Thinking back to my school days, the compound interest effect is the only thing I was taught about money in school. Later, in practice, when I accidentally received my first distribution from an active fund, I used the unexpected windfall for my consumption and rewarded myself. I had not thought of reinvesting the dividends. I knew the effect, but mercilessly underestimated it. This is probably true for most people who invest their money in a low-interest manner or who have even handed over their investment completely to their bank advisor. But Albert Einstein already knew better:

The compound interest effect is the eighth wonder of the world. Those who understand it earn money from it; everyone else pays for it.

Albert Einstein

Compound interest can act like a snowball, especially in the long term. At first, it starts rolling slowly, but then it forms a powerful avalanche more and more quickly. The concept is very simple: If you put your money at someone else’s disposal and thus receive interest as compensation for the risk you have taken, you can simply reinvest the additional money you have received and thus get back an even larger sum in absolute terms. One can earn further money with money and let this proverbially “work for oneself”. The compound interest effect is a simple means to build up wealth, but is often underestimated and not used.

Comparison: With and without compound interest

If you invest 5,000 euros at a return of 5% per year and collect the interest at the end of the year but do not reinvest it, you will be credited with 250 euros every year. After 20 years, he has a capital of 10,000 euros, with half coming from his own reserves and the other from interest credits. In this example, it takes 20 years to double the capital invested without compound interest.

| Year | Starting capital | Interest | Final capital |

|---|---|---|---|

| 1 | 5.000,- | 250,- | 5.250,- |

| 2 | 5.000,- | 250,- | 5.500,- |

| 3 | 5.000,- | 250,- | 5.750,- |

| 4 | 5.000,- | 250,- | 6.000,- |

| 5 | 5.000,- | 250,- | 6.250,- |

| 10 | 5.000,- | 250,- | 7.500,- |

| 15 | 5.000,- | 250,- | 8.750,- |

| 20 | 5.000,- | 250,- | 10.000,- |

The situation is different if the interest credits received at the end of the year are also invested in the next year. In that case, doubling is already possible after about 15 years. The 10,000 euros finally become 13,226.49 euros after 20 years. In total, one has received interest payments of 8,266.49 euros instead of only 5,000 euros without taking advantage of compound interest.

| Year | Starting capital | Interest | Final capital |

|---|---|---|---|

| 1 | 5.000,00,- | 250,00,- | 5.250,00,- |

| 2 | 5.250,00,- | 262,50,- | 5.512,50,- |

| 3 | 5.512,50,- | 275,63,- | 5.788,13,- |

| 4 | 5.788,13,- | 289,41,- | 6.077,53,- |

| 5 | 6.077,53,- | 303,88,- | 6.381,41,- |

| 10 | 7.756,64,- | 387,83,- | 8.144,47,- |

| 15 | 9.899,66,- | 494,98,- | 10.394,64,- |

| 20 | 12.634,75,- | 631,74,- | 13.266,49,- |

Always use compound interest and the long term!

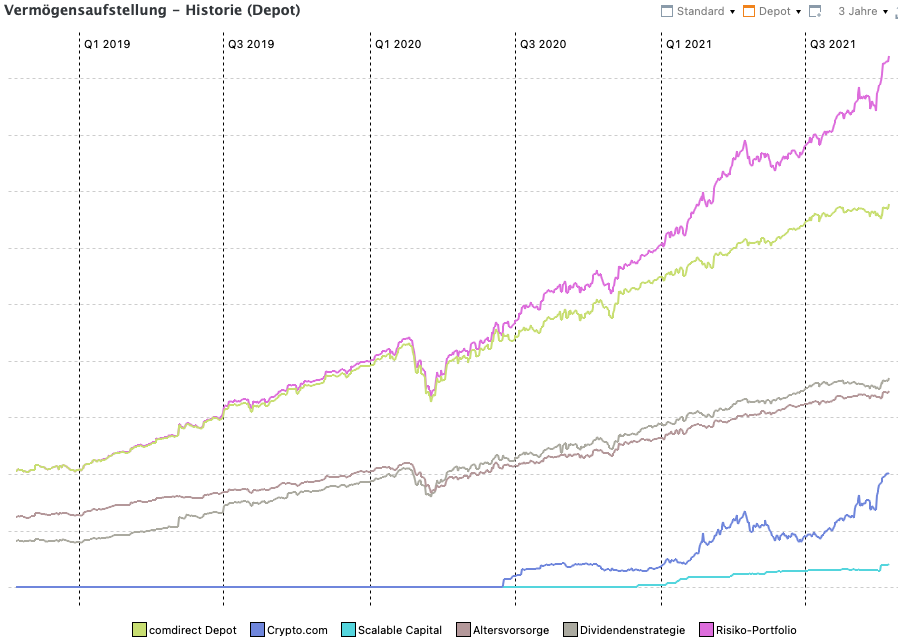

This means that the interest payments received should always be reinvested in order to allow the assets to grow in the best possible way, which we absolutely need for our old-age provision. The shorter the period of interest payment, the better. As a rule, banks pay out the interest at the end of the year. However, there are also offers where interest payments are made quarterly or even monthly. Such offers are always preferable if the risk remains the same. Compound interest works mainly towards the end of the year, and thus especially when it has been allowed to work for us for a long time. The long term is indispensable when taking advantage of it – the wealth curve becomes steeper and steeper, almost exponential, with longer investment periods:

The biggest levers are high and frequent interest payments and the time factor. Compound interest has an enormous impact on our financial investments and has been called the eighth wonder of the world by Albert Einstein, and not without reason.

Keyfacts:

- for the compound interest effect received interest payments must be constantly reinvested

- a doubling of the invested capital then occurs much sooner

- altogether one receives clearly more interest on his starting capital

- factor time and the period of the interest payments are crucial

- the compound interest effect is not considered the eighth wonder of the world for nothing