In recent weeks and months, the markets have again fallen sharply. The S&P 500, the largest and most important stock index in the USA, has lost almost 21% in value since the beginning of the year. Germany’s leading index, the DAX, even fell by almost 24% at times, although the situation here had eased somewhat in the meantime. The losses on the crypto market were even greater. The bitcoin price alone fell by over 50% since January and fell below the 30,000 US dollar mark for the first time since July. At its peak, the price was quoted at only around 25,000 US dollars. The digital reserve currency is almost 65% away from its all-time high.

Actually, the prices have thus melted down so far that one could actually get in cheaply with a high discount. But many investors surprisingly hold back in such times and do not go on a buying spree. The fear is too great that this time everything could be different and that the markets might not return to their pre-crisis level.

War, pandemic and inflation

The skepticism is entirely justified, after all, one problem is currently chasing the other. First, the Corona pandemic shook up the global economy, then supply chain problems caused supply and demand to drift apart, resulting in high inflation that seems to be intensifying from month to month. This is just melting away large financial assets and causing problems for people with low incomes. Add to that the war in Ukraine with looming food shortages for the poorer part of the world’s population and, of course, a lot of suffering for those affected and involved.

In the crypto market, the Terra ecosystem around LUNA and the stablecoin UST, one of the largest blockchains with a market capitalization of over $50 billion, was wiped out by a Gar attack, causing the entire crypto market to shake.

Prices always follow the same patterns

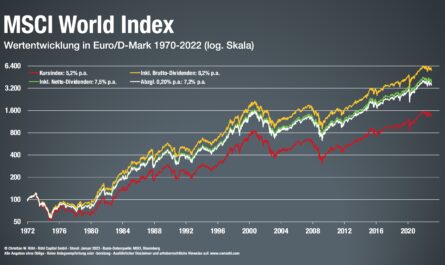

There are many imponderables that could have a further negative impact on the markets and lead many to the well-known stock market truth that “this time everything is different”. In fact, however, price developments on the stock markets repeat themselves and always follow the same pattern: An extended correction is followed at some point by a bottom followed by an upward recovery phase, and every rally is followed in turn by a correction.

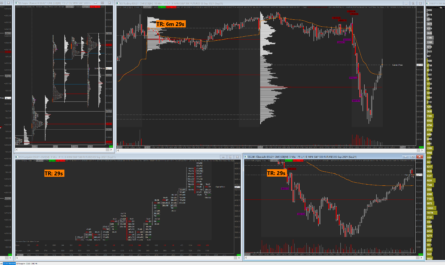

What falls must have risen first and only what moves down can rise. This can be seen every day, for example, if you go into the smaller timeframes and take a closer look at the price movements in the futures markets. It is a pure up and down.

But even in the long term, there have been these boom and burst phases time and again. In 1906, for example, a major earthquake in San Francisco caused a sharp downward market movement, which was recovered just five years later. In addition, the stock market has survived two world wars, which of course had a severe impact on prices, and recovered during the subsequent peacetime periods. Other examples include the Great Depression from 1929 to 1932, the Cuban Missile Crisis in 1962, the assassination of John F. Kennedy just one year later, Black Monday in 1987, the Gulf War in 1990/1991, September 11, 2001 with the destruction of the Twin Towers in New York or, more recently, the financial crisis in 2008.

The market has always emerged stronger from all crises and has always climbed to new all-time highs. Sometimes it happened very quickly, sometimes it took years. However, anyone who invests regularly like a robot over the long term until retirement via savings plans will profit in the long term and create wealth.

Such times simply have to be endured. In a pinch, our recommendation is: Zoom out!

Keyfacts

- hefty price declines are actually the best buying opportunities

- but due to the many imponderables many are cautious

- “this time everything is different” is the stock market truth

- However, statistics and the past say something completely different

- Prices always move according to the same pattern: up and down

- Zoom out!