At my (so far) best times, I transferred 850 euros to the clearing account of my securities account* month after month in order to be able to service the savings plans for my ETF strategy and my individual stocks – and this despite the fact that I did not receive a lavish salary and was even just below average earnings in Germany. I used two levers: on the one hand, I drastically reduced my expenses, and on the other hand, I drew on existing call money reserves to slowly but surely increase my equity quota during the low-interest phase.

In the meantime, I can only dream of such a high savings rate beyond 50%. I don’t want to reduce my cash reserves any further in the sense of a nest egg. On the other hand, the increased cost of living is forcing me to reduce my savings rate, which has recently been due primarily to the high rate of inflation.

A few years ago, I was able to increase my savings rate quite easily by paying more attention to my spending with the help of a budget book and simply reducing unnecessary ones. I drew up a weekly meal plan and wrote myself a shopping list so that I could buy only the things I really wanted, so as not to fall prey to impulse buying. I went to the bar less often and swayed the dance leg in the nightclub less frequently. At times, I even gave up vacations and limited my mobility by doing more on foot.

A healthy middle course is the key

At some point, the turning point came: I had to realize for myself that any savings potential had been exhausted and that I could no longer increase my savings rates under my own steam. In the end, the frugalistic compulsion to save even came at the expense of my health and I began to increase my quality of life again and finally to save less. I moved into a larger apartment and started spending more money on my consumption again, resulting mainly in more frequent bar and restaurant visits.

In order to increase my savings rate again with my goals and financial independence in mind, I need to work on my income side. Only if I manage to earn more will I be able to raise higher savings plan amounts again, at least in absolute terms, and perhaps scratch the 1,000-euro mark again at some point. It is especially important in times like these to ask your employer for a salary adjustment. Higher costs, which are mainly caused by third parties, but also social experiments by politicians, such as the defense umbrella or even the drastic increase in the minimum wage, are really forcing us to do this on the long run. I have never been as close to the minimum wage as I am now.

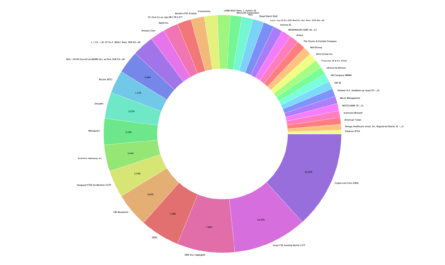

However, not only do I try to make myself more valuable to my employer with better performance, thus earning the next raise, but I buy myself additional income every month. I regularly rake in dividends, have a positive cash flow in crypto, all of which I steadily reinvest without consuming, thus starting a nice snowball in the long run. Futures trading should also increase my income in the future.

Keyfacts:

- those who spend less can save more

- at some point, any savings potential is exhausted

- a happy medium must be found

- the income side must also be increased

- … through salary adjustments or passive income