After the willingness of Germans to save had increased significantly during the pandemic, simply because various reasons for spending money had disappeared at that time, the number of those who have no reserves at all has recently risen again significantly. This was the result of a survey conducted by the major Dutch bank ING at the beginning of December.

Whereas last year around a quarter said they had any money at all for more difficult times, the number has risen significantly again. Around 30% of those surveyed said they had no reserves at all. They scrape by from month to month on their salaries and are therefore unable to cover unplanned purchases in an emergency from their own funds, as would be recommended in terms of a nest egg.

Inflation and low salaries are to blame

The reason for this is the predominantly rising prices for energy and food and the general increase in inflation, which cracked the 10% mark again for the first time last year. One in eight said that their previously existing savings had been eaten up by this. However, more than half of those affected cited a generally too low income as the main reason. Germans save above all in the gastronomic sector and in leisure, whereas restrictions are avoided in personal care. Shockingly, three out of ten of the survey participants said they did not spend a single cent on education.

Germany, which likes to call itself “the land of savers,” has long since ceased to occupy this position. On the contrary, in a European comparison of 13 countries, the proportion of those who have no savings at all is the highest. Only in Romania is this figure even higher. Germany scores poorly on this indicator by more than five percentage points in a European comparison.

A warning signal for prosperity

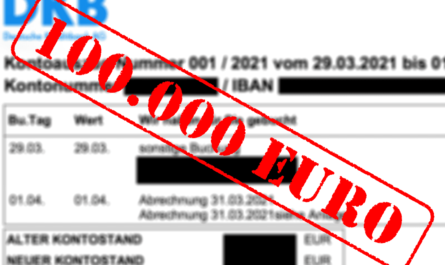

Germans’ savings are under pressure – this is also evident when looking at their level: Although the number of those who have saved more than twelve net monthly salaries went up, the number of those who have less than four to six or seven to twelve net monthly salaries on the side went down. Less than one Monday’s salary is held by about 7% of savers.

That alone should be seen as a warning signal. Meanwhile, the traffic light government is trying to counteract this with strong relief measures. Most recently, the number of shareholders has also been declining.