Punctually at 2:00 p.m. German time, the Frankfurt Stock Exchange ended trading for the year 2022 on Friday, December 30. However, there was no real celebratory mood afterwards, as the DAX also closed with a negative sign on the last trading day of the year, ending the stock market year with heavy losses. It was one of the worst results in four years.

While Germany’s largest benchmark index, which was expanded to 40 companies this year, was still able to rake in a gain of almost 16% in 2021, geopolitical tensions in particular – driven first and foremost by Putin’s war of aggression on Ukraine – and skyrocketing energy prices as well as the high inflation rate caused strong sell-offs on the markets. Over the past twelve months, the DAX lost almost 13.9% of its value and once again closed below the magic 14,000-point hurdle. The 16,000-point mark from last year was quickly sold off, with the Dax falling to below 12,000 points at its peak this year, but was able to recover these losses in the summer.

There were also significant losses in the USA

On the U.S. markets, the declines were even more pronounced. The S&P 500 lost almost 27% of its value since its all-time high of around 4,800 points last year and exited trading before New Year’s Eve with a loss of around 19%. On the NASDAQ, the negative sign even amounted to more than 30%. Overall, it was a very volatile year. In some cases, prices fell by mid-single digits within a single day, only to close with slight gains at the end of the day. Among the culprits were the central banks with their aggressive monetary policy, especially their verbal communication. Interest rates rose at a record pace, which did not exactly boost the stock markets.

Also hot this year were the crypto markets. While bitcoin, as the main reserve currency of this asset, recently correlated very well with the traditional markets, it often ran independently this year. However, it rumbled here as well: The attack on the TerraLUNA ecosystem and the associated total loss dragged the Bitcoin price down with it. Numerous bankruptcies of large platforms up to the third largest crypto exchange FTX did the rest.

During the last twelve months, the bitcoin price dropped by almost 64%. At the turn of the year, one Bitcoin cost about 16,500 US dollars. Not quite a year ago, the price stood at almost 69,000 US dollars at times. That is a loss of over 75%.

Our personal return on investment

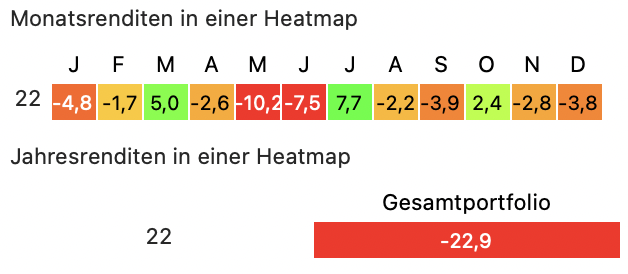

Our personal returnaOur long-term investments also returned a negative return in 2022. The overall portfolio recorded a loss of 22.9%. These high losses are mainly due to the bull run on the crypto market. Without our cryptoassets, the minus would have been much smaller at just under 9%, which means that the stock portfolio had performed better than the overall market.

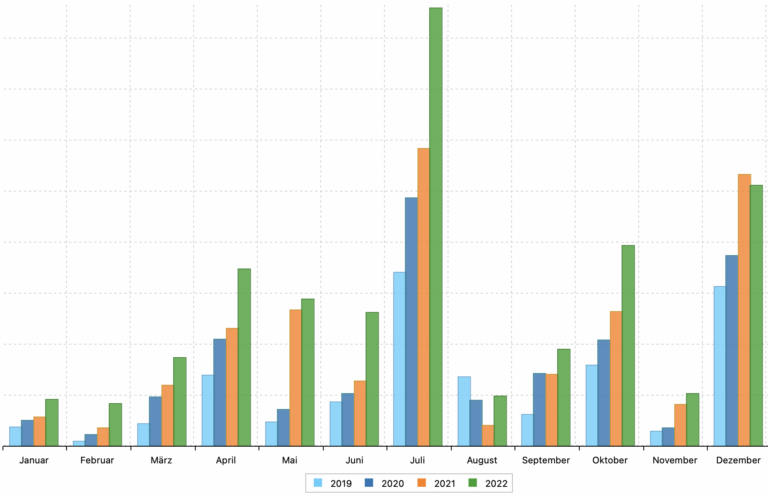

Looking at our monthly dividend payments, we recorded new highs and were able to tick off quite a few more days in our freedom calendar. Meanwhile, our monthly cash flow from passive income covered our fixed costs for not quite two months. Due to the higher allowance for capital gains and our further deposits, we also expect higher net distributions in 2023.

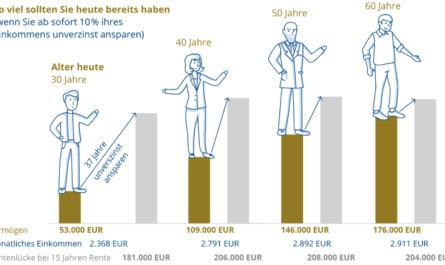

We almost don’t care about the price development: at new highs we are happy about a steadily growing fortune, at falling prices we simply accumulate more shares at a cheaper price – over decades the automated money investment via savings plan is the most powerful tool after all.

We continue to stay on the ball and look forward to the next experiences we will have! Good returns all the time!