Trading is easy and difficult at the same time, reveals some freedom, but can also be quite lonely. Anyone who has mastered the hard and tedious work to become a profitable trader or is still on the rocky road with all its ups and downs as well as some emotional construction sites, should have noticed one thing above all: Trading is pure personal responsibility.

In trading, you are always on your own, day after day. You don’t have a boss who gives you any instructions or even has the last word in the upcoming salary negotiations. But you also don’t have any colleagues who can help you out of trouble if you make a mistake, or who don’t have to worry about the continuity of your job during bad economic times. No one is telling you what to do, no one is trying to slow you down or working against you.

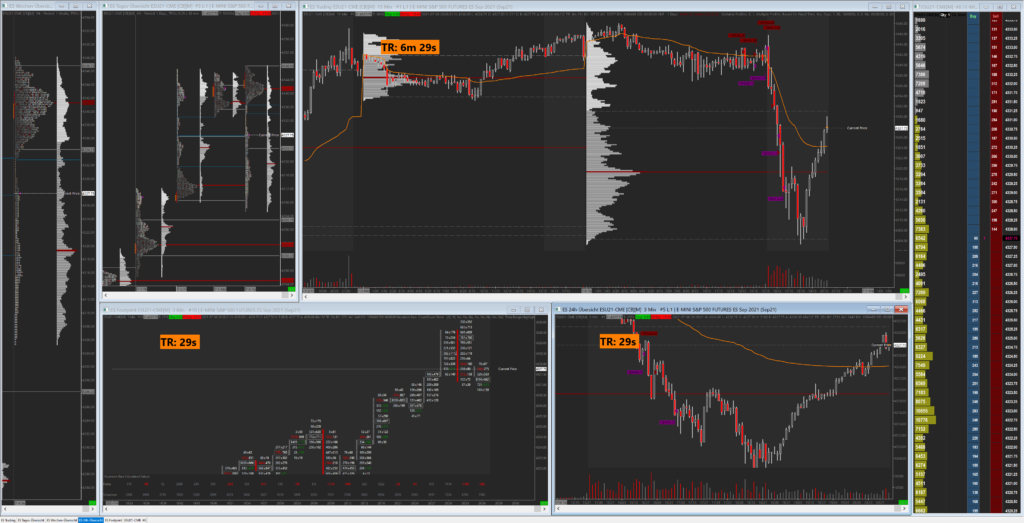

In the markets, such as ES futures, no one is looking out for anyone else. The market never dictates when exactly you should enter, no one determines when to close your position where or adjust your active management. No one helps when it comes to determining the right lot number or choosing the appropriate stop level.

The market is always right

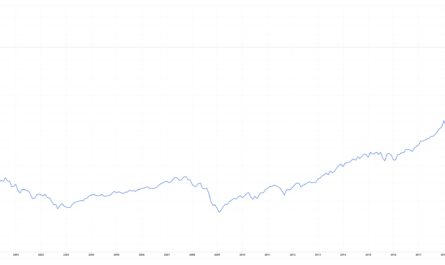

In turn, no one builds up the trader, if a trade once did not work out or a series of losses burdened the account with bitter regressions. The market takes no account of individual participants. It simply continues to run until it takes a short break at the end of the day and over the weekend. No matter what happens: In the end, the market is simply always right. It doesn’t care what the trader has assumed or what his plan was. It does not care who has just exchanged how much money.

In the end, as a trader you are completely on your own, you can’t blame anyone for your mistakes, laziness or your cockiness and arrogant risk-taking. Traders have to pay for every mistake themselves and take responsibility for it, after all, only they sat at the trigger of their trading station. But they must also celebrate every profit alone, without becoming arrogant. Fear and greed remain the biggest enemies of a trader* – day after day and even after years of experience.

A trader is alone with every decision on the market, acts completely independent of others, but must also bear all the consequences. The trading business means pure personal responsibility. Those who do not accept this will never be able to survive on the markets. Those who succeed, on the other hand, enjoy pure freedom.

- Tradingpsychologie: Trading in the ZoneTM: Denken und handeln wie ein professioneller Trader

- Farbe: Yellow

- Douglas, Mark (Author)

Letzte Aktualisierung am 2024-07-22 at 22:32 / Affiliate Links / Bilder von der Amazon Product Advertising API