To get a better overview of all your expenses and income in everyday life, it is recommended to set up a multi-account system with budgets. Until now, I used Vivid Money, a checking account with twelve possible sub-accounts, each with its own IBAN. A few months ago, however, I switched to bunq*, which offers some highlights in daily use. In this post, I introduce the Dutch account.

bunq* is a fairly young bank from the Netherlands that offers a current account with various subscription models and was founded by Ali Niknam back in 2012. The vision is simple: bunq wants to revolutionize the banking world and offer its customers the greatest possible freedom, but also not disregard sustainable aspects. Under the motto “bank of the Free”, the company wants to meet the current zeitgeist of society. For example, in cooperation with Eden Restoration Projects, the company plants a tree for every 100 euros of card sales, depending on the account model, does without paperwork completely as a mobile bank, and lets its customers decide ethically what to invest their customer funds in. bunq assures to keep the data of German customers exclusively in Germany and not to sell it to third parties.

The fintech has a banking license from the Dutch National Bank (DNB) and can therefore operate in over 30 European countries. Of course, the legal deposit protection of the EU applies up to an amount of 100,000 euros.

A checking account with many great features

At the heart of bunq* is a current account that offers such a few features. While many German banks are still not able to offer real-time transfers in both directions or charge extra for them, transfers in seconds are standard at bunq and can be used indefinitely in all account models. Of course, the account supports direct debit and brings a physical Maestro or Mastercard if desired, which can be deposited in Google Play or Apple Pay.

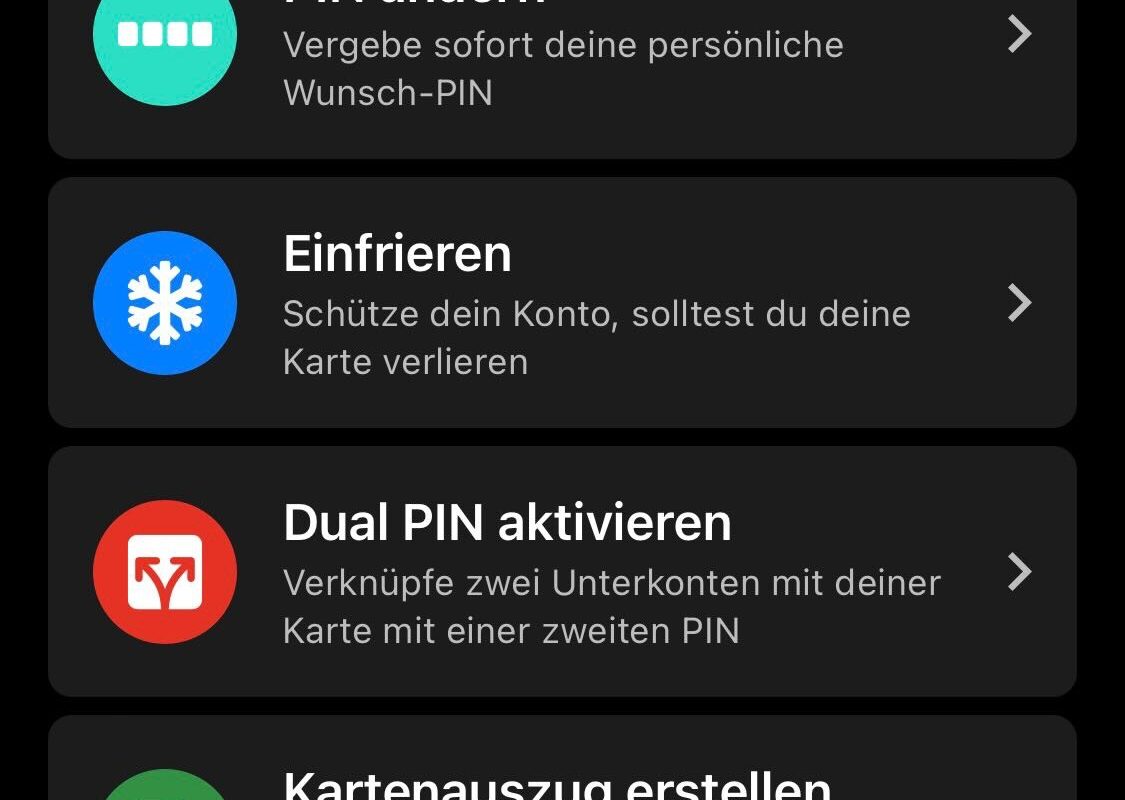

As befits a modern fintech, the payment cards can be conveniently blocked temporarily via the app, the PIN can be changed or even individual transactions, such as withdrawing money or foreign use, can be deactivated. Outside of the EU, one partly does not charge for foreign use and relies on the real exchange rate of Mastercard. This makes bunq very interesting for travel. Foreign transfers are realized via Wise, which also promises extremely low conditions. Depending on the account model, 25 sub-accounts are included, each with its own IBAN, and more can be added for a fee.

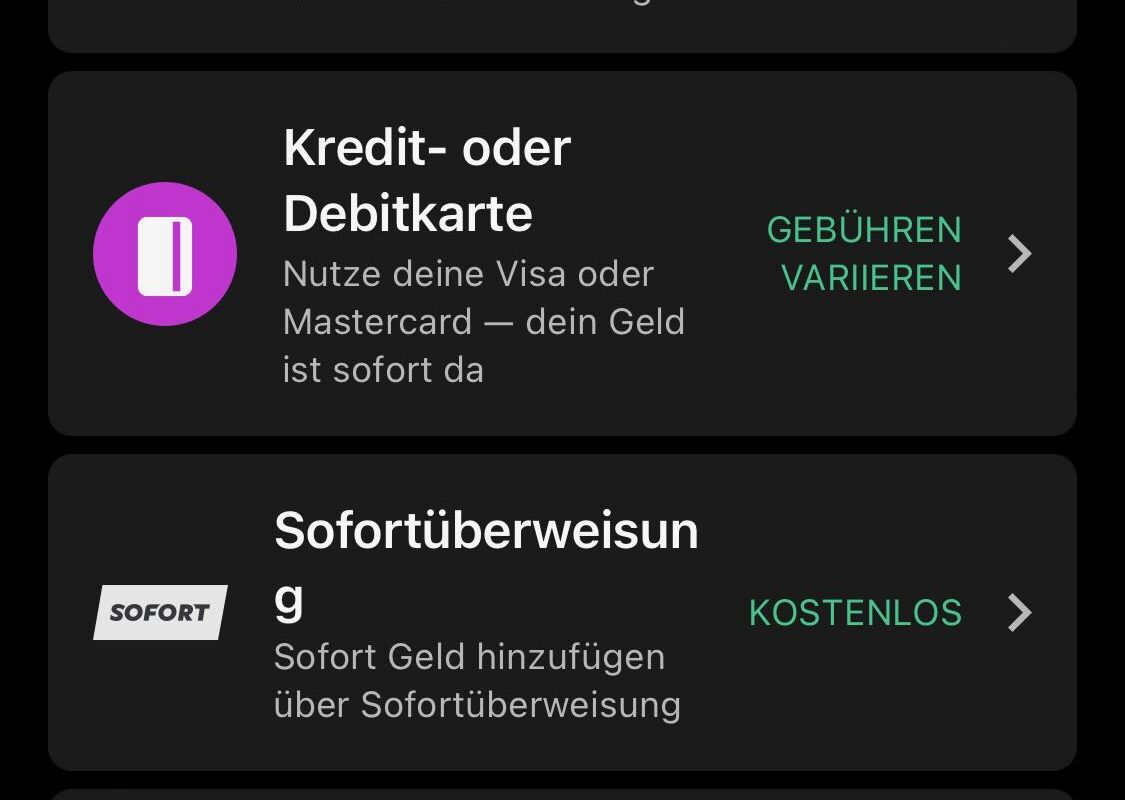

Cash can be deposited via viacash directly at supermarket checkouts such as Rewe, Real or Rossmann and DM, and withdrawals are possible at all ATMs via the Mastercard. Deposits can also be made by credit card, instant bank transfer or iDEAL. Payment links can be generated for friends and acquaintances, who can then use them to pay by simple bank transfer or credit card – similar to PayPal*, but without any third-party providers.

Great app with extensive budgeting options

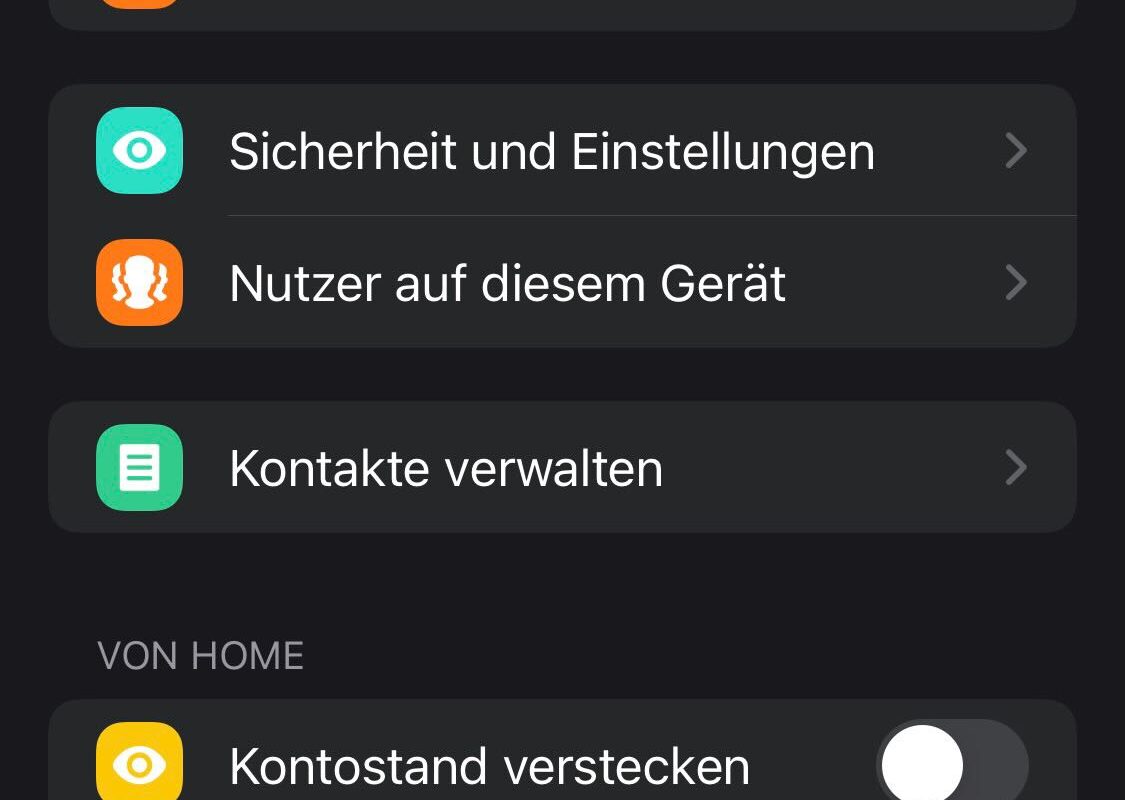

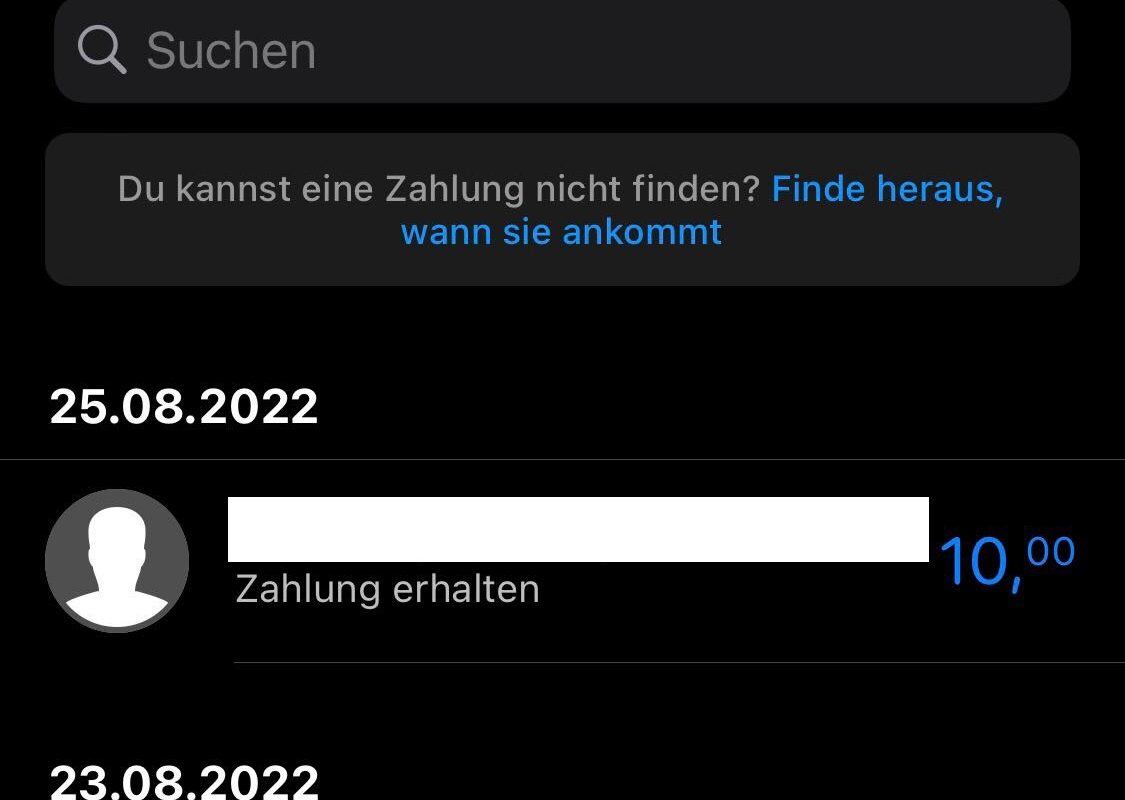

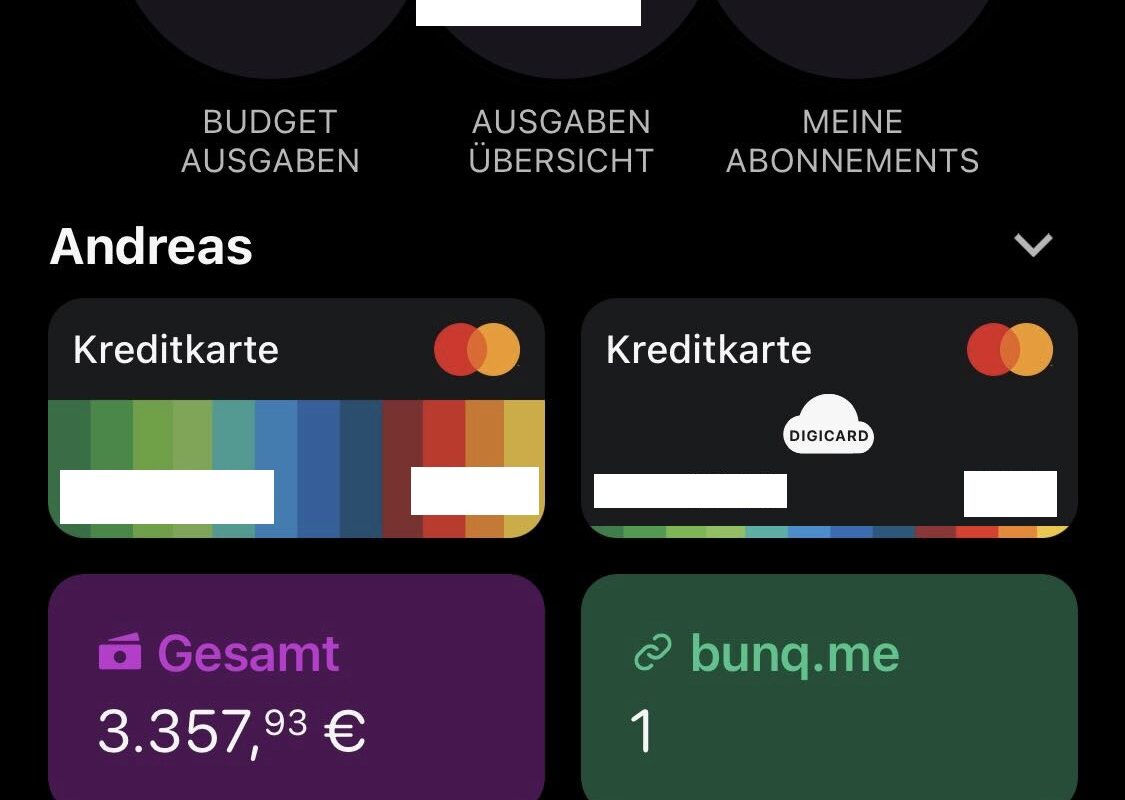

Although the most important banking transactions can be carried out conveniently via the computer and classic online banking, this happens much more extensively via the bunq app*. It offers extensive budgeting options for all sub-accounts, whereby every turnover is automatically added to corresponding categories and subscriptions such as Netflix or Spotify are recognized. The development of account balances can be displayed graphically, and after a certain period of use, the app even learns the user’s spending behavior and warns if spending gets out of hand. However, negative account balances are not possible due to the lack of an overdraft facility. You can only spend the money you have via bunq. In return, there is interest on all deposits of currently 0.09%.

A budget can be set for each of these categories. Once this is reached, new transactions are automatically rejected. With the help of different PINs for card payments, users can even discreetly tell bunq which sub-account the transaction should be debited from. Of course, the app provides real-time information about all transactions on the accounts and pushes the information directly to the smartphone. Even direct debits are announced in advance and can be rejected by the user if necessary.

Multiple account models

In total, bunq* offers four different account models. However, the “Easy Savings” tariff only offers a single account without a card and only the option of real-time withdrawals to one’s own account. Cards are not offered, it is a simple call money account with 0.09% interest.

In the “Easy Bank” tariff, there are all the basic functions of the account including a physical or digital card. However, you always have to pay for every cash withdrawal, you don’t get any sub-accounts, you have to do without the dual PIN function or pay for foreign use. The smallest current account model costs 2.99 euros per month, which means that bunq no longer offers a free account.

Those who pay 8.99 euros for the “Easy Money” rate get up to three cards, 25 IBAN accounts and are allowed to withdraw cash from ATMs four times a month free of charge. In addition, the foreign usage fee is waived. At 17.99 euros per month, the “Easy Green” tariff is bunq’s most expensive account model. Here, the metal card comes as standard, with a tree planted for every 100 euros of card turnover, or invoices can be attached directly to each transaction via photoscan. A simple accounting function is included.

All differences between the account models can be found directly on bunq’s website.

| Service | Easy Green | Easy Money | Easy Bank |

|---|---|---|---|

| Monthly fee | 17,99 Euro | 8,99 Euro | 2,99 Euro |

| Number of free sub-accounts | 25 | 25 | 0 |

| Number of free cards | 3 | 3 | 1 |

| Number of free cash withdrawals | 4 | 4 | 0 |

| Real-time transfers | free | free | free |

| Direct debit | free | free | free |

| Card payment non-euro area | free | free | +3 % |

| Foreign transfers Wise | yes | yes | yes |

| Billing/quitting scan | yes | no | no |