At the start of this blog, we published an extensive series of articles on the German pension system. In it, we not only went into how the pension insurance system works, but also showed the importance of the pension gap and how you can calculate it for yourself, but also clearly pointed out the imminent danger of demographic change and wished for more transparency in payroll accounting. Naturally, we made constructive suggestions for improvement. We also looked at early retirement and calculated how much you actually have to earn during your working life in order to receive 2,000 euros later on.

Since the beginning of our work, we have repeatedly made it very clear that the system is ailing and cannot work in the long term. More and more Germans are now coming to this conclusion.

Survey confirms concerns about pensions

As a survey conducted by the Insa opinion research institute for Bild am Sonntag last week showed, 72% of respondents believe that pensions are rather insecure in the long term. Only 21% still consider it secure, while 7% have not yet formed an opinion on the matter. In addition, 75% of the 1,045 people surveyed were of the opinion that pensions are too low. The vast majority (83%) are in favor of civil servants, freelancers and politicians also paying into the general pension insurance scheme, while only 8% are in favor of raising the retirement age to 67 – 53% would rather see it lowered.

This shows: The majority are aware that the current system will not work in the long term, but would still like to receive more money in old age, preferably earlier than most of today’s pensioners. It is questionable whether the pieces can be enlarged by increasing the size of the cake both on the payers’ side and later on the payers’ side. The real problem is merely being delayed. Even worse: the most effective option via the capital market is being rigorously rejected and even fought against.

The fight against investors

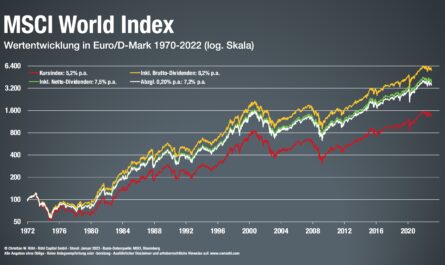

The Süddeutsche Zeitung recently published an essay calling for a “redistribution from top to bottom” by asking shareholders to pay. Those who have recognized the problem with pensions and have taken their retirement provision into their own hands are now to be punished. The stock market has long been home not only to evil and wealthy speculators, but also to numerous small investors who may want to buy into the market continuously from their multi-taxed money by forgoing consumption with small savings installments and thus save a tidy sum for their old age over 30 years, even from supposedly small sums.

The originally planned equity pension, which will now come as generational capital, also had to be fought for hard, but in the end it is just a construct that has been ruined by compromises and will not be able to fulfill the above-mentioned wishes of citizens in the long term. Stabilizing contribution rates will certainly help many people, but it will not increase pension payments for those who actually deserve it most in view of their lifetime achievements.

Generational capital could make things even worse

On the contrary: in a few years’ time, when politicians make the first distribution from the Generation Capital, it will become clear that the Kenfo fund, with its target return of 4% and an equity component of just 30%, was not enough. The left wing in parliament in particular will then regard the first step of the equity pension as a failure, want to roll it back and move on to making things as difficult as possible for all private investors. Generational capital will damage the German equity culture in the long term.

Most Germans simply lack the necessary basic financial knowledge. An awareness of this needs to be created. This blog was created more than two years ago to do just that.