One of the achievements of Liberal Finance Minister Christian Lindner and the current governing coalition of the SPD, FDP and Greens was the increase in the savers’ allowance, which came into force at the beginning of the year. The tax-free allowance represents an important tax regulation that is intended to provide savers with relief from the flat-rate withholding tax and at the same time provide an incentive to save, but also to provide for retirement on one’s own responsibility away from the statutory pension.

While the tax-free allowance until 2022 was still 801 euros for singles and 1,602 euros for married couples, these amounts were increased to 1,000 and 2,000 euros respectively at the beginning of 2023. This article will explain in more detail that this is still far from sufficient.

Inflation and loss of purchasing power

One of the main reasons for the need to further adjust the saver’s lump sum is inflation. It causes money to lose purchasing power over time. The same amount of money will be worth less in the future than it is today. Inflation has risen sharply in recent months in particular. The cost of living, especially for energy and food, has risen significantly. We need to set aside more money today to be prepared for future expenses. A higher saver’s allowance would mitigate the loss of purchasing power and strengthen everyone’s financial provision.

Incidentally, the allowance has not been touched since 2009 – 13 years during which savers suffered an average loss in value of around 2 to 3% due to inflation. In the years from 2002 to 2003, the savers’ tax-free allowance even once amounted to 1,550 euros and it was possible to offset an additional lump sum for income-related expenses, for example to claim the costs of attending the shareholders’ meeting for tax purposes.

Long term financial planning

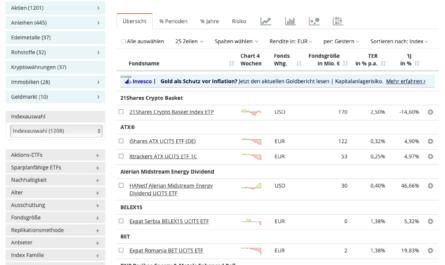

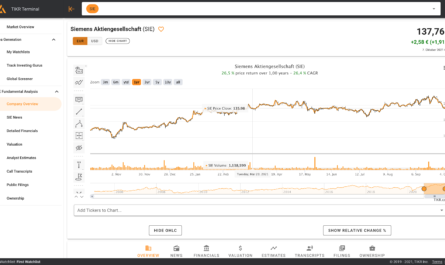

A higher lump sum for savers would also make it possible to plan for the long term and invest savings more effectively. With a higher lump sum, people would be able to invest more money in different types of investments to protect and grow their wealth – just as we keep advocating in this blog with a view to broad-based management. Not only would this benefit individuals, but it would also promote the economic stability of the country by stimulating the capital market and encouraging investment.

Securing the future

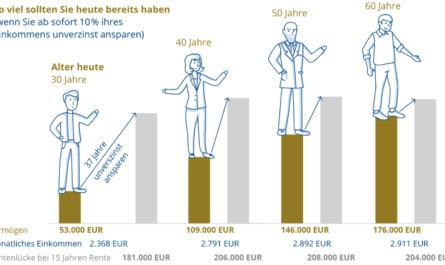

The aging of the population and the decline in state pension benefits make private pension provision increasingly important. A higher lump sum for savers would make it easier for citizens to provide for their future and ensure their financial security in old age. Ultimately, this would relieve the burden on state aid and thus reduce the burden on future generations.

High interest rates

Above all, however, because the interest that one receives for one’s credit balance has also risen drastically in recent months, the saver’s allowance should continue to rise as quickly as possible. On many call money accounts, you now receive 3.5% per year again, and in some cases even more than 4%. This means that even the current lump sum of 1,000 euros is quickly exhausted.

Anyone who earns the median of 3,650 euros and thus has around 2,400 euros net available each month should keep six months’ net salary and thus around 14,400 euros on the high side just for his emergency reserve, with a view to the nest egg alone. At an interest rate of 3.5%, this alone would mean that he has already exhausted 504 euros and thus slightly more than half of the current lump sum for savers. If he then invested additional money for his old age, the other half would also be reached quickly.

With the same interest rate and 25,000 euros on the call money, one gets already 875 euros per year and undercuts thereby the tax-free amount only scarcely. With 50,000 euro this sum is already exhausted in July, with 100,000 euro even after in the fourth month. Due to the compound interest effect, this increases more and more over the years.

| Month | 2,000 euros | 5,000 euros | 10,000 euros | 25,000 euros | 50,000 euros | 100,000 euros |

|---|---|---|---|---|---|---|

| January | 5.83 euros | 14.58 euros | 29.17 euros | 72.92 euros | 145.83 euros | 291.67 euros |

| February | 11.67 euros | 29.17 euros | 58.33 euros | 145.83 euros | 291.67 euros | 583.33 euros |

| March | 17.50 euros | 43.75 euros | 87.50 euros | 218.75 euros | 437.50 euros | 875.00 euros |

| April | 23.33 euros | 58.33 euros | 116.67 euros | 291.67 euros | 583.33 euros | 1,166.67 euros |

| May | 29.17 euros | 72.92 euros | 145.83 euros | 364.58 euros | 729.17 euros | 1,458.33 euros |

| June | 35.00 euros | 87.50 euros | 175.00 euros | 437.50 euros | 875.00 euros | 1,750.00 euros |

| July | 40.83 euros | 102.08 euros | 204.17 euros | 510.42 euros | 1,020.83 euros | 2,041.67 euros |

| August | 46.67 euros | 116.67 euros | 233.33 euros | 583.33 euros | 1,166.67 euros | 2,333.33 euros |

| September | 52.50 euros | 131.25 euros | 262.50 euros | 656.25 euros | 1,312.50 euros | 2,625.00 euros |

| October | 58.33 euros | 145.83 euros | 291.67 euros | 729.17 euros | 1,458.33 euros | 2,916.67 euros |

| November | 64.17 euros | 160.42 euros | 320.83 euros | 802.08 euros | 1,604.17 euros | 3,208.33 euros |

| December | 70.00 euros | 175.00 euros | 350.00 euros | 875.00 euros | 1,750.00 euros | 3,500.00 euros |

In the course of a lifetime, such sums are not exactly unrealistic, especially if one has set oneself the goal of accumulating 100,000 euros already at the age of less than 30 years, in order to have it easier later for retirement provision.

Keyfacts

- an increase…

- … should counteract the loss of purchasing power

- … creates an incentive to save

- … facilitates long-term financial planning

- … lowers the state’s supplementary pension benefits

- high interest rates quickly exhaust the amount