Savers still have to wait for the turnaround in interest rates. A look at the call money calculator shows that most banks are still only paying around 0.01 to 0.09% interest on their customers’ deposits. Occasionally there is even on the call money account no more interest at all, depending upon fortune one is asked even with negative interest to the cash and must pay for the supply of liquidity or the bare storage of money. With a simple trick, you can get a little more yield out of your nest egg without having to make major sacrifices in terms of risk and liquidity, taking into account the magic triangle of investing money.

Saving with an interest rate staircase

In order to be able to financially cope with unforeseeable events in life, there is no getting around a certain emergency reserve in the account, which must be available on a daily basis. Everyone should have a call money account for the emergency reserve. As a rule of thumb, the nest egg should be about two to three months’ salary. Depending on security needs, the reserve can be significantly higher, and many investors put additional money aside to buy more in crash phases.

This money does not have to be available on a daily basis and can therefore also be parked in time deposit accounts at better conditions. Those who then also opt for a so-called interest rate staircase still remain quite flexible and can enjoy higher interest rates for longer maturities.

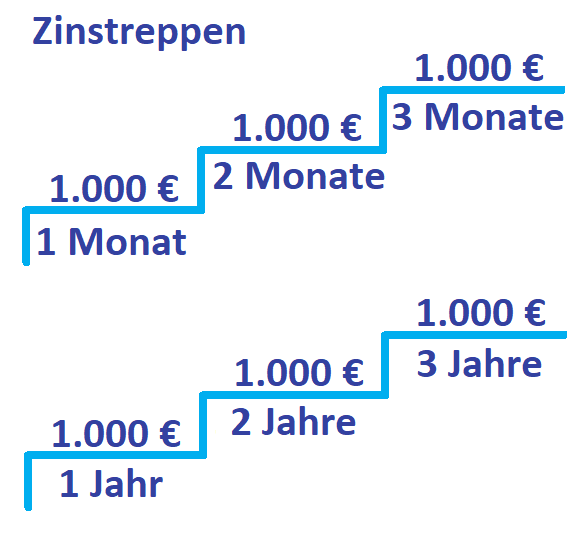

To do this, you divide your money into several tranches and invest them at different maturities so that one tranche is due each month and can then either be reinvested or used up for emergencies.

Example: Saskia Mayer wants to invest a total of 3,000 euros using an interest rate step. She spreads her savings over an entire quarter and invests the first 1,000 euros for three months at 0.1% interest. The second 1,000 euros are invested for two months at 0.015%, and the last 1,000 euros for one month at 0.01%. In this way, she has access to 1,000 euros every month and, on top of that, benefits from a better return on average.

Of course, this also works on an annual basis: 1,000 euros are invested for 36 months at 1.1% interest, another 24 months at 1.0% and the last 1,000 euros at 0.6%. This frees up a third of the savings amount each year.

Higher yield, better compound interest effect

An interest rate step not only enables a better return on average, but also allows the investor to benefit better from the compound interest effect, since the interest is additionally invested after each expiration of a savings contract. With time deposit accounts, this may be little and have hardly any effect, but the situation is different with the lending of Stablecoins, where you sometimes receive 10 to 20% interest and the earnings are even distributed weekly. If you build up an interest staircase here, you can simply invest the weekly distributions additionally in the next month without having to wait three months for the savings contract.

We use this procedure not only at Zinspilot* and Weltsparen*, but actually also at Crypto.com*, where we start a new 3-month term every month and thus steadily accumulate new coins.

Keyfacts

- Divide savings amount between daily and fixed gold accounts

- choose different terms

- you remain flexible, but benefit from higher interest rates

- … and can theoretically better profit from the compound interest effect

- the nest egg MUST always be available on the call money