For long-term asset accumulation and thus also for additional retirement provision, favorable fees are an important criterion. In recent years, neobrokers such as Trade Republic* or Scalable Capital* have been the main providers of this. They usually enable share transactions at prices starting at around one euro per trade and offer monthly savings installments completely free of charge, even with small sums. This could be over by mid-2026 at the latest.

The reason: this week, negotiators from the EU member states and the European Parliament agreed on a new revision of the Markets in Financial Instruments Regulation and Directive (MiFIR/MiFiD II) and thus decided to ban “payment for order flow“. This will take away discount brokers’ biggest source of revenue and, in some cases, their entire business model, starting in July 2026. Although the paper still has to be approved by the EU finance ministers and the parliamentary plenum, this is considered a mere formality.

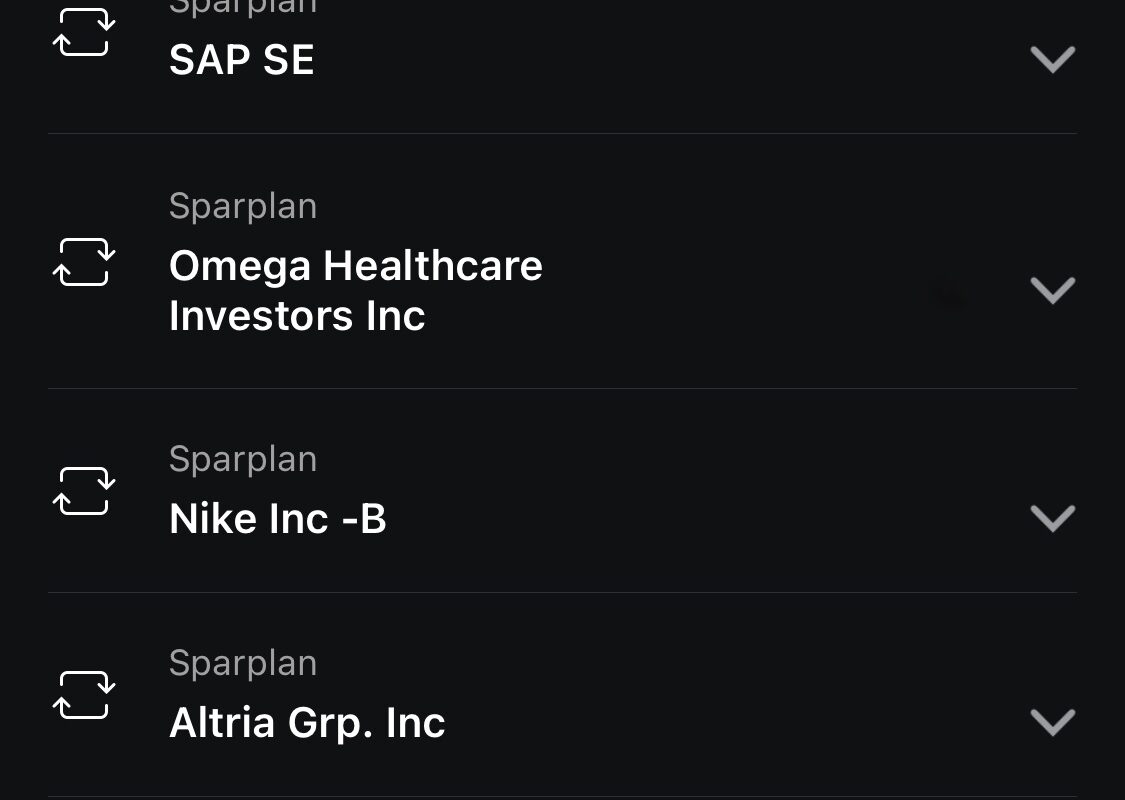

In short, brokers and banks were able to collect so-called kickbacks from the marketplaces and market makers if they forwarded their customer orders to them. Neobrokers thus received kickbacks when they executed their customer orders on a very specific exchange and were thus able to make the favorable conditions possible in the first place – one reason why Scalable Capital* and Trade Republic* execute via the Munich and Hamburg exchanges by default and, at least in the case of the latter provider, do not offer any other trading venue.

Supposedly more transparency, fewer trades

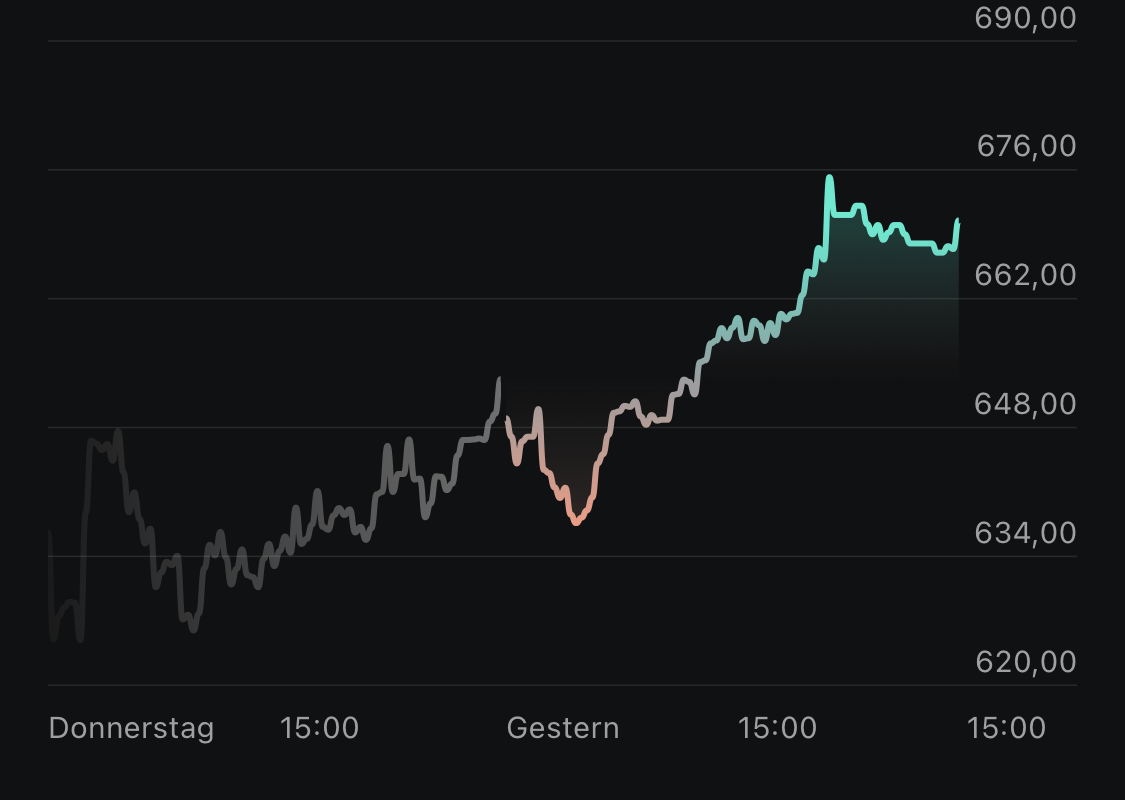

The reason given for the planned ban is that investors often do not know whether they are getting the best price when they buy, because the brokers in question do not have other exchanges on offer – competition between the trading venues would be circumvented. In fact, by placing limit orders, customers can set a maximum price for their planned stock purchase and thus hedge against undesirable prices. Moreover, if this is done during the peak trading hours between 4:00 and 5:00 p.m., there are the smallest spreads and thus the smallest deviations between each other due to the high liquidity on the market.

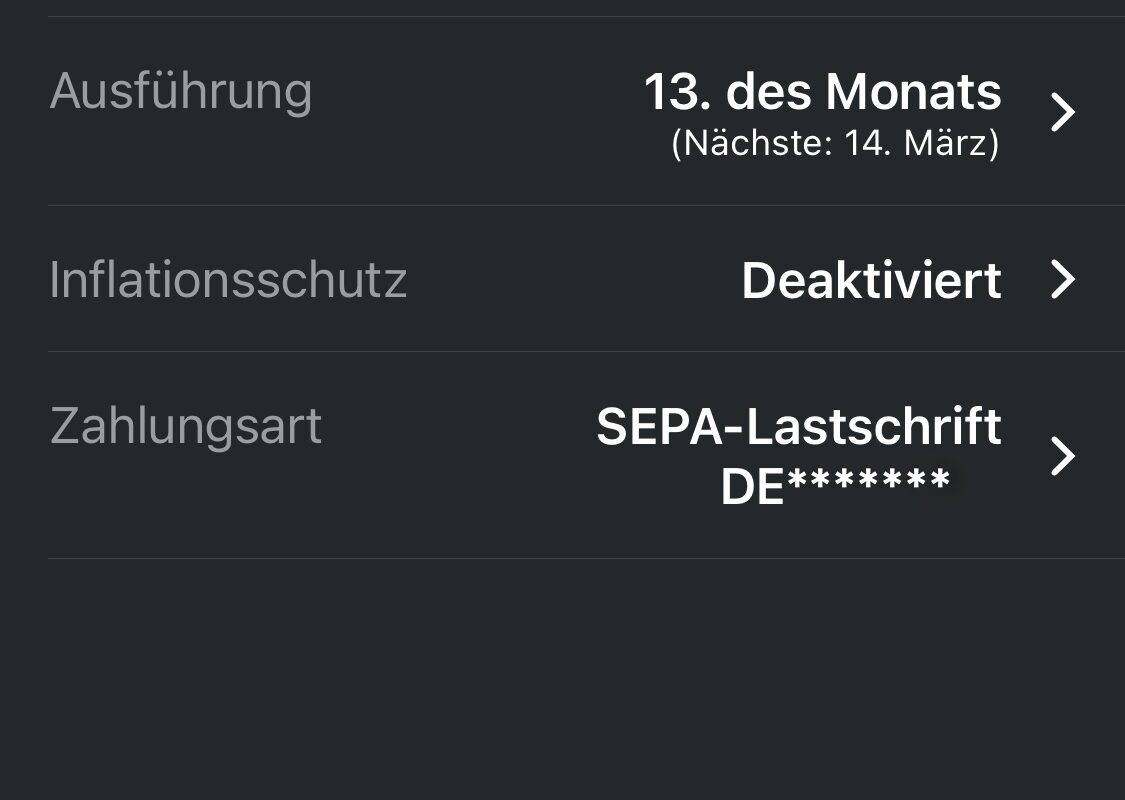

On the other hand, those who execute via a savings plan have no influence on the price anyway and are dependent on the execution times of their broker.In the long term over the decades, however, this circumstance plays only a minor role, whether one has acquired individual positions for a few cents more or less.Another argument for a ban on PFOF is that the low fees would lead to imprudent trades by customers.

A ban on the payment-for-order-flow method hits hard especially those who want to provide for their old age in the long term and in turn disadvantages those who can only act on the markets with small sums. If we had to return to fixed fees of 9.95 euros per trade, those who can act with high investment sums would pay the least in percentage terms. 10 euros on a stock purchase of 1,000 euros is just 1%, while the percentage on a volume of 300 euros is 3.3% – almost three times as much.

New pricing models are already being tested

Scalable Capital* shows that neo-brokers have long since addressed this problem: The Munich-based company is experimenting with its pricing model and testing how much customers are willing to pay for certain services. Those who trade a lot can take out a monthly subscription with Scalable Capital* and receive free trades. Those who also want interest on their liquid reserves in the reference account (2.6% p.a. as of August, by the way) pay another higher monthly fee of currently 4.99 euros.

Providers have three years to develop new fee models. For Germany, a grace period has been set until June 30, 2026. With the end of PFOFF, the EU is damaging the share culture – once again.