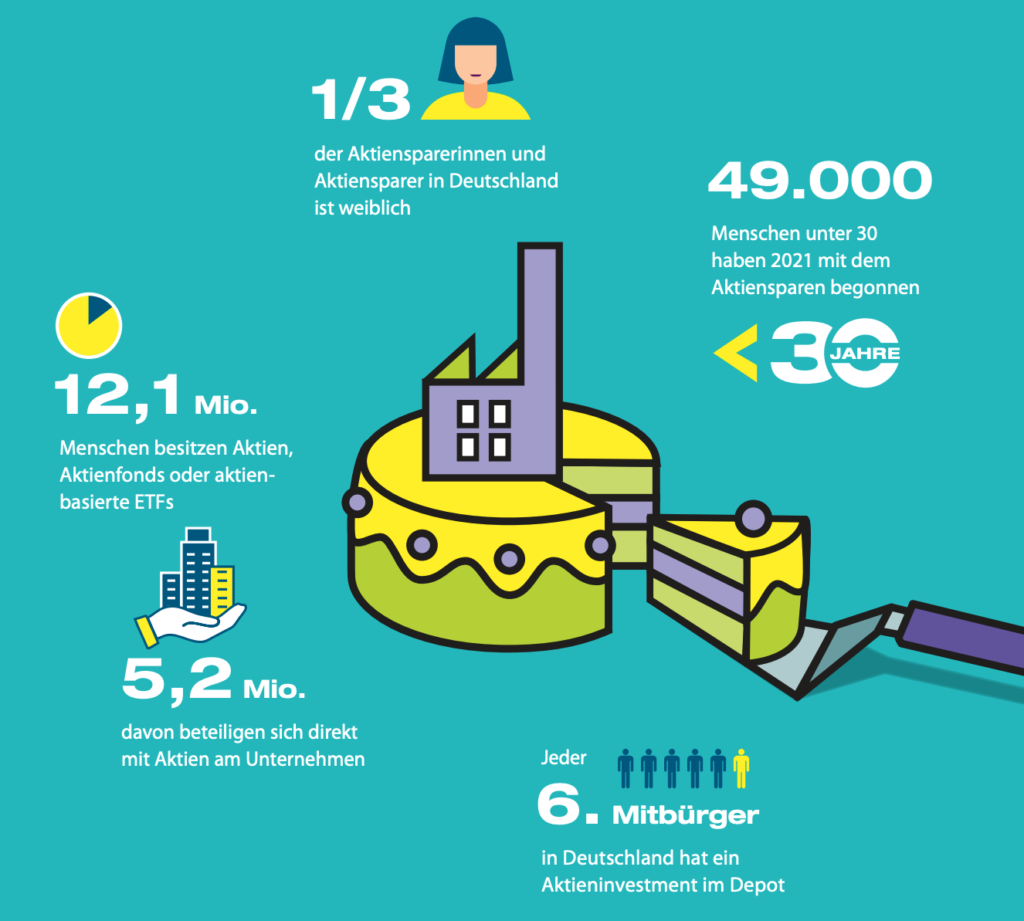

As the Deutsches Aktieninstitut (DAI) recently announced, just under 12.1 million people in Germany were invested in shares, equity funds or equity-based ETFs in 2021. This means that the number of German shareholders has fallen again after a sharp rise at the start of the pandemic. Around 280,000 investors took their leave of the markets. A year earlier, the number was still around 12.4 million. The peak was reached in 2001 with 12.9 million people. The latest figure, however, still represents the third-highest level since the institute began its survey in 1997.

The largest proportion of stock savers is made up of the over-60s, who alone account for 3.95 million shareholders. After that, the number of shareholders goes down continuously in steps of 10. In general, the lower you go in the age structure, the fewer stock savers there are. Nevertheless, the group of 14 to 29 year-olds continued to increase, whereas the 30 to 39 age group saw a slight decline. In particular, 40- to 49-year-olds parted with their deposits.

The Deutsche Aktieninstitut explains the declining figures by the fact that investors took profits after the price increases of recent months and did not reinvest directly. In addition, new investors had the feeling that they had missed the right entry point. There is no such thing, as our readers know.

Predominantly funds are in demand

It is still predominantly men who invest in shares and funds. Women account for just 4.3 million, while 7.8 million men invest their money in the stock markets. However, women in particular are often at risk of poverty in old age. More than half of both sexes invest mainly in funds, while only around 12 to 19% also invest in individual stocks. Only very few invest exclusively in shares.

Stock investments are indispensable for asset accumulation and retirement provision, especially in view of the low interest rate environment. Those who invest broadly and, above all, for the long term have a high probability of success. Nevertheless, policymakers must finally make equity savings more attractive to people or at least anchor them deeply in the pension system.

- the number of shareholders in Germany has fallen again

- people in Germany rely mainly on funds

- Men invest more, women less

- higher risk is indispensable for retirement provision