If you take your investment into your own hands, you naturally want to know how well it is yielding. Although every custodian bank shows beautiful charts and analyses, there can always be shifts and falsifications. After a portfolio transfer, the cost prices (at least in the web interface) are no longer correct, the reinvestment of profit realization is not taken into account and even the distribution of dividends is usually not logged at all. The overviews in the web interfaces of depots are thus only a rough smear of the actual performance.

After making recommendations for accounts, portfolios and providers a few days ago, we now disclose the tools we use for tracking performance.

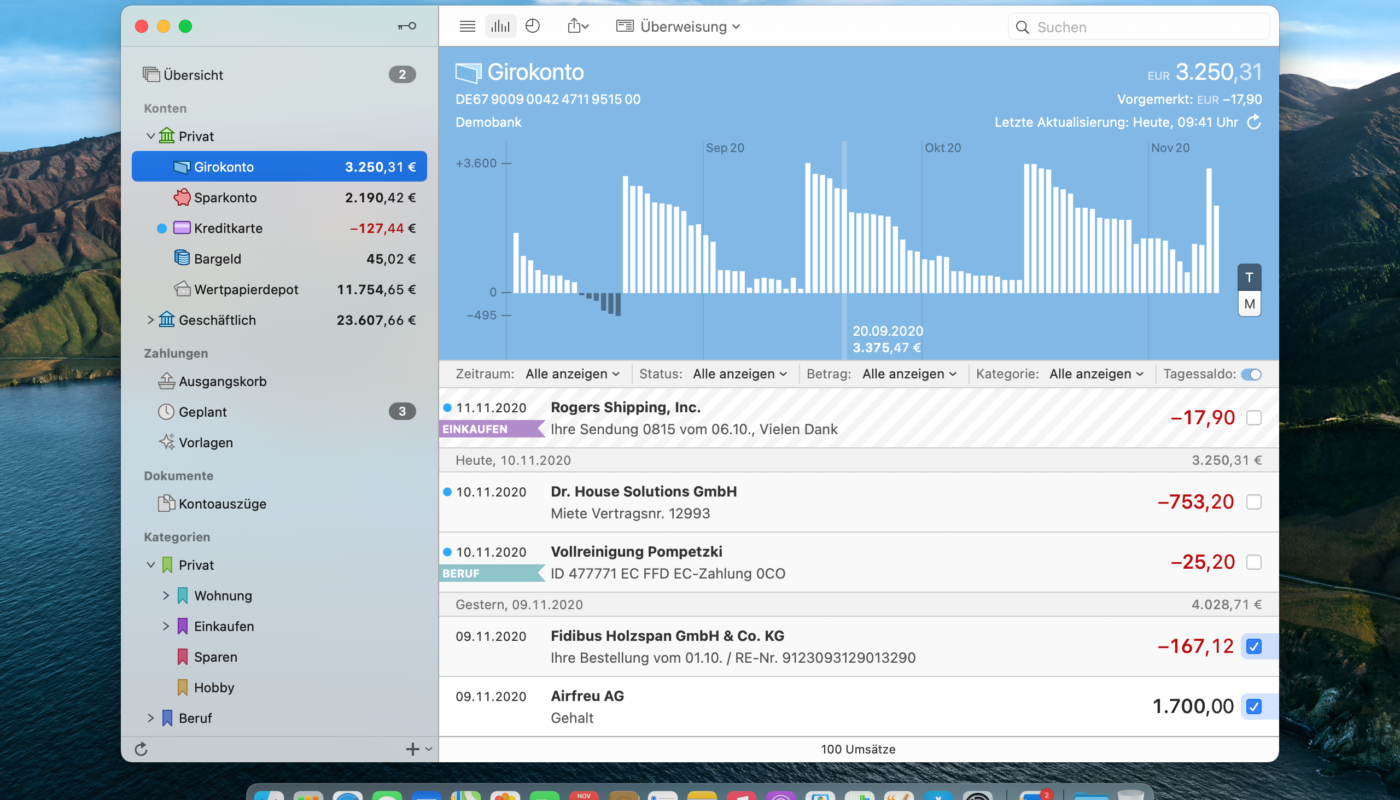

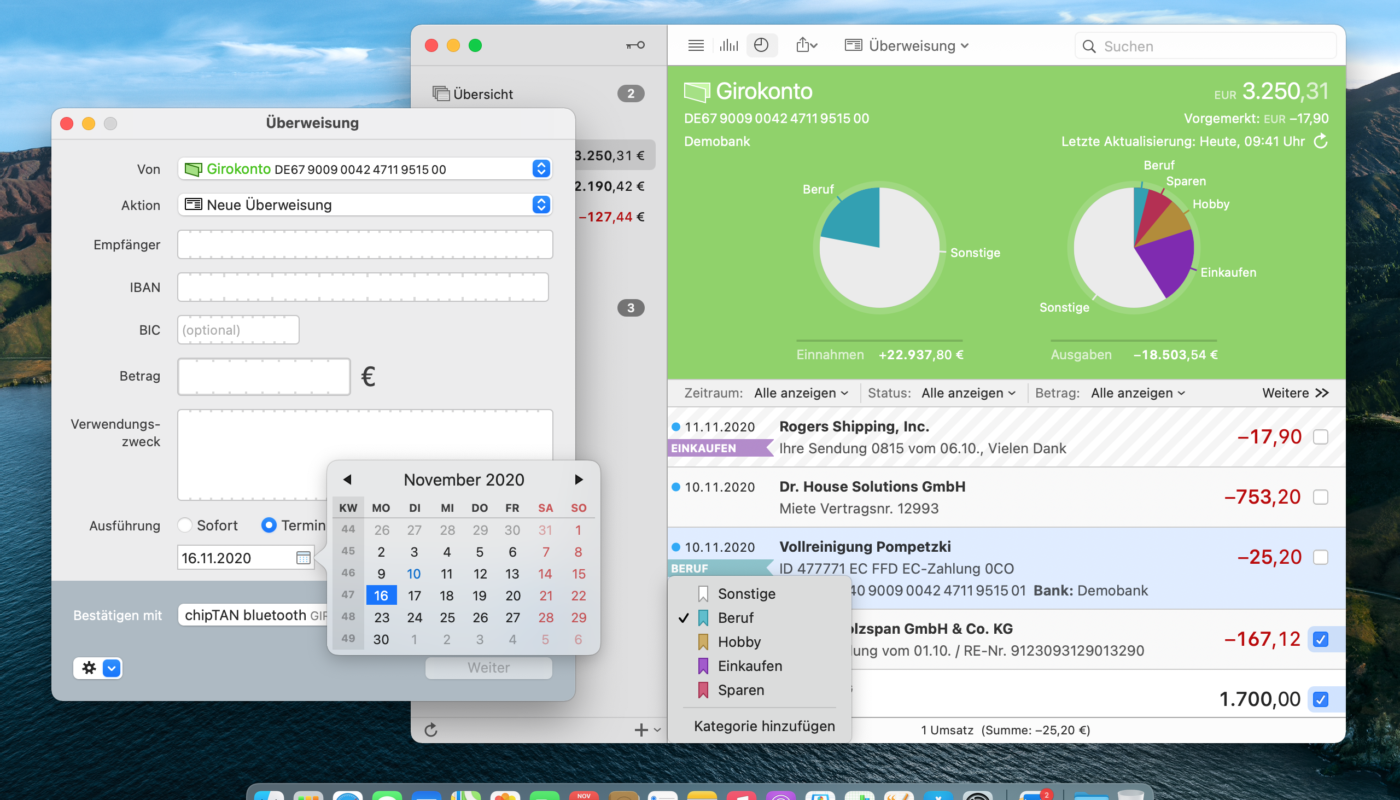

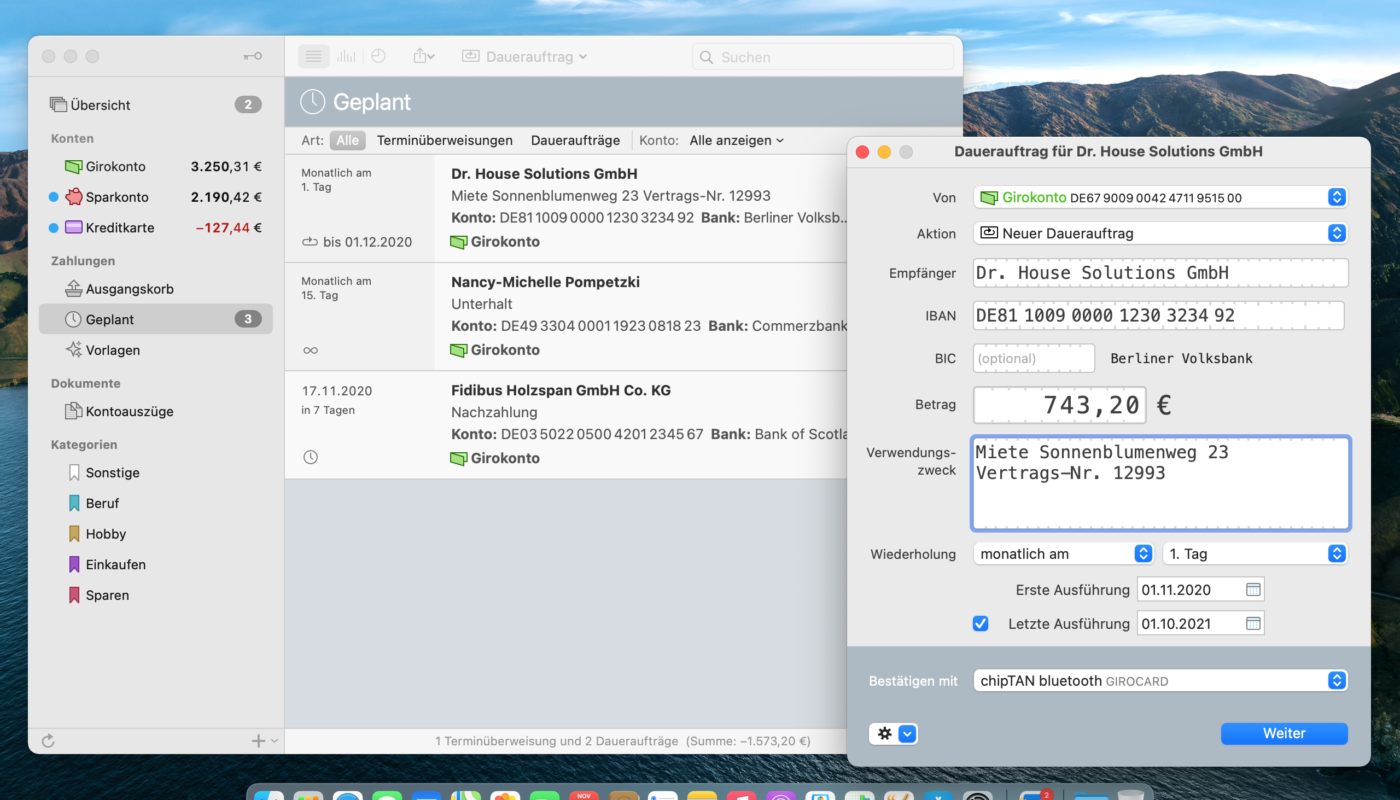

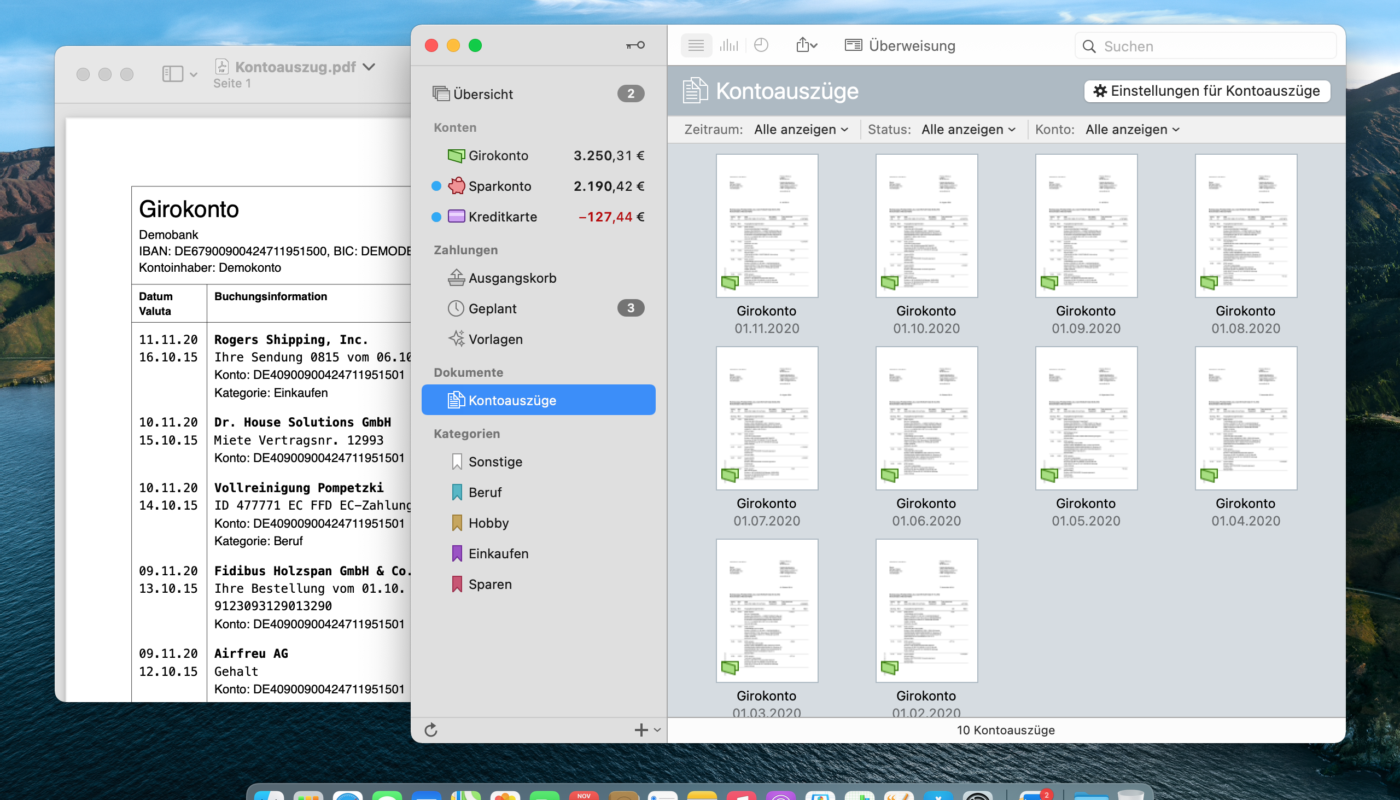

MoneyMoney

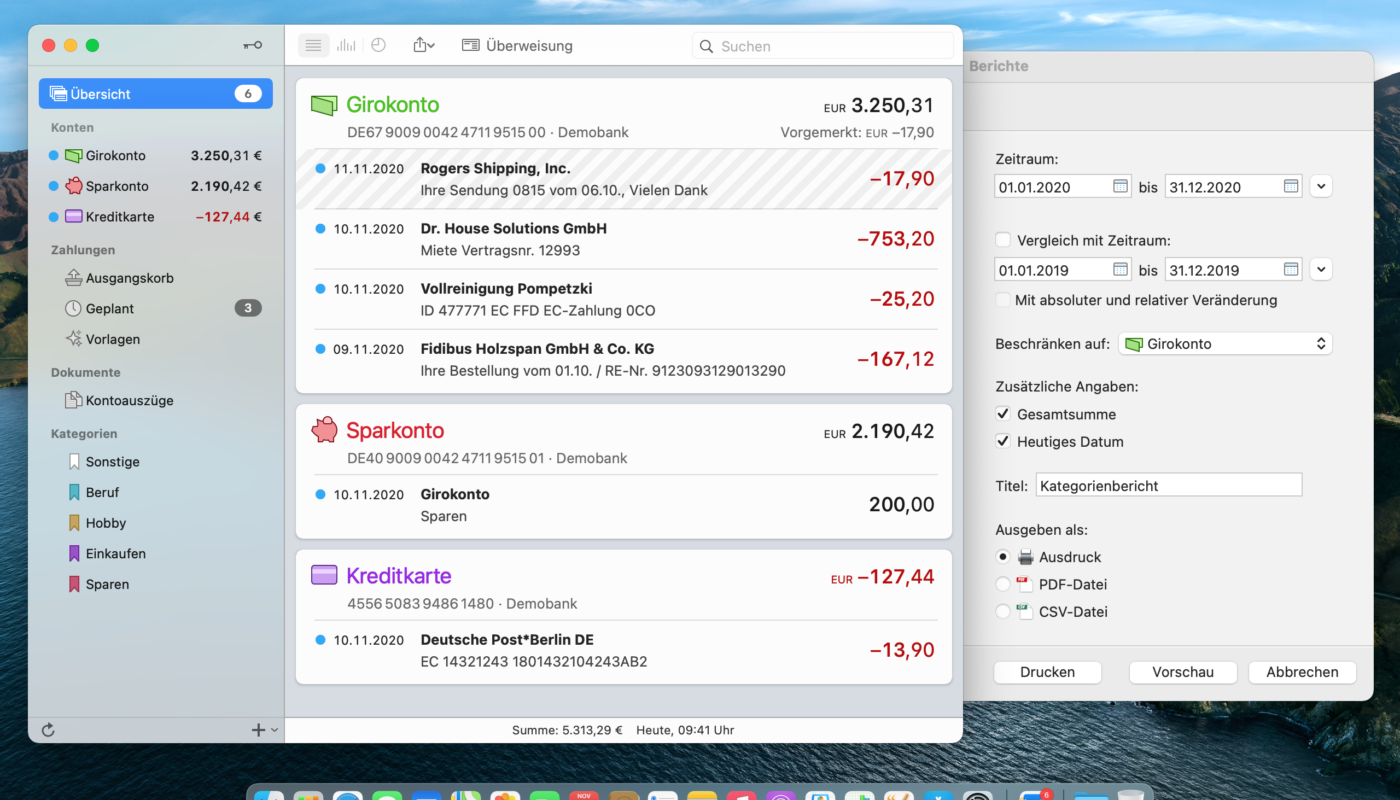

For the daily overview, we primarily use banking software. Here we use MoneyMoney, which, however, is only available for macOS and costs around 30 euros. Through it, we can automatically retrieve all of our account balances and assign each transaction to a category to be able to record where our money is actually going.

The tool not only supports common banks and even allows us to execute transfers in some cases, but also copes with more exotic providers, such as Crypto.com, Revolut* or Weltsparen and Zinspilot, via PSD2 retrieval. There is also the option to have an offline account to be able to manually enter each transaction. This is what we do with cash transactions.

Outbank

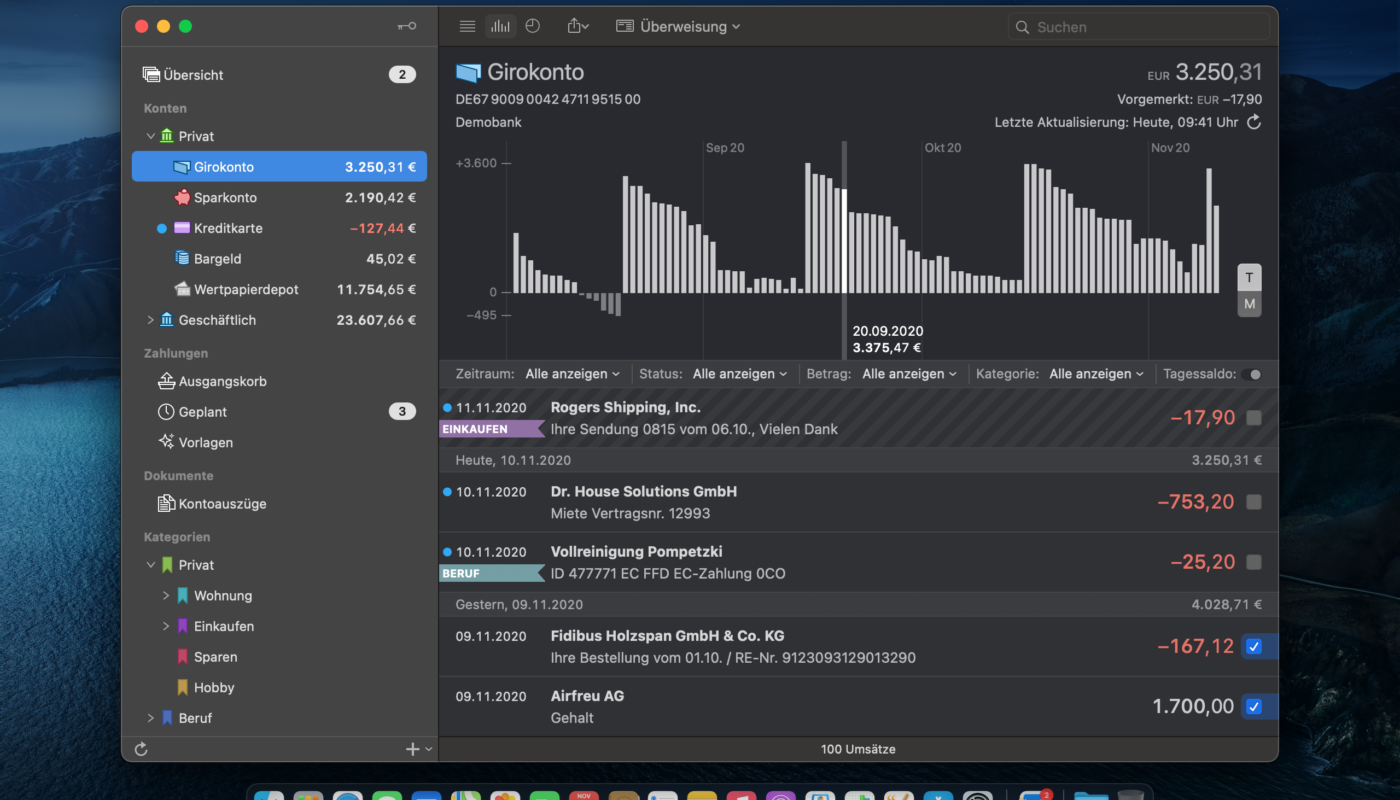

To get a quick overview of our account balances on the go, we also use Outbank.The free software is available for macOS and Windows systems, and there is also an app for Android and iOS smartphones that automatically synchronizes via the cloud.Unlike MoneyMoney, the banking support is not quite as good, but the tool is completely free.

MoneyControl

For more far-reaching analyses with a fancy look, we also use the MoneyControl budget book, where we enter all expenses and income in a disciplined manner. Thanks to a smartphone app, this even works conveniently on the go.

Portfolio Performance

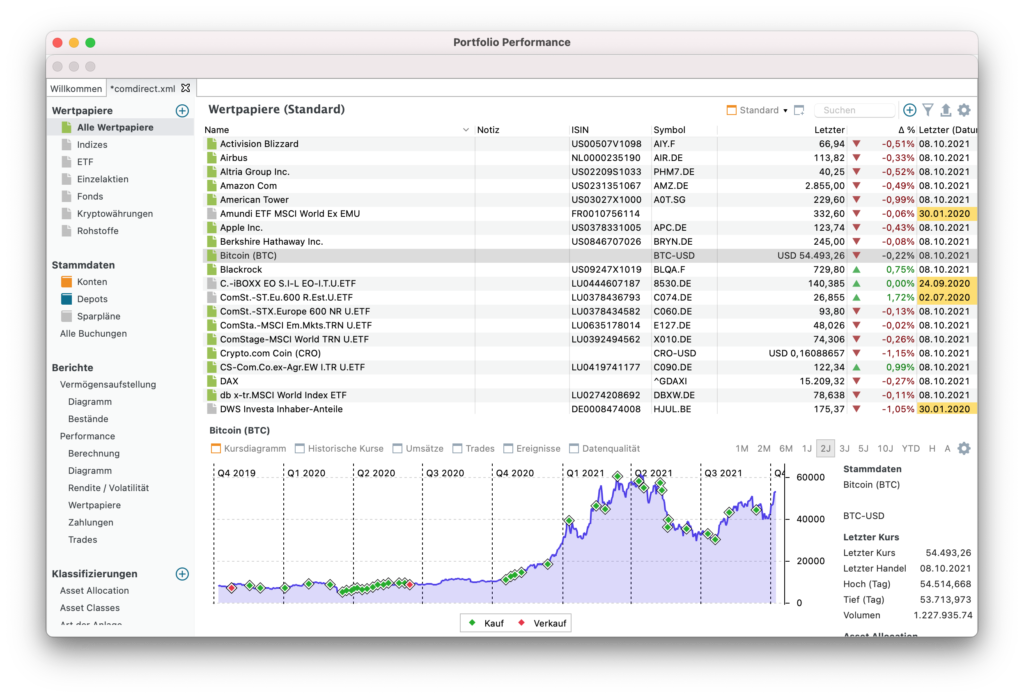

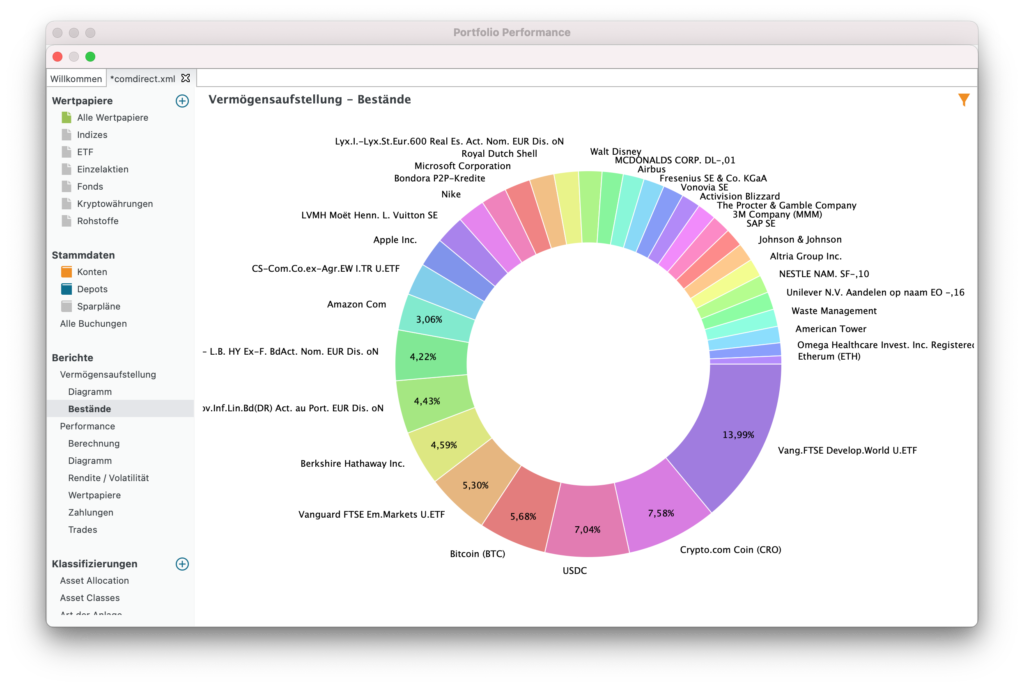

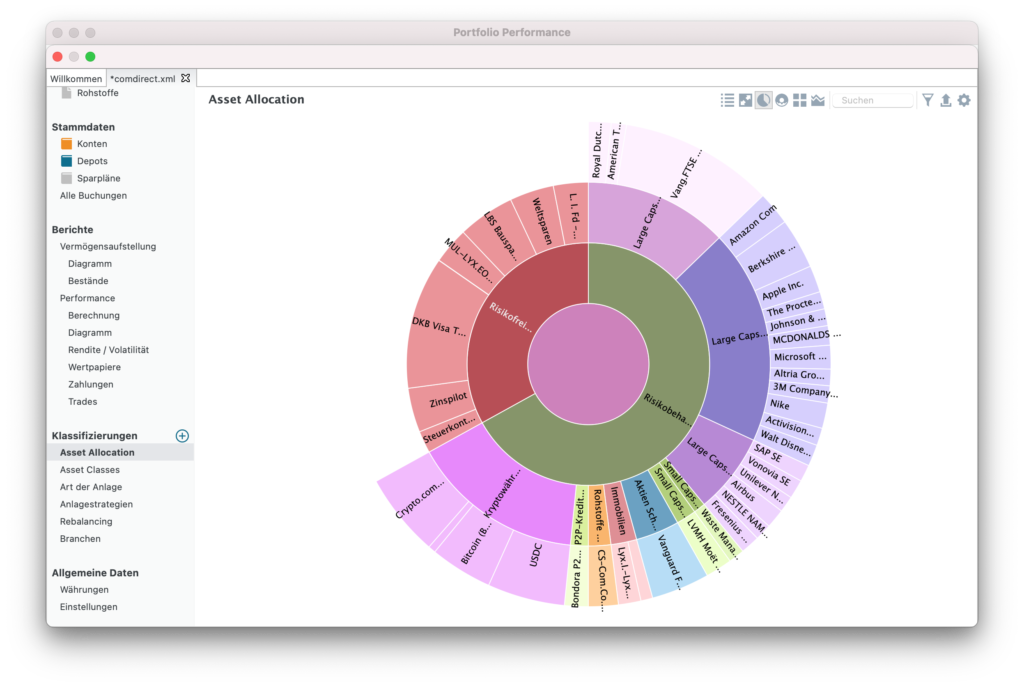

Portfolio Performance is much more comprehensive in terms of analysis functions and key figures.Here, the actual development of the performance can be displayed in a progress graph, the development of the dividend payout in a bar chart, the asset allocation in a pie chart and, of course, also extensive key figures such as the largest drawdown, the longest drawdown phase, the volatility, the internal rate of return, the development on a monthly and annual basis or the own dividend yield.For this, however, one must be disciplined and enter everything conscientiously by hand.From common custodian banks such as comdirect, Scalable Capital or ING, however, the statements for purchases, sales and dividend payments can be imported.The advantage: Thanks to the manual entry, even cryptocurrencies or P2P loans can be entered. We use Portfolio Performance on a daily basis and keep all our overnight and fixed deposit accounts, securities accounts, crypto wallets and P2P accounts there that are relevant for our long-term investment.

Portfolio Performance is the Swiss Army Knife of tracking tools, and it’s completely free!

DivvyDiary

As a dividend investor, logging the distributions is of course very important. For this we use DivvyDiary.Once everything is entered, the tool makes rough analyses of all payments in the past and future and thus gives us an overview of which payments are due this month and in what amount. Advantage: If you also use Portfolio Performance, you can automatically transfer the data to DivvyDiary and save its entries!Rentablo

Rentablo

If you want to have as little effort as possible, you should take a look at Rentablo. Here the depot can be connected to Rentablo via PSD2 access to be able to transfer all transactions automatically. Then, numerous interesting statistics can be viewed.

CoinTracking

For performance measurement of our crypto portfolio, we use CoinTracking*. The platform supports an API call to well-known exchanges like Crypto.com or Binance, but also allows importing CSV files.Every exit, every entry, every staking bonus and every airdrop can thus be entered and taken into account more or less automatically.As with Portfolio Performance or Rentablo, there are some exciting analyses and key figures, whereby CoinTracking pulls the current price data of all coins fully automatically.

Particularly practical: At the end of the year, you can even generate a tax report that is accepted by the tax office. Two birds with one stone killed!

TIKR Terminal

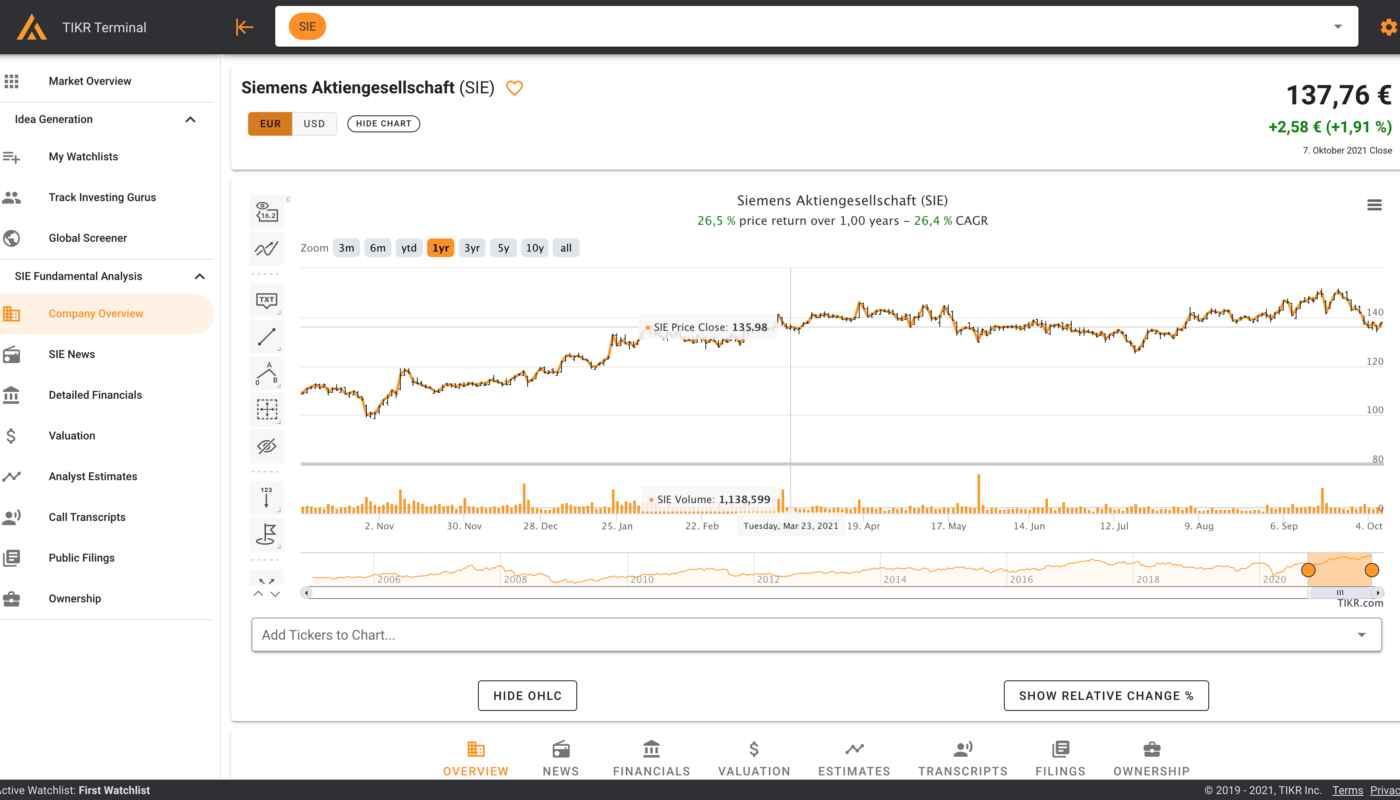

For all those who like to go deeper into stock analysis and do not want to (or cannot) pay the exorbitantly high price of the Bloomberg terminal, another real insider tip: The TIKR terminal.Here you can find not only current price charts for each stock, but also ticker messages with the latest news about the company, balance sheet ratios in clear tables or ownership ratios of major shareholders.The variety of information is enormous!

The best thing about it: After a short registration, the TIKR terminal is completely free of charge!