“I don’t have any money left to save at all”. This is the excuse many people give, but without keeping track of their actual expenses and income. Meanwhile, there is a certain savings potential slumbering in each of us, because in everyday life we spend money again and again on something that we don’t actually need. We often do this with a subconscious routine. Be it the coffee-to-go in the morning, the roll at the bakery or the roasted almonds that we have only quickly taken because of the tempting smell. It’s the little snacks of the day that keep costing us money. These supposedly small expenses quickly accumulate to a large sum!

A budget book provides an overview

If you don’t keep a book, you’ll never find out and discover this savings potential for yourself! The first step for a savings beginner who wants to take the scepter for his retirement provision into his own hands is therefore to keep a budget book. In it, all expenses and income are entered chronologically down to the penny and sorted into different categories. The latter then makes it possible to obtain a precise overview of expenses at the end of the month. Many people will be amazed at what they spend their money on!

Keeping a budget book is not difficult! Either you sum up your items independently in a simple table, or look for an appropriate template on the Internet. In Microsoft Excel, such a template is even integrated by default. It’s even easier with the help of a smartphone app, which you can use to make entries while you’re on the go, without having to remember your expenses later because the money in your wallet doesn’t match the total in the budget book.

Excel, app or banking software

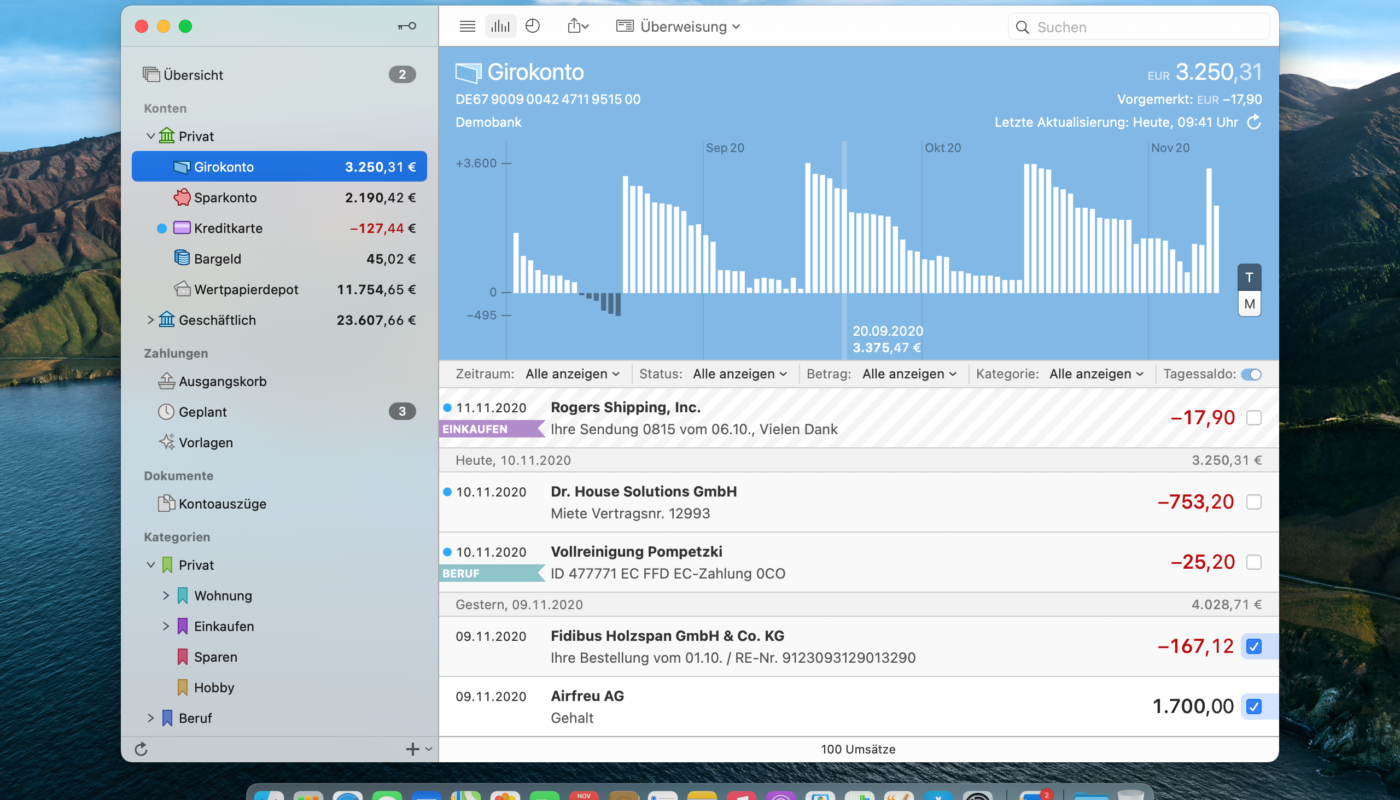

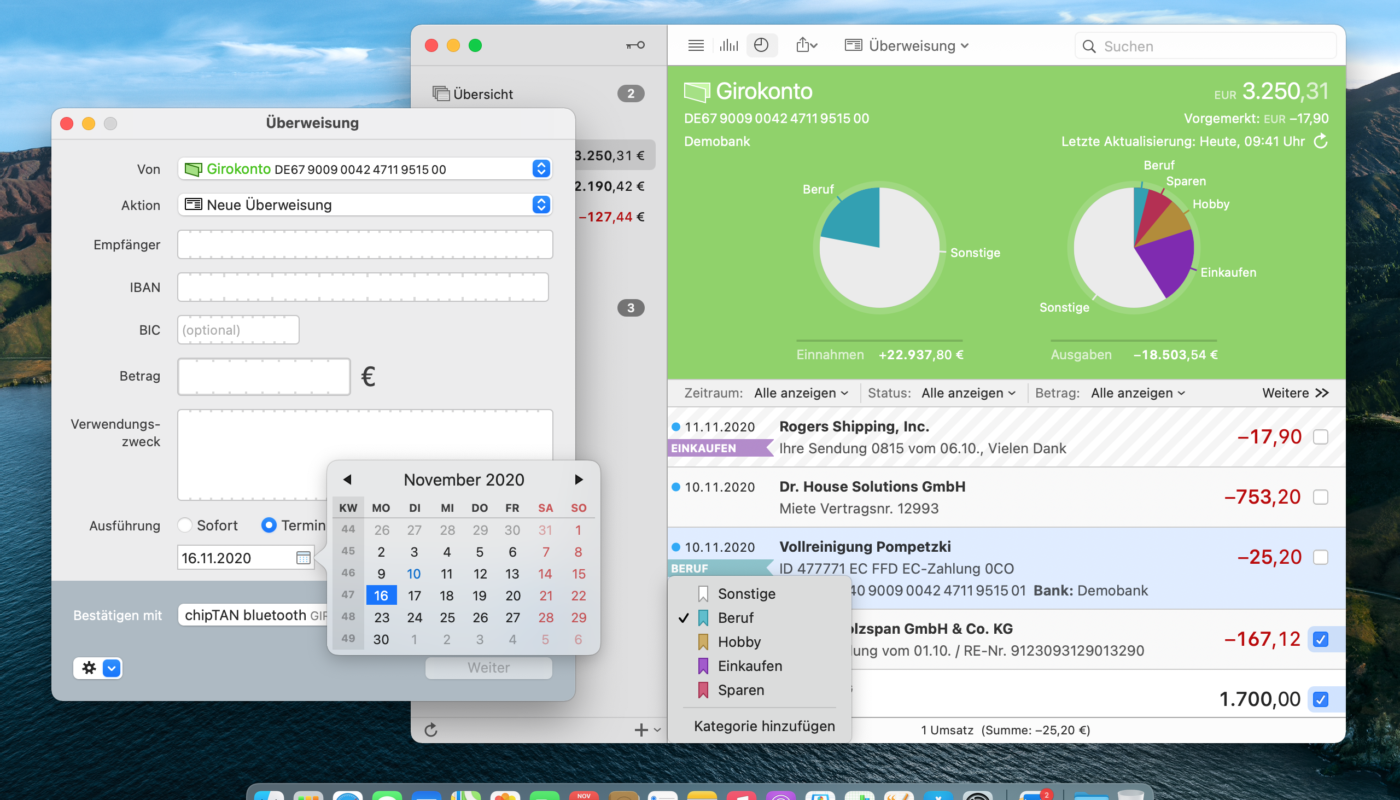

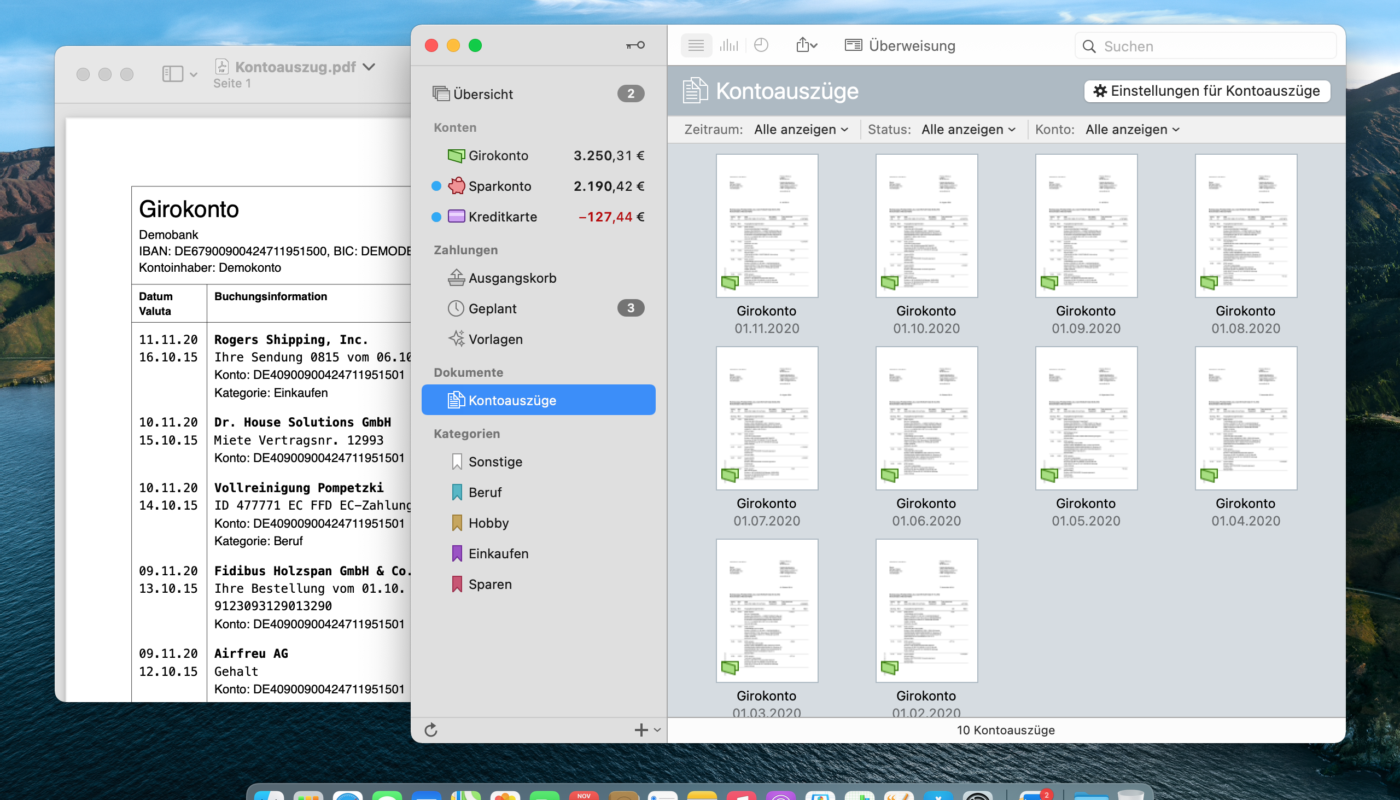

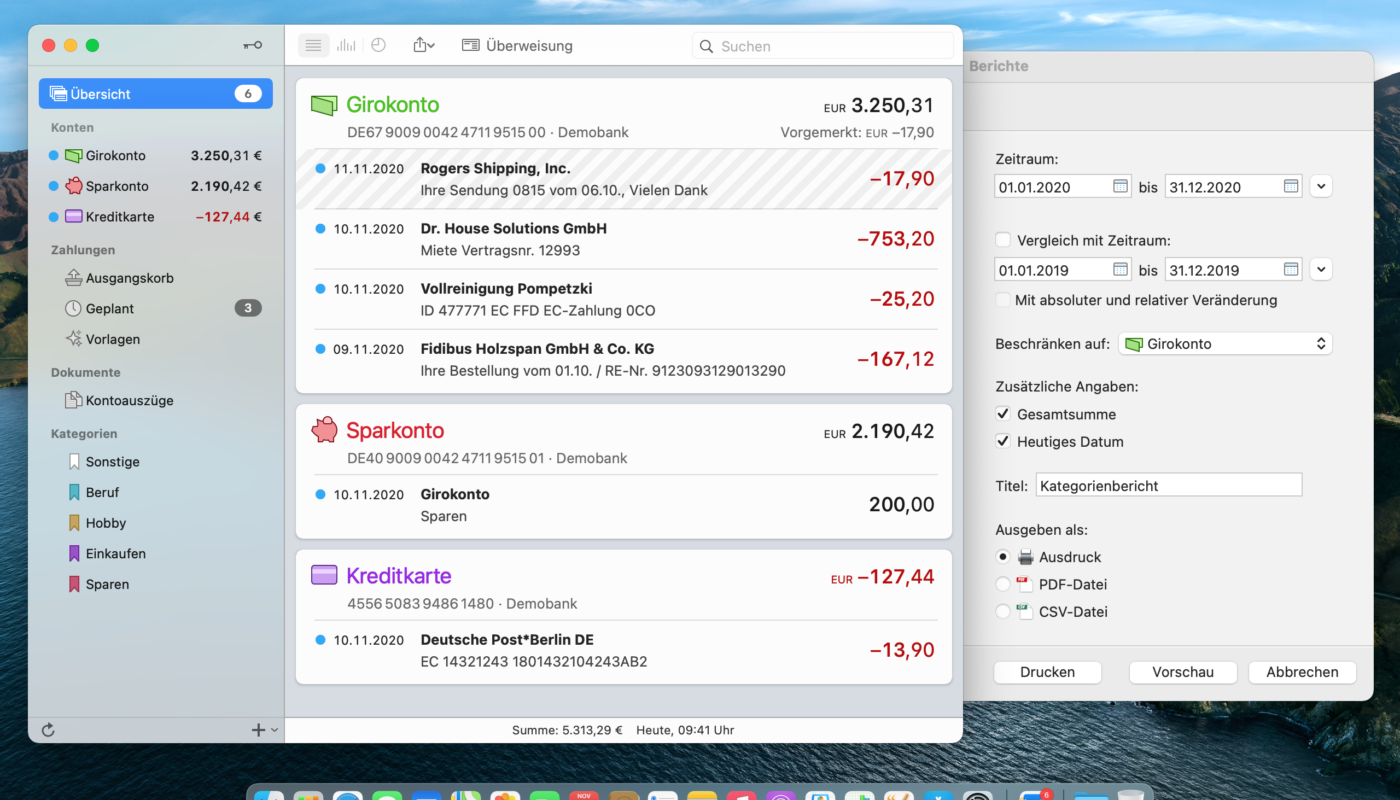

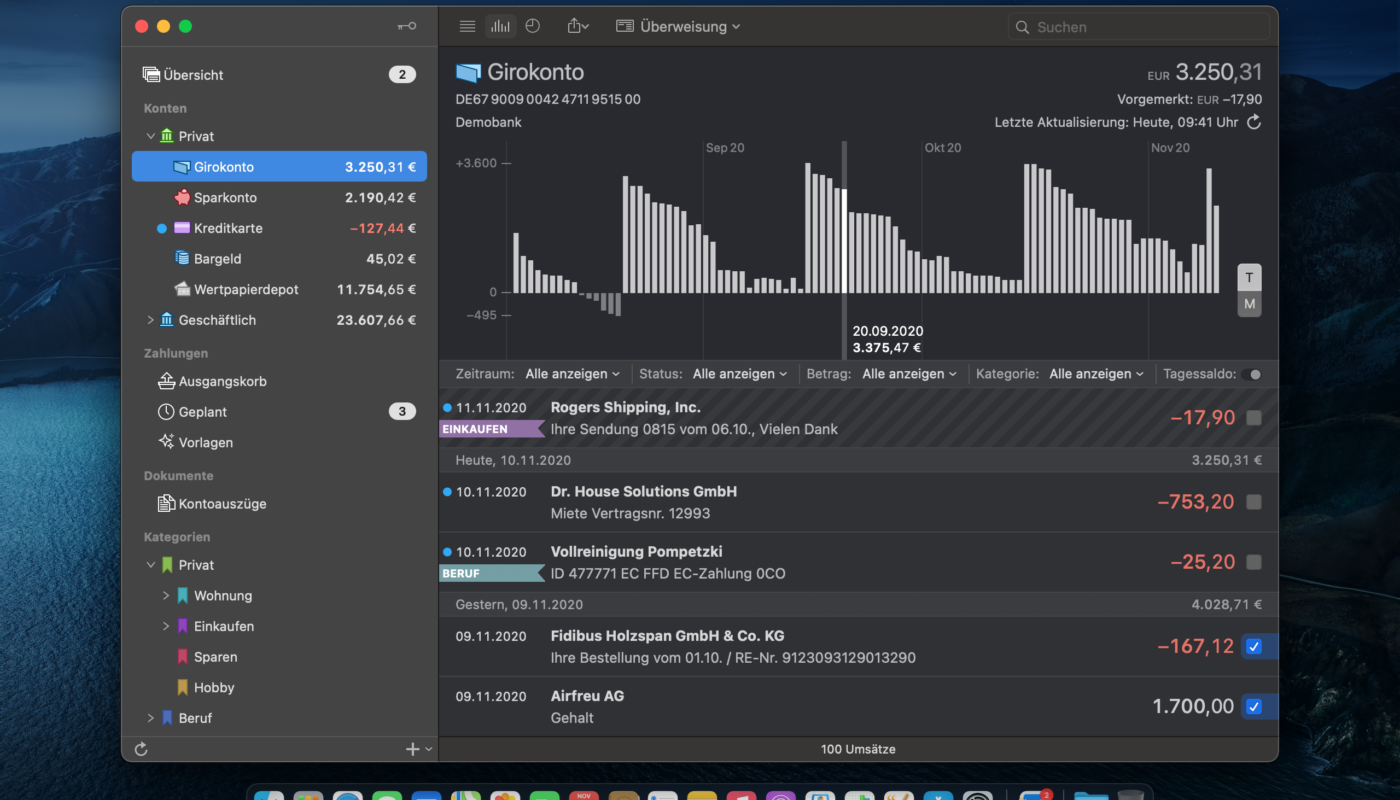

I use the MoneyControl software from the developer Mobiware for this purpose. The application is available for Mac and Windows users, as well as for iOS and Android devices. Meanwhile, there is even a web app available. It allows the creation of various accounts and categories and enables clear statements, which can then be conveniently saved and printed as a kind of account statement in PDF format. Synchronization between the individual devices takes place via the cloud.

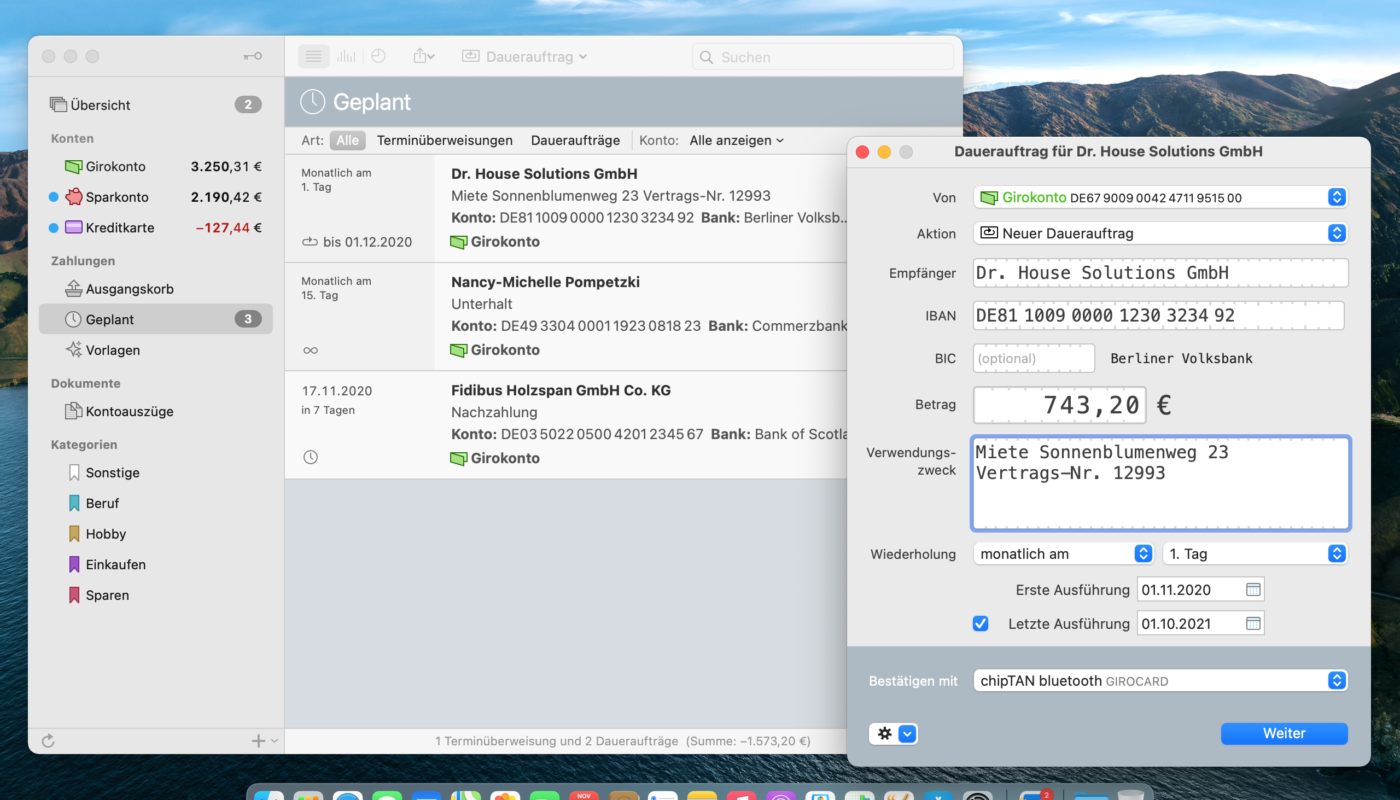

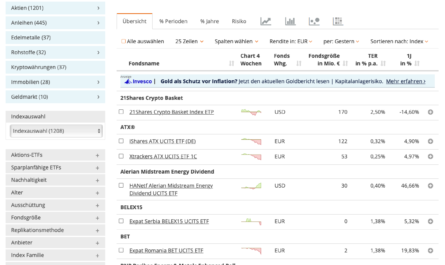

Another alternative is banking software with an offline account and category function. Then all transactions on the checking account or credit card are automatically retrieved and sometimes even classified correctly. I use the free Outbank app here, although I clearly prefer MoneyMoney in terms of analysis functions, even though the software is only available for Mac users and costs just under 30 euros. On the other hand, if I have the right account, I can make transfers and transfers directly from the app and always have an overview of all my deposits.

Multiple sub-accounts increase discipline

Having many accounts is another trick of this article. It is recommended to use a multiple account system: First, to allow you to keep track of your expenses, but also to improve your discipline. I recommend keeping at least three accounts, which automatically replenish each other via standing orders each time a salary is received.

The main account is where all income and fixed costs come together. The employer transfers the salary to this account, and constant expenses such as rent, electricity or the smartphone flat rate are deducted directly from this account. The second is the savings account. This is where the monthly savings installment for the nest egg or, later on, the securities account is regularly paid into – in the spirit of “pay yourself first”. The third account is the spending account for all other consumer expenditures such as food, restaurant visits, Netflix or gasoline at the gas station. You work with budgets and set yourself fixed limits.

A simplified version of a possible multi-account system in brief:

- Main account: Employer’s salary transfer, regular expenses (rent, electricity, cell phone service, etc.)

- Savings account: Monthly savings rate for own nest egg (3-5 net monthly salaries are recommended) as well as capital for a future custody account

- Spending account: Consumption – in the sense of food, restaurant visits, fuel for the car, tickets for public transport, etc.

Extreme: separate account for each money recipient

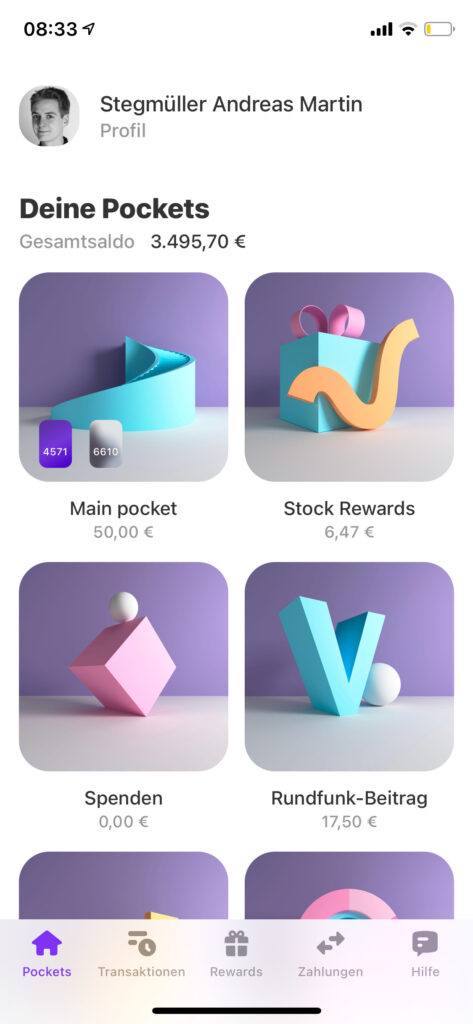

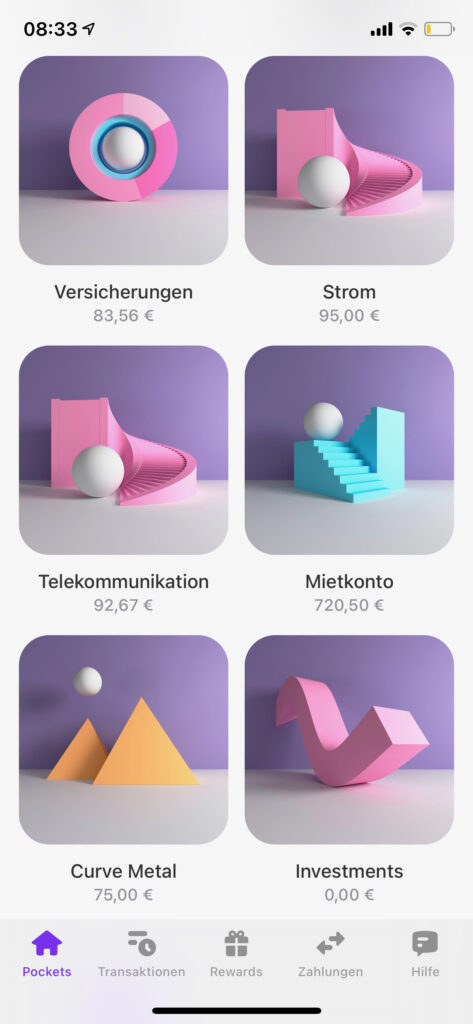

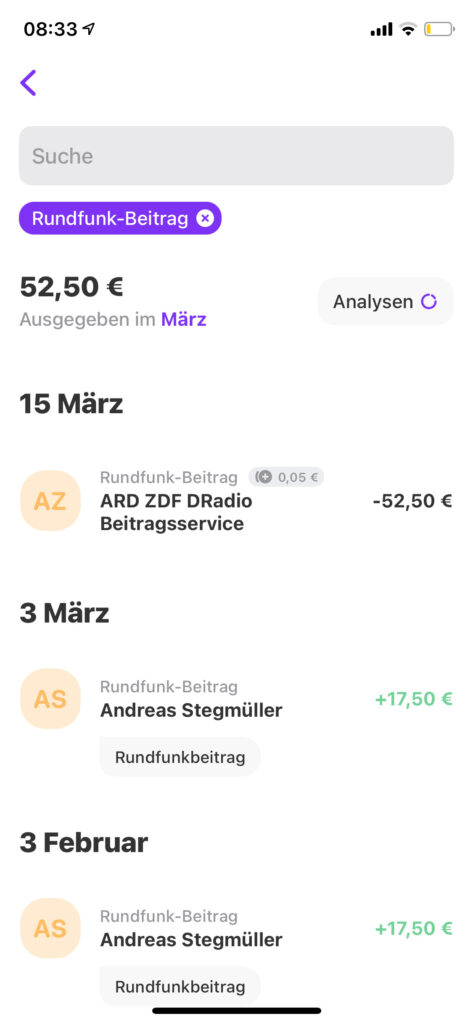

I even go one step further and have a separate account with a separate IBAN for almost every service provider I use: One for Deutsche Telekom and my landline and mobile phone connection, one for my electricity provider, one for my landlady, one for Netflix, one for Amazon Prime, one for my insurances, one for the broadcasting fee and so on. That quickly adds up to a few accounts!

Standing orders are then automatically sent from my salary account to the individual sub-accounts, broken down once a month. From the annual costs of 69 euros for the Amazon Prime subscription, 5.75 euros go to the designated account each month. The advantage: As the annual payment approaches, I already have the money ready and can continue the month without worrying about where I’ll get the money. Sure, that might work for 69 euros, but for car insurance it can add up to several hundred euros.

So in the worst case, you save yourself the expensive overdraft fees. Another advantage is the overview. I always have everything in view and can even see from the balances when the next payment is due.

For this function, I used the free Neo-Bank Vivid Money. It doesn’t cost me a single cent a month and allows up to twelve sub-accounts with their own IBANs, from which direct debits can even be made. Vivid Money has other interesting features like a cashback function, great analytics reports, and of course can be used conveniently from your smartphone to quickly initiate payments or request money from friends.

Other alternatives would be N26* or bunq*, although the sub-accounts are only available in the payment plans.

Keyfacts:

- Keep a budget book. This helps enormously to keep track of daily (sometimes unconscious) expenses.

- Use a multi-account system to primarily pay yourself. Click here for more aspects of this approach.

Conclusion: How many accounts you personally need depends entirely on how you want to organize your everyday finances. Fixed standing orders, such as for consumption, allow you to set yourself a fixed framework. However, with disciplined documentation, it is also possible to get by with one account for rent expenses & all everyday consumption. Here again, it is more challenging to maintain a permanent overview.