In this blog, one or the other savings trick has already been published, which should help in everyday life to be able to put away more money for his retirement provision. However, in order to be able to continuously increase the savings rate, this ability must first be brought into focus and a certain awareness must be trained. The 752 and 173 rules can help here.

They are designed to improve motivation to reduce unnecessary consumer spending while continuously increasing the savings rate. If you multiply your weekly spending by 752, you automatically get the amount you would have if instead of spending the money you had invested it for ten years at 7% interest. An example: Coffee-To-Go costs 2 euros every workday and thus 10 euros a week. If one were to save these expenses, one would end up with an impressive 7,520 euros on the high side according to the 752 rule. Instead of a cup of coffee, you could then treat yourself to a small car or make a larger purchase for your own apartment.

It’s not about not being able to afford coffee on the road, but rather about creating an awareness of one’s weekly expenses and discovering hidden savings potential. How much money can you save brewing your own coffee early in the morning and taking it to work?

For monthly expenses: The 173 rule

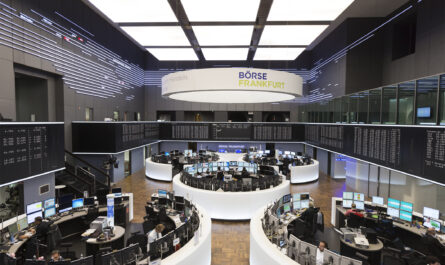

The 173-rule works in a similar way. Here, however, it is not weekly expenses that are used, but monthly ones. This can be, for example, the cost of Netflix, the gym or spending on cocktails and alcohol, which are simply added up as a monthly budget. For example, if you spend 50 euros a month at your favorite bar, you’d have an investment with a 7% return of 8,650 euros after a decade, which would allow you to buy a small car or plan a longer vacation. Nevertheless, 7% is not unrealistic in times of low interest rates on call money accounts. In recent decades, the global stock market had achieved such a return on average.

If you can’t identify with either the 752 or 173 rule, you can think about how long you would have to work for your employer for every expense you incur. One simply converts one’s lifetime to the expenditure. For example, with minimum wage starting in October, a person will have to work for his employer for about ten minutes to get a cup of coffee.

Keyfacts

- multiply weekly expenses by 752…

- …monthly by 173…

- …you get the sum you would have earned after 10 years with 7% return on investment

- or you convert the expenditure into working hours