Before you even start investing, you first need to lay two important foundations on which everything will be built later. The first golden rule is a psychological thing, the other, on the contrary, lets us sleep better and go safely through everyday life. It cannot always be planned.

Always pay yourself first!

If at the end of the month the salary is credited on the current account, then all important expenditures, like rent, insurance or the budget for the electricity supplier go away from it first of all at the beginning of the new month. Sure, this is indispensable and important, but why do we always think of others first and not of ourselves after receiving our salary?

Each of us lives only once on this wonderful planet and has only one chance to make his life a dream worth living and fulfilled! So why go to work to always serve others first afterwards? Turn the tables and pay yourself first!

Of course, you should not overdo it and still leave enough money in the account to pay all your expenses! Make the effort once and count up all your monthly expenses with an additional buffer and then choose the remaining sum as the amount that you will use next month only for yourself. This will ensure that you actually put something aside for yourself! If you always use only the leftover money at the end of the month to save, then you slow yourself down in your possibilities: “I still have 100 euros in the account before the next salary comes – come on, let’s go celebrate one more time” – poof, the last amount is also consumed and there is nothing left for you and your savings amount…

Build up a nest egg as a protective wall

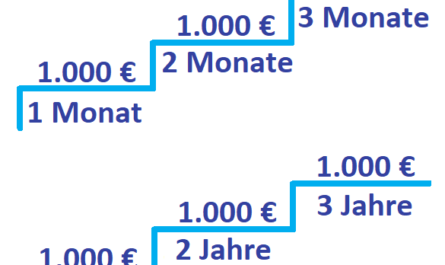

If you have managed to do this for a few months, you should not immediately spend everything on the next vacation or treat yourself to the latest game console as a reward, but always keep the money saved as a nest egg in your account. This way, you are prepared if something unforeseen happens in your life. You can easily pay the next repair costs for the car, the new washing machine or the daily hospital allowance from your nest egg without having to cut back or even take out a loan within a month. As a rule of thumb: Always keep at least three to five net salaries on the high side!

In addition, this nest egg will later serve as a kind of protective wall for your financial investments. If it is high enough, you will never have the problem of having to sell any shares at expensive transaction costs or even at a loss – you simply pay off part of your wall and reinforce it later. A nest egg brings serenity to life and makes you less dependent on others.

Also important: ALWAYS keep this nest egg in your daily bank account, because the money needs to be available quickly in case of an emergency. Please be disciplined enough to tap this really only for emergencies. Otherwise you will fall back into dependency and have to start all over again! It will be your first milestone on your long road to retirement planning!

Keyfacts:

- pay yourself first!

- build up a nest egg!