One of the reasons why risk-taking investors repeatedly try their hand at short-term stock market trading is the prospect of high profits that can theoretically be made within a very short time. The stock market is not only a place for long-term investors looking to save for their retirement, but also for those hoping to make particularly high profits in the short term. Leverage is a financial instrument that makes it possible to trade with larger positions than the actual equity available. This can potentially increase returns, but also entails an increased risk of loss. This article will explain in more detail how to deal with leverage professionally.

The effects with and without leverage

Anyone who buys a share must always hold the full amount with most brokers. If this share then rises by 20 % with an investment amount of 1,000 euros, the portfolio also rises by 200 euros. This is of course congruent in the event of a fall in the share price. If, on the other hand, you buy with leverage, you can take a position in trading that is worth far more than the capital invested. The difference between the position size and the capital invested is provided by the broker.

With a leverage of 5, you would only have to hold 200 euros for the same position size, while the remaining 800 euros would be advanced by the broker. In relation, the position would therefore be five times as large as the investor’s initial capital investment. Nevertheless, in the event of a positive price development of the above-mentioned 20%, the investor is credited the full EUR 200. When the position is closed, the trader gets back the EUR 200 invested, the broker gets back the EUR 800 lent and the entire profit ends up in the trader’s account. In this example, the trader has doubled his stake due to the leverage effect. If the price fell by the same amount, however, the stake would be completely lost.

The broker takes an interest rate for laying out the additional capital and can thus further increase its own turnover in addition to the actual fees. Regardless of whether a trade is positive or negative: The broker always receives its fees, which contributes to its profit. The more trading turnover is generated, the more money the broker earns.

To ensure that his customers do not overleverage themselves and lose the money they have borrowed, the trader must deposit a security deposit for each trade. Once this has been used up, the trade is automatically closed to protect investors and brokers from financial losses.

The interaction of leverage and margin

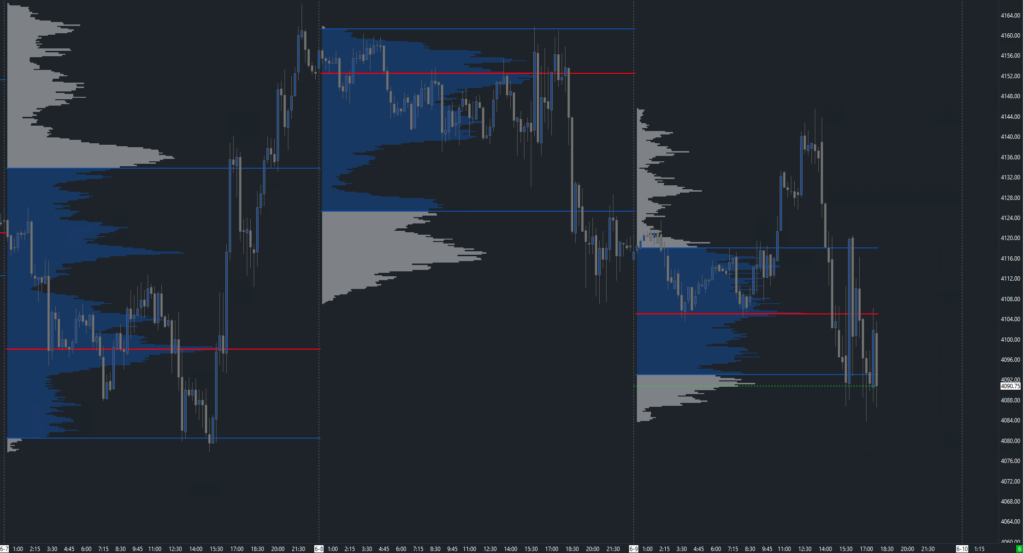

With a leverage ratio of 5:1, a margin rate of 20% of the exposure must be deposited, i.e. 20% of the full position size. Based on the above example, this means that with a trading volume of EUR 1,000, a margin of at least EUR 200 must be held to open the trade. In this case, the leverage ratio is 5:1 and the margin rate is 20%. If the losses now approach 200 euros, the margin utilization of the trade increases automatically. As a rule, the broker notifies the trader when the margin utilization is 80%, which would correspond to a loss of 160 euros. The trader can then either provide additional margin by injecting more money, or the trade is automatically closed when the margin is fully utilized and the full loss is realized.

A professional trader can take advantage of this interplay between margin and leverage. He first opens a position without leverage and waits to see how it develops. Theoretically, the trade is only liquidated when the full stake has been used up, i.e. the price has reached zero. With a leverage of 2, he could absorb a maximum price drop of 50 %, with a leverage of 4 only 25 %. The higher the leverage, the closer the liquidation price is to the entry price.

If the trade now develops in the desired direction, the trader can pull his stoploss to one and increase the leverage in order to take out part of his stake as deposited margin. Although the position then receives a liquidation price, this is always lower than the entry price, as the position is already in profit. If the price falls, the trade is closed at breakeven and the liquidation price is not reached.

The trader can then use the money thus freed up to open further trades in other assets or scale the position further, which in turn has an impact on the liquidation and entry price.

Only use leverage when the position is in profit

This strategy works best if you want to hold an asset in your portfolio regardless of the price and assume that prices will rise anyway. Take Bitcoin, for example: the asset has numerous advantages regardless of the price and we are facing the next bull cycle in terms of ETF appreciation or halving. The trader now buys a futures contract on Bitcoin without leverage in the long direction. If the price corrects downwards, he can add additional money as in a savings plan, steadily increasing his position and reducing the average price and thus the entry price.

If the trade then moves back in the long direction, the trader has a larger size in the market and is back in profit more quickly due to the lower entry price. If the trade has then moved a considerable distance away from the entry in the positive direction, the stoploss is pulled into profit and no more money can be lost. You then increase the leverage and can deduct margin, as you have to hold less capital due to the leverage and the difference is made available by the broker.

The liquidation price will always be lower than the entry price and therefore no longer has any significance. You can use the freed-up capital to scale up further or open other trades and proceed in the same way again. The leverage effect begins.

However, not every platform and broker allows you to adjust the leverage retrospectively. One such provider is Bitget*, the sixth largest provider for crypto trading and one of the cheapest providers for leverage trading. However, only cryptocurrencies such as Bitcoin, Ethereum and other altcoins can be traded here.

Risks nevertheless high

However, this strategy is of course not risk-free. On the one hand, the trader’s plan does not necessarily work out and the price can move in the opposite direction to what the trader had in mind, even over weeks and months. By regularly buying at a loss, he constantly enters into new positions in order to reduce the average purchase price. He leverages himself more and more into the loss until he has no more reserves.

In addition, the broker not only charges fees for opening and closing a position, but can also deduct ongoing costs – so-called funding fees. Even without leverage, the position receives a liquidation price due to the holding costs, which are constantly deducted. The longer a trade runs, the more it has to run into profit later on in order to actually achieve a net return.

In addition, the leverage trader always buys a derivative and never the actual asset. If the broker goes bust, any deposits in the account or open trades are lost. There are no special assets as with physically acquired shares or ETF units. There is a constant platform risk.

Keyfacts

- Leverage and margin play closely together

- Leverage significantly increases the profit and loss potential

- leverage should only be activated when a trade is in profit

- … then you can take out margin

- … and open further trades

- Risks nevertheless remain

- not possible on all platforms

- Bitget is recommended*

- Brand: Finanzbuch Verlag

- Tradingpsychologie So denken und handeln die Profis: Spitzenperformance mit Mentaltraining

- Produktart: ABISBOOK

- Welz, Norman (Author)

Letzte Aktualisierung am 2024-07-21 at 12:24 / Affiliate Links / Bilder von der Amazon Product Advertising API