For our short-term investments, we have long since moved beyond overnight and time deposit accounts, where we have virtually no risk but no return at all after deducting inflation. Therefore, to improve returns in this segment, we resort to foreign accounts, P2P lending and, most importantly, stablecoin lending, which, while providing us with a high return, can result in the total loss of our entire deposit. Diversification is also the key to success here, because 100 euros in Stablecoins can be more profitable than ten times that in overnight money, whereas losing the 100 euros would be easily tolerated with a view to the overall portfolio.

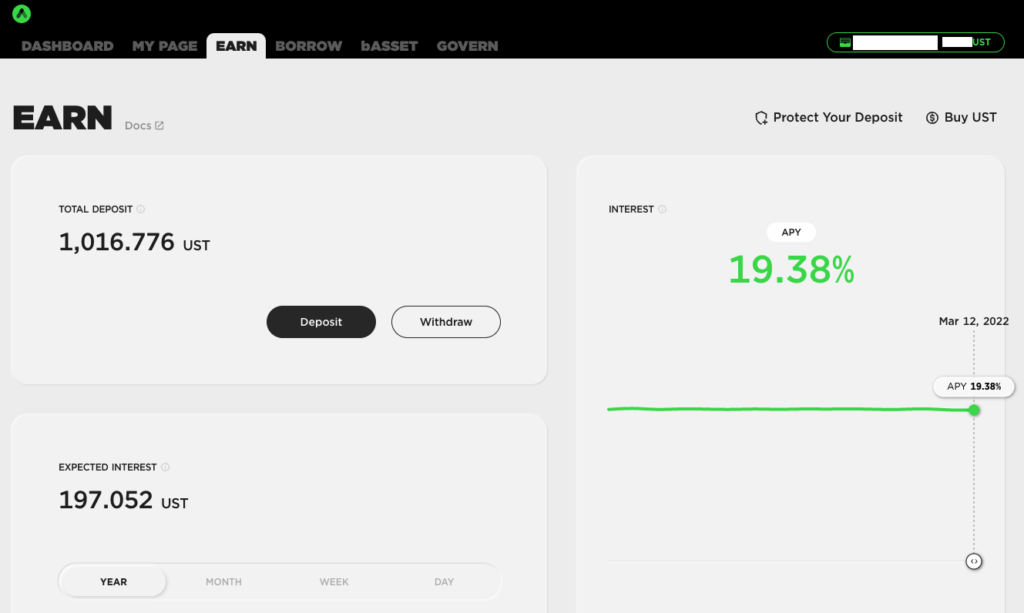

So far, we have almost exclusively used our favorite crypto exchange Crypto.com for staking/lending stablecoins, where we were able to collect a proud 12% in interest per year for an investment period of three months in conjunction with the Jade Green card. Since the conditions of the Earn program will worsen noticeably in April and we wanted to add other platforms and providers to our portfolio anyway in order to broaden our base, we came across the LUNA ecosystem and the Anchor protocol in the course of our research, which allows us to earn around 19.5% in interest on the US dollar with a manageable risk.

Terra (LUNA) and UST

Specifically, the stablecoin is UST, which is based on the LUNA ecosystem of the Terra blockchain (whitepaper), which uses the proof-of-stake consensus process to be able to operate the network. The goal of Terra (LUNA) is to develop stablecoins that are based on the value of real fiat currencies, such as the U.S. dollar or euro, for example. The network should not only ensure price stability, but also offer fast and inexpensive transactions and be resistant to censorship. Terra was developed by Do Kwon and Daniel Shin in early 2018 and is operated by Terraforms Lab. The operators and creators are thus known and are not hiding.

An algorithmic stablecoin

The protocol essentially consists of a two-token system, which is made up of LUNA and Terra. With the help of the open-source protocol, algorithmic stablecoins can be created that are not backed by the classic currencies but maintain their price stability using algorithms.

Shifting supply and demand are intended to bring maintain stability.

Using TerraUSD (UST) as an example, the US dollar price and the LUNA token price are compared. If the price of UST exceeds the real dollar price, LUNA tokens must be burned and new TerraUSD tokens must be created. The increase in supply causes the price of the stablecoin to fall, while the shortage of LUNA causes the price of the network token to rise. The quantity of both tokens is variable, by shifting supply and demand the price is kept stable, the fluctuations for the UST stablecoin are supposed to be extremely small.

On the other hand, if the price of UST falls below the level of the real U.S. dollar, network users will receive attractive offers to burn TerraUSD and generate new LUNA tokens. Once again, a shift in supply and demand takes place, which should lead to the desired change in the price of the stablecoin. In practice, TerraUSD should fluctuate only slightly and always remain at about the same price level as a US dollar.

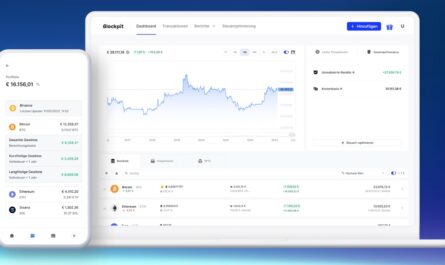

Taking advantage of this, we first buy UST on a cryptocurrency exchange and transfer the tokens to Anchor’s savings protocol (ANC), which typically promises just under 19.5% on Terra stablecoin deposits. The high yield comes via various staking rewards from various proof-of-stake blockchains, but was also created to increase demand for TerraUSD to make the platform more attractive overall.

The Anchor protocol brings lenders and borrowers together. On one side, there are investors who want to get a stable return on their stablecoins, and on the other side, there are borrowers who want to borrow the deposited assets. The Anchor protocol works like a bank, the Terra network is the central bank.

Step by step to almost 20 % return

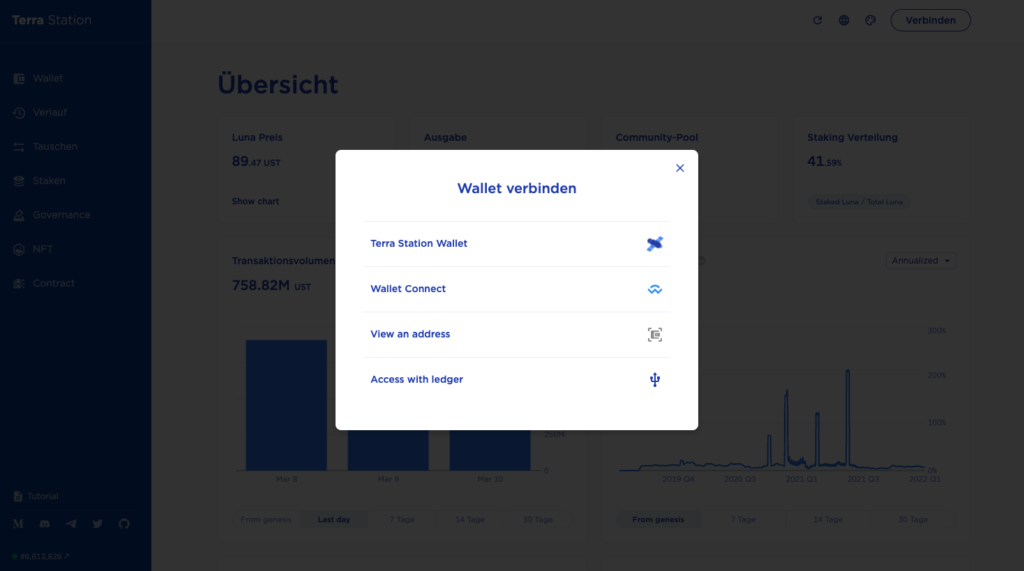

In the first step, we first need a crypto wallet that supports the Terra blockchain. We got the TerraStation wallet, which either runs as a standalone Windows and macOS application or is available as a browser plugin. In it, we first create a wallet address, secure it with a strong password, and get our twelve security words that we can never lose. Only with these will we gain access to our wallet.

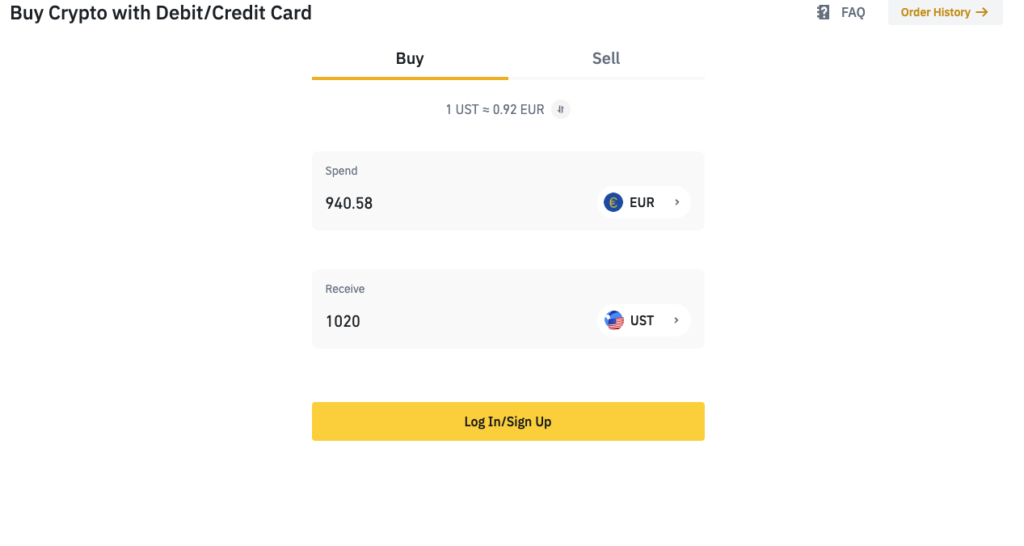

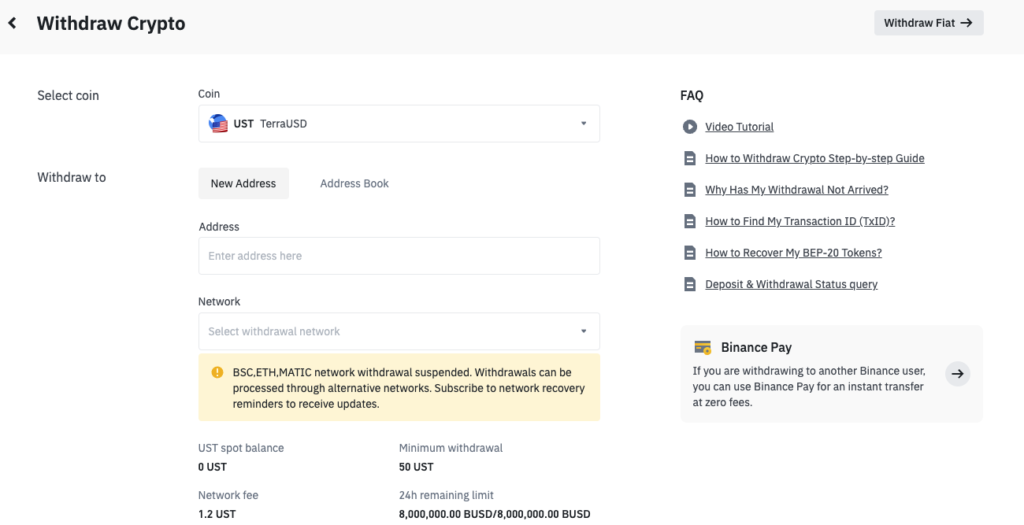

In the next step, we have to buy UST via a crypto exchange – depending on how much we want to invest. For this, we can buy UST directly from Binance* for Euros, or buy the LUNA token from Crypto.com*, which we can then exchange for UST on our TerraWallet. In both cases, we need to send the tokens to our new TerraStation wallet.

From there, we go into the Anchor protocol. We connect the platform to our Terra wallet, go to the Earn section and place our just purchased, or exchanged UST there. Both the transaction from the exchange to the wallet and the transaction to the Anchor protocol have fees associated with them. So we should purchase a few additional coins and keep them in our wallet to be able to liquidate the investment later. About 0.25 to 1.20 UST is due per transaction. To liquidate the contract, we simply go through all the steps in reverse order.

That’s it! The investment now automatically generates 19.5% in interest and pays out the return with each new block in the Terra blockchain, which happens roughly every six seconds. This is the best way to benefit from the compound interest effect.

Schritt für Schritt

- Create Terra Station Wallet

- Buy UST from an exchange*

- Transfer UST to Terra Station

- Put UST into the earn at Anchor

High risks remain

But beware: Staking and lending of Stablecoins is associated with significant risks that can make the entire deposit run towards zero. So you should only invest money that you can lose 100%. Possible risks include UST token fluctuations, platform risk, blockchain risk, smart contract errors, and of course currency risk against the US dollar and euro. Return and risk always go hand in hand, which we pointed out in our last article.