Over the years, I have tried many accounts, securities accounts and banks. Some of them appealed to me functionally, others were very favorably positioned and others I have been using for a very long time simply out of convenience. In this post, I’ll tell you about all the banks and providers I really like using myself and briefly list their pros and cons. In the end, a lot depends on what products you buy for your investment, how often you save and how much, or what your personal preferences are in terms of usage – whether smartphone or desktop view, for example.

Disclaimer: The majority of the links and banners used in this article are affiliate links. When a contract is concluded via these, TradingForFuture.de receives an advertising cost refund. This has no disadvantages for the customer. On the contrary: Mostly he also receives a bonus for opening through such links. In this blog, only programs and providers are recommended and linked, which the operator himself has found good and uses himself in his everyday life!

Shares and ETFs

Scalable Capital

My favorite broker, which I am currently very happy to recommend, is Scalable Capital*. This is mainly due to the very favorable cost structure. For example, you can trade as many shares as you like on the Munich Stock Exchange for a monthly fee of 2.99 euros if you pay annually or 4.99 euros if you pay monthly, as long as you generate a turnover of at least 250 euros. This makes Scalable Capital especially interesting for those who frequently buy shares in smaller tranches. Without the monthly subscription or below the minimum amount, also very favorable 0.99 euros are due.

Those who prefer to trade on the Xetra exchange can also do so, but must pay 3.99 euros per trade here, regardless of the subscription. Those who save via a savings plan do not even pay a single cent at Scalable Capital – regardless of whether they choose the paid Prime Broker or free model. Especially practical: Savings plans are executed from as little as one euro! In addition, Scalable Capital can be used via a smartphone app as well as via a desktop interface in the browser.

I currently have my second custody account with Scalable Capital and regularly make additional purchases here in smaller tranches. I am considering transferring my individual securities to Scalable Capital in order to also execute my savings plans there at even better conditions.

comdirect

My large main custody account is held at comdirect*. In my early days, the direct bank had some of the best conditions and enabled the execution of savings plans and thus the purchase of fractional shares at a very early stage. Here, one pays a fee of 1.5% of the savings amount for each savings plan and can do this from a savings amount of 25 euros per position. However, the acquisition of individual securities in a one-time purchase is quite expensive with at least 9.99 euros. In return, you can trade on almost all stock exchanges in the world and thus also acquire more exotic values. I use comdirect mainly for convenience, but I still find the usability and the fee structure for savings plans quite okay.

Smartbroker

Smartbroker* is like comdirect and full broker, which provides access to some trading venues, but is slightly cheaper than comdirect. As a rule, one pays here for a one-time purchase 4 euros per trade. When executed via Lang & Schwarz, only 1 euro is called, and with gettex the trading fee is even waived completely. However, at least 500 euros must be traded. ETF savings plans are offered free of charge from 25 euros.

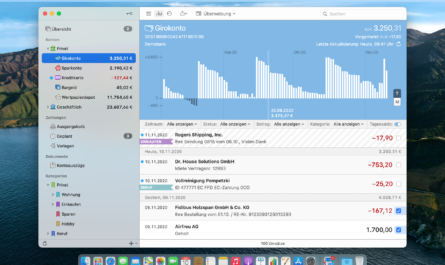

Girokonten

DKB

I currently have one of my main accounts at DKB. This is where my salary ends up, and from there it is distributed to other accounts via automated standing orders. In addition, my nest egg is in the call money account with a low interest rate of no less than 0.001%. The conditions are otherwise excellent: DKB does not charge any account management fees, and the credit card is a real credit card as an active customer with monthly salary receipts, without charges for use abroad or cash withdrawals.

Vivid Money

The standing orders go directly into up to twelve sub-accounts with their own IBAN at Vivid Money. All my contractual partners, such as Deutsche Telekom, Zurich Insurance, the broadcasting fee or membership fees, as well as the landlord, are then allowed to debit from there. This improves my overview of my expenses. On top of that, there are some interesting cashback options that let me save a few more euros.

Kreditkarten

Amazon Visa

The Visa card from Amazon* is a basic component of our wallets when it comes to saving a little money on our daily shopping around the corner. Every time you use the card, you earn Amazon points of up to 0.5%, which you can then use to make cheaper purchases from the largest online retailer. If you use the card directly at Amazon, you can even save up to 3% on your purchase. The card is permanently free for Prime members. All others pay an annual fee of 19.99 euros from the second year of use.

American Express Payback

American Express Payback* also helps us to save a few euros when shopping. Through it, we collect additional Payback points, which we then transfer to our checking account once a year and then send towards the deposits, where the former points are allowed to multiply even further. We also regularly use the American Express Offers to save even more. Just recently, there was an Offer that offered a 10-euro credit on a 70-euro purchase at Aral.

Curve

In order to be able to bundle all our cards and not always have to have them in our wallet, we use the fintech Curve*. This is a MasterCard that, as an overdraft card, debits directly from the deposited card and thus simply passes the transaction through. It also lets you transfer bookings from one card to another, ironing out lost cashback or a booking on the wrong account. A nice side effect: Thanks to the best exchange rates, the card is very inexpensive, especially abroad, and also allows cash withdrawals completely free of charge. The Curve card is therefore our real main card: completely flexible, completely free. There is a 5 euro bonus via our link!

Fixed-term and call money accounts

Weltsparen und Zinspilot

For larger reserves, for example to be able to buy more in a crisis, to pay for a vacation or a possible move, we have a few call money and time deposit accounts in other European countries. There are sometimes more returns, but in the long term, with a view to inflation, this type of investment is still a losing proposition. To avoid having to open an account at every bank, we use the two providers Weltsparen* and Zinspilot*. With them, one opens a trust account and instructs them to open corresponding accounts. This is convenient and simple.

P2P loans

Bondora

To further improve the return on our liquid cash holdings, we also leverage the P2P market and lend our money to numerous different borrowers. We do this mainly through Bondora Gow & Grow* and collect 6.75% annual return for this. Just 100 euros brings in significantly more than 1,000 euros in overnight money! We could therefore cope with the possible total loss of the 100 euros.

Cryptocurrencies

Crypto.com

We are also invested in various cryptocurrencies, but have also invested so-called Stable-Coins, in order to earn even higher interest rates without being greatly exposed to fluctuation risk. As a platform, we use Crypto.com* for this purpose, which we had already presented in detail in a separate article. Another interesting feature is their VISA card, which promises high cashback rates on purchases and allows us to generate additional coins, which should bring us further returns in the long run.

Trading futures

AMP

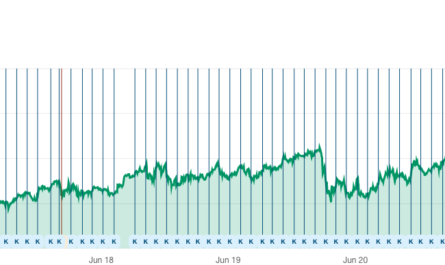

We manage our real money accounts in futures trading directly in the USA at AMP Futures. Here you can find the most favorable conditions. However, futures trading is associated with great risks. Losses can, under certain circumstances, considerably exceed one’s own deposit. Since we also deal with derivatives on this blog, we do not want to withhold the broker at this point.