Anyone who invests their money on the stock exchange or is even active in short-term exchange trading on the futures markets has it exposed to constant fluctuations. The higher the invested capital or the trade position, the faster the amounts increase in absolute terms. While at the beginning of an investor’s career there is relatively little money in the portfolio, after decades or until official retirement it is already significantly more. If you regularly put a few hundred euros aside, you may have saved several hundred thousand euros by then. A setback in the markets will then be more noticeable.

I still remember my first major setback on the stock markets. At that time, I lost about 50 euros of my invested capital after only a few weeks to months. As a young teenager, I imagined what I could have done with those 50 euros. I could have treated myself to a delicious dinner at the Italian restaurant or a party night at the club. But I was denied this experience, because the 50 euros were already gone. Of course, I kept my eye on the ball, continued to invest with a savings plan, and was able to quickly return to profit with my portfolio.

I also remember my first one-time purchase of just over 1,000 euros. I was quite tense, almost a bit nervous, and checked all the entries several times so as not to make a mistake. Today, larger one-time purchases are no longer a big deal and I almost laugh about my 50-euro book loss at the time. My daily fluctuations alone now far exceed that amount.

During the Corona crash in February 2020, I had lost almost a complete year’s salary and could still smile wearily – I even made larger one-off purchases several times.

The reason: Because I had saved triple-digit sums month after month, my assets and the fluctuations in absolute figures grew continuously faster. There was almost a habitual effect for smaller sums. Added to this is the routine and gaining of experience, which gives me additional security to remain steadfast.

Dealing with losses and fluctuations becomes normal

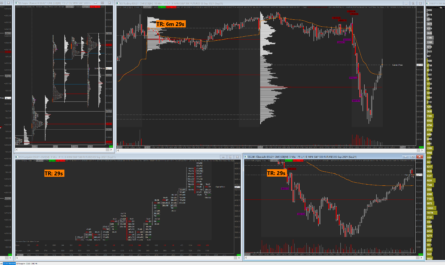

Of course, the same applies to day trading: since not all trades work out, I have to be able to deal with losses every trading day and still keep going. I know through my research and experience that the strategies and setups work in the long run and that I can rely on them. However, this only works because I have spent thousands and thousands of hours sitting in front of the charts, doing analysis and simply watching the market. Only those who make experiences can learn from them and get better from time to time. The daily handling of fluctuations is trained from time to time.

In the meantime, I can say that I have become accustomed to dealing with larger and larger sums. Today, even larger fluctuations in four-digit amounts are nothing special for me anymore and I am sure that this will soon be the case with five-digit sums as well. It will become the norm.

Keyfacts

- who saves regularly, builds up more and more wealth

- … and thus increases the price fluctuations in absolute terms

- experience brings security

- … but this only exists if you act