“Trading for Future” may seem at first glance to be a very narrow name that deals exclusively with the topic of “trading”. But that’s not true, or rather, it’s not supposed to be that way at all. You can call just about anything a “trade”: If you buy a share, you have simply entered into a long trade on the stock exchange and assume that prices will rise. Even in the supermarket or in the café you are a trader. You buy coffee and cake and spend a certain amount of euros for both – goods for money, money for futures contract.

“For Future” also has an ambiguity: if you have ever dealt with the topic of “trading”, you know that a future is an exchange-traded derivative, which we will actually also cover in this blog and use in our portfolios ourselves. “For Future” is also meant to refer to our own future. We are trading for our own future, making retirement plans by buying stocks, wanting to earn a little extra money in reselling, or even making the big bucks in day trading. We do all this for our future, i.e. “For Future”.

And then there is a fairly young, green and rather anti-capitalist movement, which relies on the same claim and is mainly active on Fridays. We’d be lying if we denied not positioning our blog name as a conscious counter-movement to that. Ultimately, however, both pursue goals worth supporting – only the approaches are different and need to come together.

Stocks, P2P lending, cryptocurrencies, minimalism, …

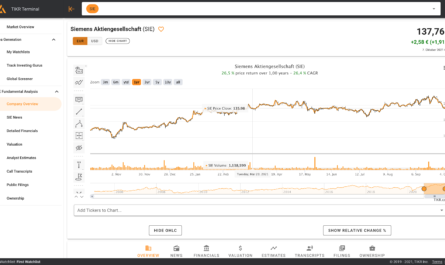

Consequently, this blog will address three major topics: saving, investing and trading. In the “Saving” category, we want to show that everyone has some savings potential and can get a few more euros out with little tricks and tricks without really having to limit yourself. In the investing section, on the other hand, we will show you what you should do with your savings. The main focus here will be on stocks, bonds, commodities, funds and ETFs, but will also cover other asset classes such as P2P loans, real estate or cryptocurrencies.

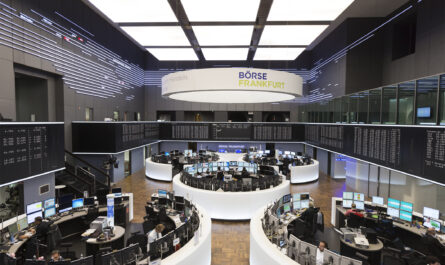

Finally, in the trading category, we want to show how to get the last ounce out of the capital markets. Initially, only the absolute basics will be addressed, but later on we will add experience reports and even diaries with performance reports – maybe we will show one or the other trading approach. This category will be the most extensive in terms of the range of topics and will therefore rightly occupy a large place in the actual blog name.

… and much more!

Thematic excursions into the world of minimalism and frugalism are also planned, after all, these areas are somehow related and are closely linked to the topic of investment and retirement planning. Also conceivable would be articles on the topic of “Reselling”, which is nothing other than trading.

So be just as excited and look forward to our journey together!

Keyfacts:

- Tips and tricks for saving

- Investing for retirement

- Speculation through (day) trading

- Minimalism and Frugalism

- Reselling

- … and much more!