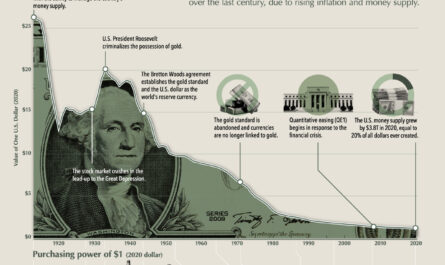

Although I have been active on the stock market since 2016 and thus already around five years, it took me several months to define my own strategy for eternity in order to be able to implement it continuously until retirement. In the first years I was also blinded by the beautiful products of the industry. My first, actively managed funds came with high costs and fees. My self-built world portfolio, investments in dividend stocks and especially in cryptocurrencies came much later. I have only been investing in a truly automated way with monthly savings rates since 2018, which means that I can at least look back on an investment horizon of about four years.

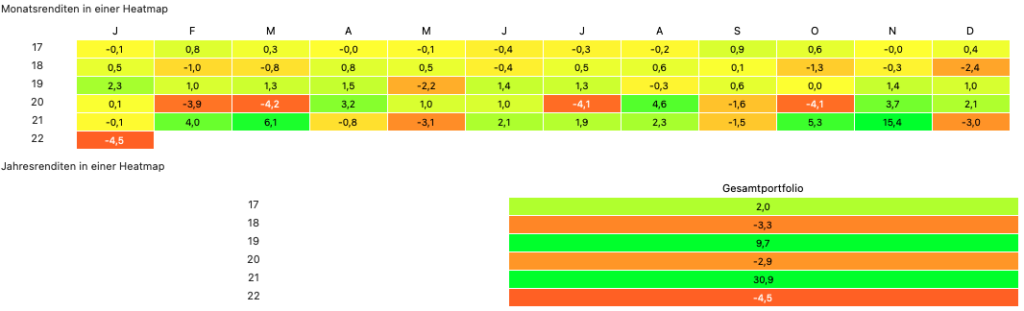

Last year was the most successful of my career as a private investor. I earned a whopping 30.9% return during this period alone. This was not only due to the significantly higher deposits and my rather high savings rate, but also due to the Corona crash, during which I made additional investments with a predefined plan. During the crisis on the stock exchanges, I paid in remaining additional money and was thus able to increase my shares considerably.

In November alone, my investments made a whopping 15.4% return, but that was due to strong gains in the crypto market. The CRO Coin on my Visa credit card alone gained 253.2% during this period.

Corona crisis was a powerful yield boost

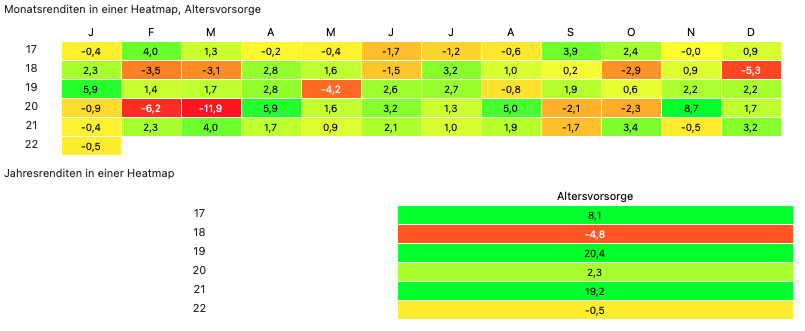

But it wasn’t all smooth sailing: at the time of the Corona crisis in March and April, I lost 3.9% and 4.2% respectively at the peak, which added up to almost a full year’s salary. In retrospect, the additional deposits made the price losses not quite as bad as on the overall market. Today, I’m well in the black, and that’s despite the fact that during the last six years, I’ve only had positive returns in three years. In 2018, my investments lost 3.3% and in 2020, 2.9%. The losses were easily recouped in 2019 and just 2021 with 9.7% and 30.9%, respectively, with the totals on the right side of the timeline being the largest. In the first few weeks of the year, my statistics again show a significant drop of almost 9%.

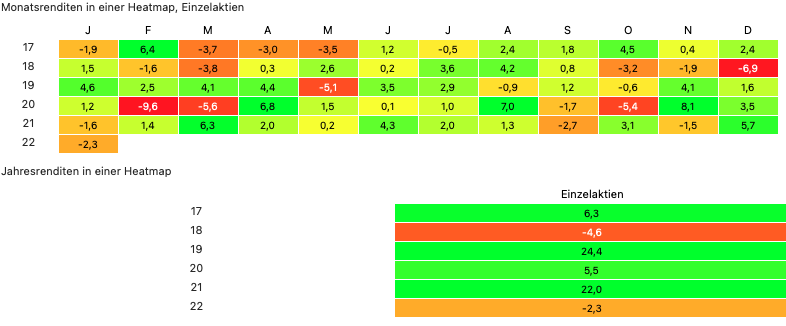

My fixed income strategy with the replicated world portfolio is proving to be very solid so far. With the exception of 2018, I have been consistently making gains with it from year to year – sometimes in single digits, sometimes in double digits. My Developed World ETF alone has an internal rate of return of just over 16%. Only the real estate sector made slight losses of around -5.4%.

From total loss to over 350% return

Among the individual stocks in my early retirement strategy, I suffered my first total loss with Wirecard in July 2020, losing the entire position with the exception of a few euros. It is my worst investment to date. However, the red lantern also goes to Fresenius and Altria, where I am partly 25% in the red. In general, there were always stocks where you had to endure a lot. A good example is Royal Dutch Shell, where I was at times almost 50% in the red, but increased my holdings substantially at the time of the Corona crisis, reduced my entry price significantly, and am now back in the black, especially when dividends are taken into account.

Microsoft and Apple have always been among my best stocks, some of whose positions have more than doubled. The number of my dividend payments has increased more than twelvefold since 2017. Meanwhile, I can cover my fixed costs gross for more than two months. That creates freedom and independence!

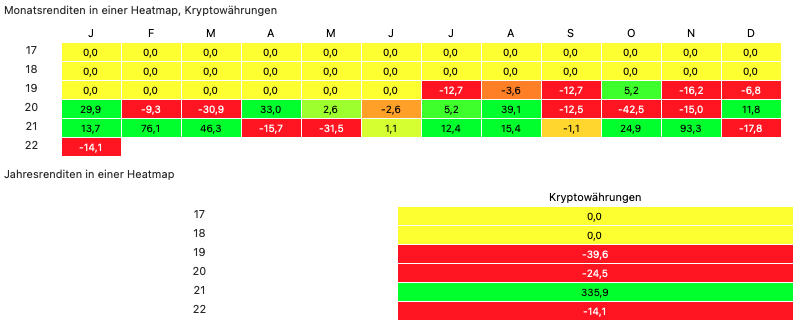

There is even more to endure due to the fluctuations in the crypto market. When I started my first investments in this asset class in 2019, I suffered a loss of 39.6% at the end of the year, only to record another loss of 24.5% the very next year despite regular deposits. However, the year 2021 made up for all losses with 335.9%, and my crypto portfolio at times exceeded the value of my individual stocks. At the beginning of the year, however, it went down again by double digits.

My investments in the P2P market show the most stable value, where I earn 6.75% interest annually due to a single position in Bondora Gow & Grow*.

Satisfied, but nowhere near my goal

Overall, I see myself on a very good path. Even if I were to stop making any deposits and simply leave my positions until retirement, I should be able to make a good living in my old age. At least for me, I no longer need to worry about poverty in my old age!

However, the goal of financial freedom is still a long way off. I am confident that I will achieve this much sooner than at the age of 67. I’m definitely keeping my eye on the ball!