via a QR/barcode app and scanned at the supermarket checkout. It’s worth a try!

Direct debits and bank transfers

The monthly costs for rent, electricity, Internet or heating cannot usually be paid with the (cashback) card. However, this is also possible with a small detour. For example, there are service providers such as Billhop or Plastiq that transfer the amount after the bill is sent in and collect it from the desired card in exchange for a percentage service fee. If you have one with a high cashback here, you can collect the difference between the cashback and the fee. In the case of the rental payment, you simply accept the additional transaction costs, since several hundred euros should certainly yield more cashback than you would have to pay for the payment service provider. In effect, you are buying favorable cashback.

Alternatively, there are debit-capable checking accounts, such as Revolut, Vivid or bunq, which allow deposits by credit card. In this way, you replenish your account via the cashback-enabled card and use it for your direct debits and transfers.

Use your credit limit

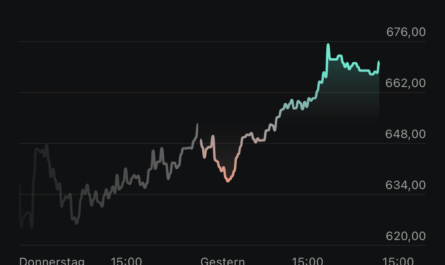

Theoretically, you can still extend the trick with the above-mentioned current accounts. You simply deposit a few more euros into the account and then transfer them to an interest-bearing overnight or fixed-term deposit account to redeem it shortly before the card account is balanced. For this time there are then a few euros of interest in addition – in the meantime there are again some banks and brokers, which entice with interest rates beyond 2 or even 3% per year.

With the Barclays Visa, amounts up to 499 euros can be transferred to the reference account free of charge if they are repaid over three months interest-free as an installment loan. This 499 euros can then be transferred additionally to the interest account, in the next month about 150 euros of it must be paid back. The entire process can be stretched and leveraged to up to ten such loans. With just under 5,000 euros, that’s 10 euros that you can collect month after month if you invest it with Scalable Capital, for example.

How I proceed

With a few tricks you can save money when shopping and thus counteract inflation. We present them to you.

Add it all up, and I’m easily raking in a triple-digit amount every month, significantly counteracting my monthly cost increases and making me feel more relaxed about inflation.

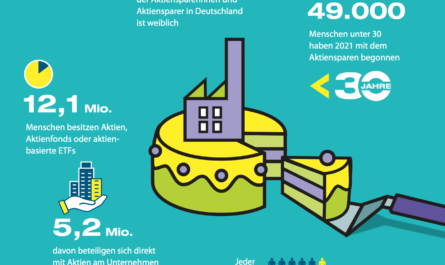

Keyfacts:

- Cashback cards allow you to get reimbursed when you spend money

- bonus programs can be very profitable

- there are again high interest rates on overnight and time deposit accounts

- the money from the credit card’s credit limit can also be used for this purpose

- you can also generate cashback on bank transfers and direct debits via service providers.