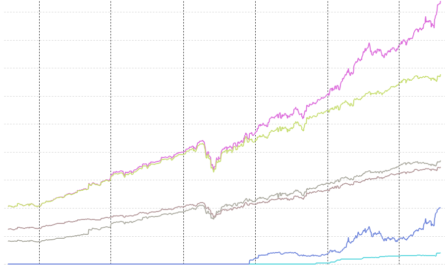

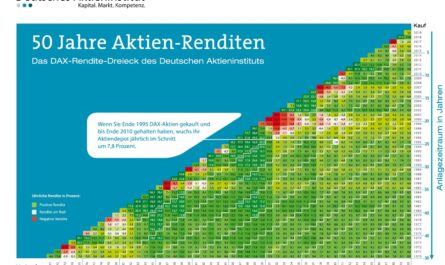

That only the holding period of a share or a future trade determines whether one acts as a speculator or investor on the stock exchange, we had already shown in November in a separate article and at the same time made clear that the statistics are rather on the side of the long-term investor, since the risk of loss is significantly reduced. In fact, there are other types of investors that we would like to introduce once in this article.

So far, most of TradingForFuture.com has been about long-term wealth accumulation. Only if there are several years between the purchase and the sale of a position, the investor may call himself an investor. It does not matter to him whether the value of his share rises or falls in the short term. The fluctuations do not bother him. He wants the company in which he has invested to be able to work with his money and grow in the long term so that it can continuously increase its sales and profits. Then, in the end, both sides have something to gain. On the other hand, if you sell a position after just one year, you are position trading. Position traders decide from year to year whether they want to hold or restructure their investment.

The shorter the holding period, the less investor you are.

The shorter the holding period becomes, the more you move towards trading. Those who hold their position for a few months usually jump on a trend and want to take their profits as quickly as possible. A good example here would be Biontech. The company was able to grow quickly due to its vaccine for the Corona crisis from a fundamental point of view, although it is uncertain how it will continue after the pandemic. The trend trader enters in such phases and then sells the position again when the trend or the hype is over.

Who acts even more short-term at the markets, because he would like to move perhaps more money, and holds his positions only few weeks, is active in the Swing Trading. Here one wants to take larger swings in the share price – all the same whether downward or upward. As a trader, you can sell a position short and thus profit from falling prices.

| Holding time | Type of investor |

|---|---|

| A few minutes | Scalper |

| A few days | Daytrader |

| A few weeks | Swingtrader |

| A few months | Trendtrader |

| A few years | Positionstrader |

| Several years | Investor |

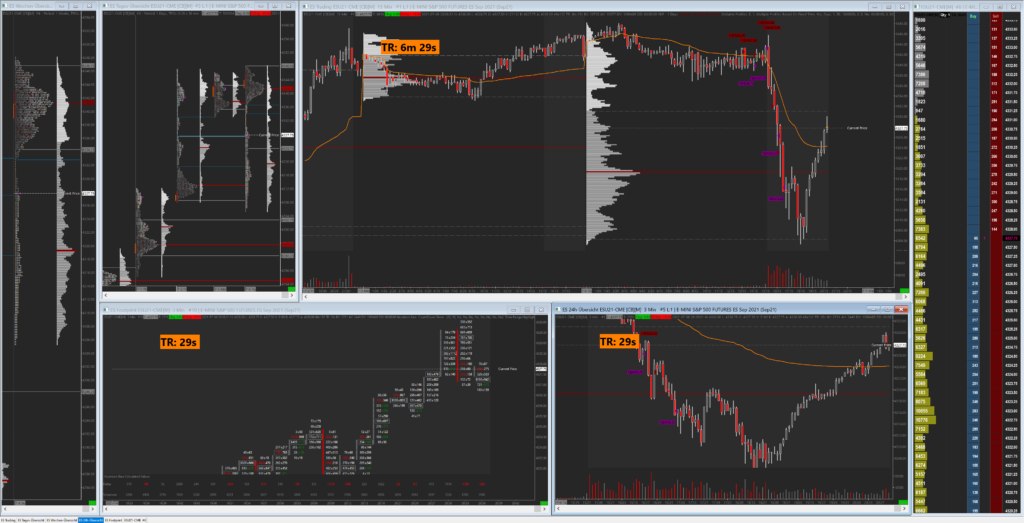

Anyone who opens a position within one trading day and closes it again at the latest at the close of trading is a classic day trader. A day trader does not want to take the overnight risk or even the risk that events happen over the weekend that affect the stock markets for Monday. We are also active in the futures markets as day traders. Our trades usually run for only a few minutes to a few hours. We do not want to take the overnight risk because of the leverage.

As a scalper, you mainly enter the market with large position sizes or a particularly high leverage and try to take every small market movement. Then even small fluctuations in price can mean a lot of money because of the position size. It is the supreme discipline in trading and requires a lot of discipline as well as emotional stability.

Keyfacts

- only those who hold their positions for years are investors

- if you hold your positions for less than one year, you are already trading.

- we are long-term investors and daytraders