Before you start investing your money as widely as possible in tangible assets, you should build up a buffer as a nest egg. This gives you a certain ease in life, as it makes it easier to cope with even unforeseeable expenses. In addition, reserves mean that you can slowly but surely leave the third step on the road to financial freedom. But in times of low interest rates and, above all, steadily rising inflation, it is not at all easy to park your cash reserves sensibly. They are steadily losing value.

One rule of thumb for a nest egg is that you should have at least three or six months’ salary on hand. For my part, I have a relatively high safety reserve that lets me sleep well. I usually have a full year’s salary sitting on the high side. It’s a good feeling to know that if I should ever lose my job. In an emergency, I then have more than a year to look for a new one without having to restrict myself in my daily life.

In addition, I am always liquid so that I can buy properly on the markets in crash times. Also, I have a move coming up this year for which I need to budget for a new living room and kitchen. I can pay for this out of petty cash, so to speak, without taking out a consumer loan.

Tripartite division of my reserves

However, my cash reserves are not just lying around in my checking account. Although a third of my liquid reserves are parked in the call money account of my house bank, earning a meager 0.001% interest per year, I have invested the majority with greater risk. Another third is in overnight and time deposit accounts in other European countries, which I do with the help of Zinspilot* and Weltsparen*. In the best case, this already yields 0.15% interest. However, I keep my distance from countries whose budgets are not exactly in good shape. I count countries like Greece, Italy or Latvia among them. Countries like France or Sweden are the safer choice for me, despite a certain currency risk.

More return is only possible with higher risk

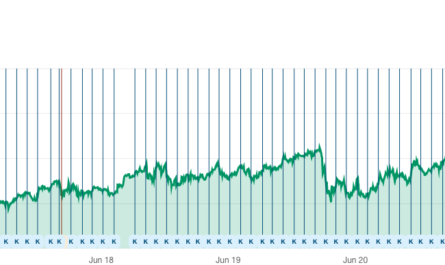

I put the last third in P2P loans and stable coins. On the P2P lending side, I lend my money exclusively through Bondora Gow & Grow* and earn a whopping 6.75% interest per year. I am aware that this position can theoretically run towards zero, but here already 100 euros generate more interest than the tenfold on the overnight money. On the other hand, I could easily absorb a loss of 100 euros.

My total investment on Bondora Gow & Grow* is significantly higher, but for me the ratio fits in percentage to the cash reserve and especially to the total assets.

Cryptocurrencies can also be an alternative

I have invested an even larger portion of the last third in Stablecoins*, lending them to my favorite platform for three months at a time, earning 12% interest per year, although the tax burden eats up a decent portion of the return, especially if I want to sell the coins again later. However, since the value hardly fluctuates, this is also acceptable for me.

Overall, I feel very secure in my nest egg and can sleep soundly. Even if I were to lose the risky third, I still have enough cash reserves available to be able to at least financially manage the unforeseeable. However, I would recommend an investment in EU foreign countries and a very small part in P2P loans to every investor.

In the next part of this small article series I will disclose my ETF strategy. This is followed by the disclosure of my investments in individual stocks and cryptocurrencies.

Keyfacts:

- one third is on low interest, but daily available on the call money of the house bank

- another third is parked on overnight and time deposit accounts in other EU countries

- The last third is divided into P2P loans and stable coins.

- higher interest rates are only available with more risk!