“ETF risks: This is how risky the MSCI World really is“, “Most important ETF stumbles: What investors should do NOW with their savings plan” or “MSCI World: World ETF under pressure” – these were the headlines of numerous media articles over the past few days. What initially sounds dramatic turns out to be mere clickbaiting, as the core statements of these very sensationalized articles are not really new and even occur regularly.

For example, the articles are often based on the fact that the MSCI World has lost 8% of its value in the last three months. Although these figures cannot be denied, such a decline is anything but unusual or even critical. By definition, a market correction only occurs when it amounts to at least 20 %. The MSCI World has never had such a drawdown and thus a maximum loss in value of more than 20 % since the last high.

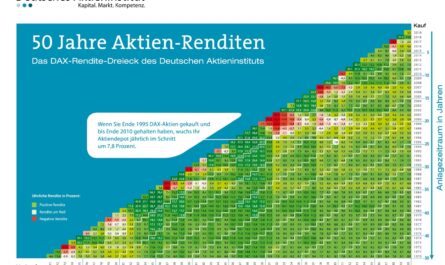

Moreover, three months is anything but representative when it comes to investing money, because on average a broadly diversified global ETF such as the MSCI World has generated returns of more than 7 % per year over decades. This can be seen even two weeks after the articles were published, because in the meantime the index has almost recovered the losses of this period. In phases like this, it is easy to continue saving. There are slightly more shares for the money than a few weeks ago.

No reform necessary

Nevertheless, some media even write that the MSCI World should be reformed because it has a high cluster risk due to an excessive US weighting. This fact, too, cannot be completely ignored, but once again it should not be regarded as critical. Firstly, this fact has been known for several years and it is therefore always recommended to include an additional ETF – for example one for emerging markets – in your savings plan.

Secondly, although the US companies listed in the index are domiciled in the USA, they operate worldwide. Microsoft only generates around 50% of its revenues in the USA, while Apple’s share is only just over 30%. The strongest index stocks are large corporations with global operations.

Do not be unsettled!

Although the articles are correct in essence, sensibly weighed up, such lurid headlines unsettle investors and may prompt them to make a few more changes to their portfolios. The strategist Carl von Clausewitz once said: “The enemy of a good plan is the dream of a perfect plan”. A long-term investment in a broadly diversified index is a good plan. The motto is simply to stick to it regularly for decades and continue to save diligently. You don’t have to constantly adjust your strategy. After all, someone is always raking in more returns!