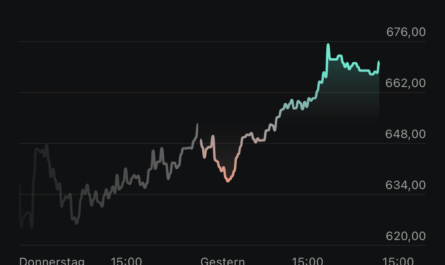

In order to put at least a little bit of a stop to the steadily rising inflation, which recently broke through the 10% mark in Germany, the European Central Bank (ECB) ended its low-interest policy and has been turning the interest rate screw again for a few months. A look at our call and time deposit calculator shows: The turnaround in interest rates is slowly but surely reaching savers.

If one had to look straight on the daily available savings account in the last year literally still for offers with regular interest credits, the banks seem to have gone now again into the competition and to make almost daily with new offers on itself attentive, in order to reach new customers. Meanwhile, those who commit to a term of three years are once again getting 3% per year. Even on overnight money without long maturities, the 1% interest mark was recently cracked again.

This is attracting many investors back to overnight and fixed-term deposit accounts. However, you should not put all your reserves into the first offer that comes along.

Interest rates may continue to rise

The upward trend in interest rates is probably not over yet. The ECB has already announced its intention to raise interest rates further. In addition, there are some banks that have been very hesitant to adjust their offers, or have not done so at all, and are still waiting to see how the situation develops. We therefore recommend remaining as flexible as possible and not being seduced by supposedly good conditions.

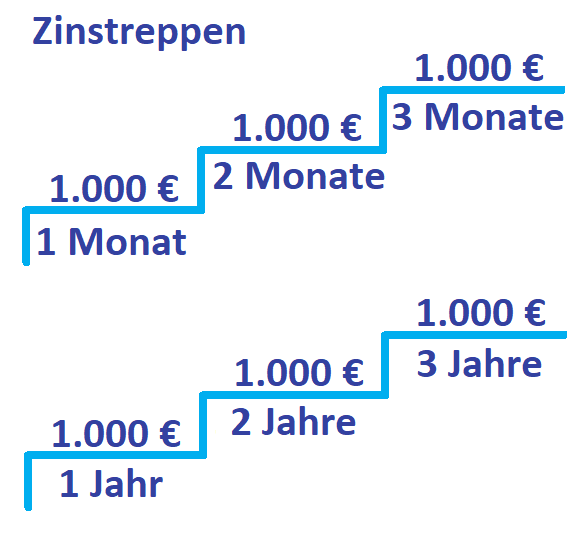

We recommend leaving the bulk of your nest egg in a good interest-bearing call money account and, if necessary, reallocating it. One can put on a part of the sum already now to better conditions on the time deposit, should hold back however a few tranches for possibly still better interest. Just here the structure of an interest staircase is recommended, as we had already presented it a few weeks ago on this blog.

In this case, the entire amount of the reserve is divided into several tranches and regularly converted into new savings deposits, so that you can always take advantage of the interest rate development to a good extent immediately and still remain quite flexible in terms of availability.

An interest staircase is recommended

Although all this cannot stop inflation for savers, it can at least cushion its effects a little. Overnight and fixed-term deposits are not suitable for long-term asset accumulation anyway, as interest rates are generally always below the inflation rate and savers thus steadily lose purchasing power, which will make up quite a bit over decades. Call money serves only as a nest egg and for planned, larger expenses.

Keyfacts:

- there are again interest rates on call money and time deposits

- the ECB will probably turn the interest rate screw even further

- the interest rate turnaround is therefore not yet over

- you should not invest all your money immediately

- an interest rate staircase is particularly suitable

- In the long term, call money and time deposit accounts are not suitable for asset accumulation.