In everyday life, many people tend to spend money almost unconsciously. Whether it’s coffee-to-go in the morning, a quick burger at the local pub at lunchtime, the odd sweet from the supermarket or the new T-shirt from the shop window. There are dangers lurking almost everywhere that tempt us to spend money all the time. It may seem like a small expense, but it adds up to quite a bit over the course of a year. Extrapolated to our long-term financial investment, we even miss out on a few thousand euros. If you take a few tricks to heart in everyday life, you can save a lot of money without really having to cut back.

Budget book and shopping list

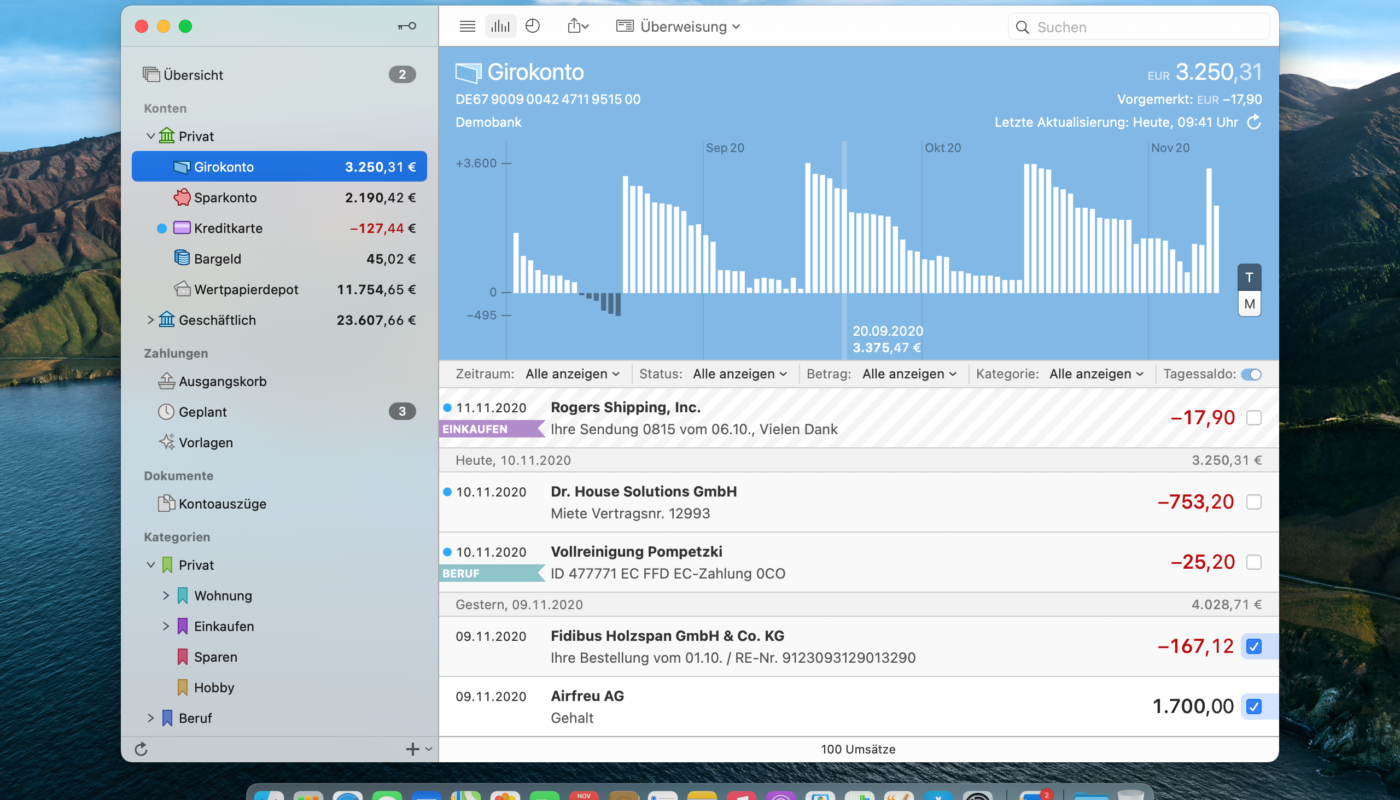

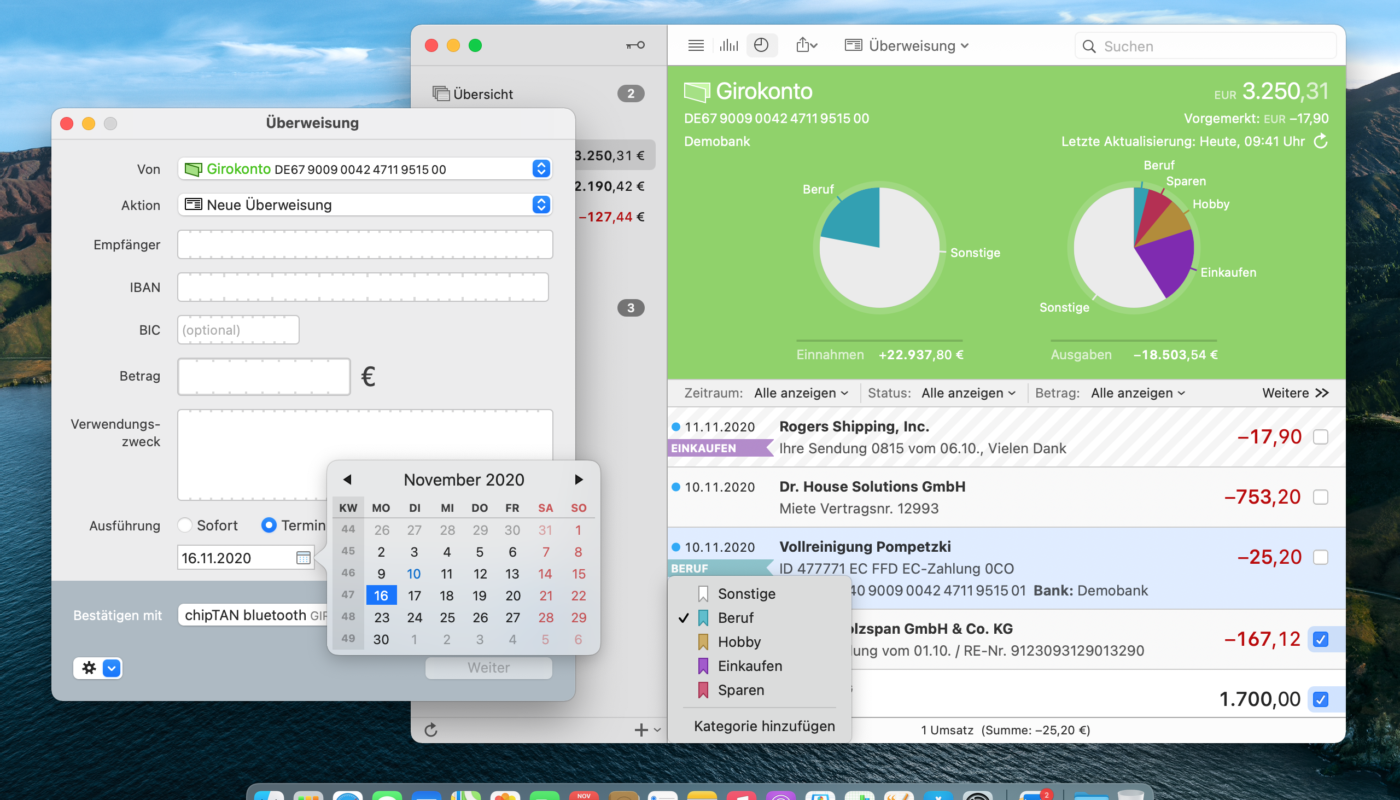

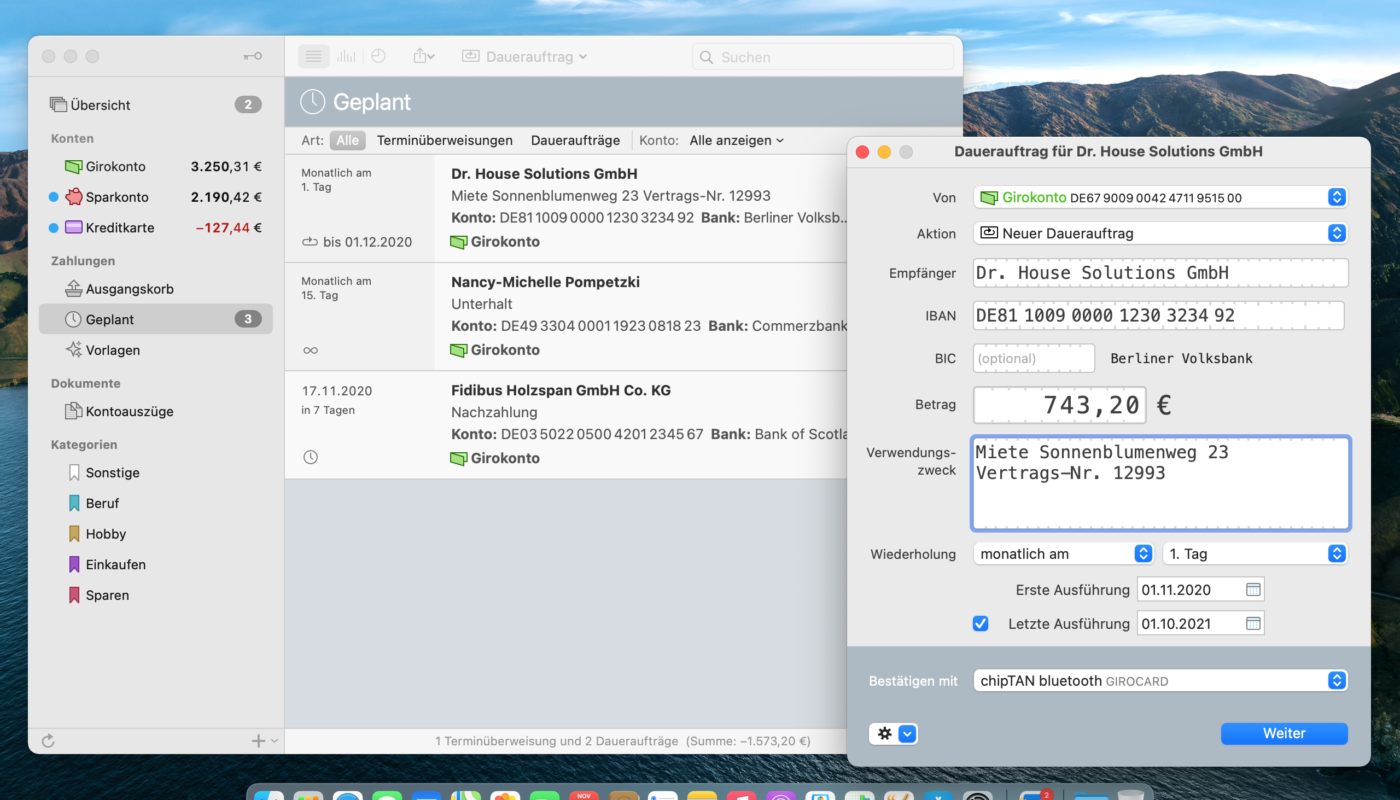

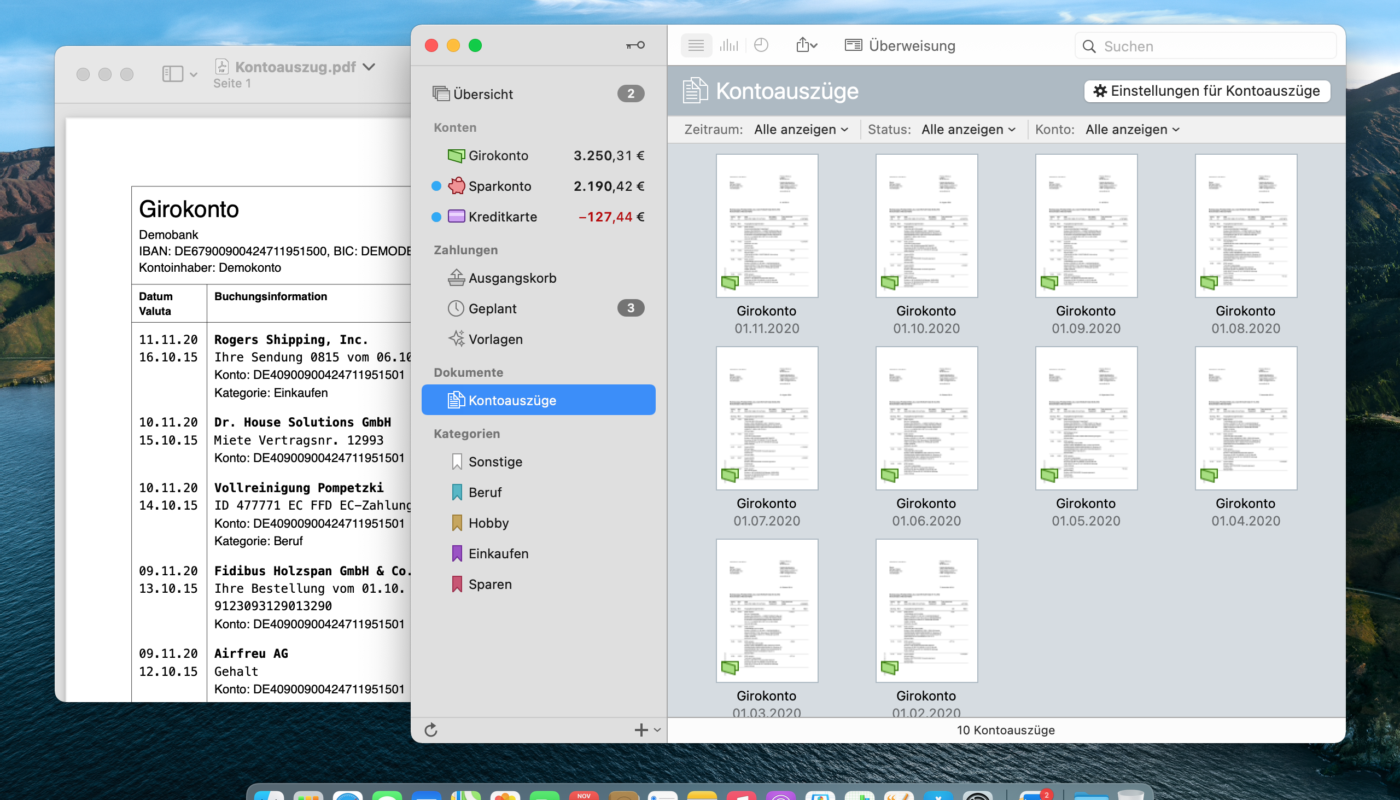

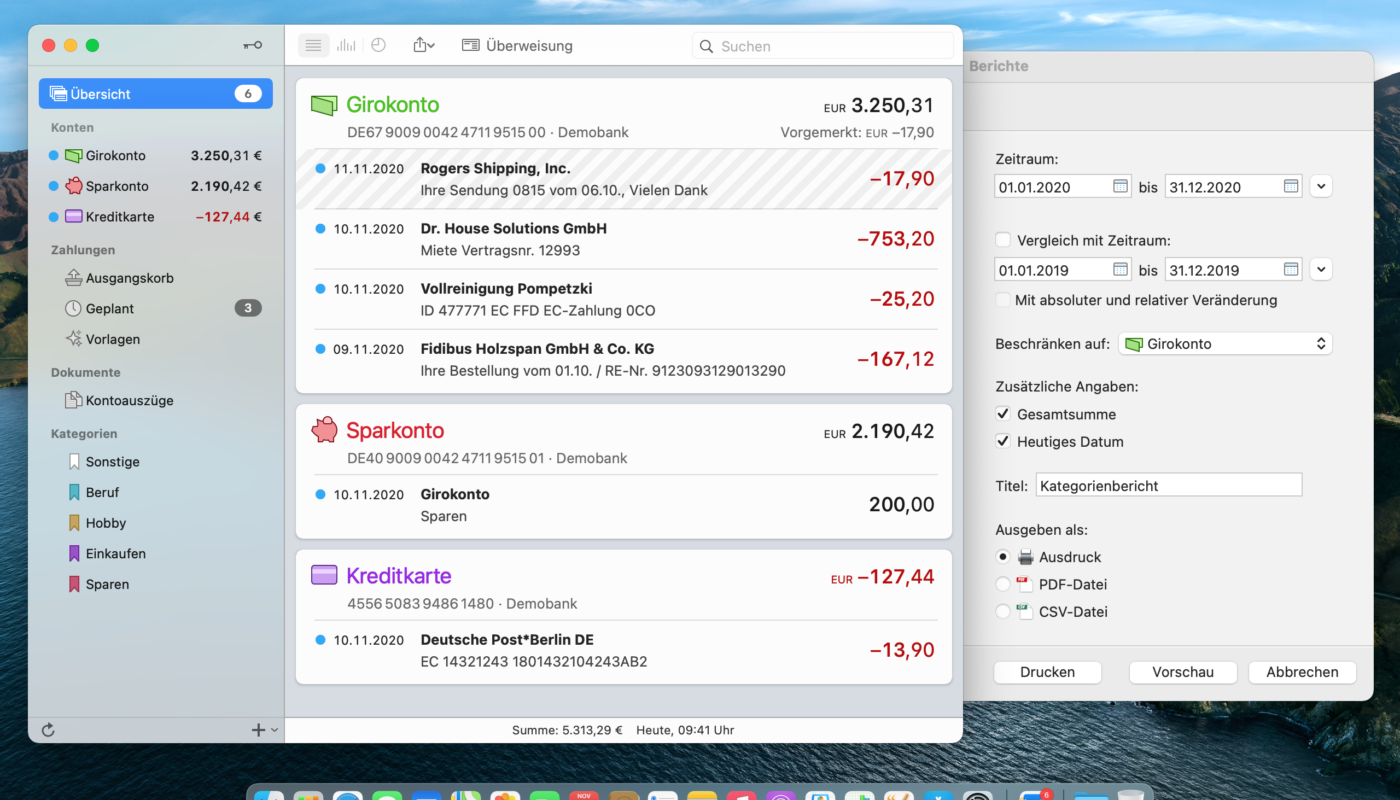

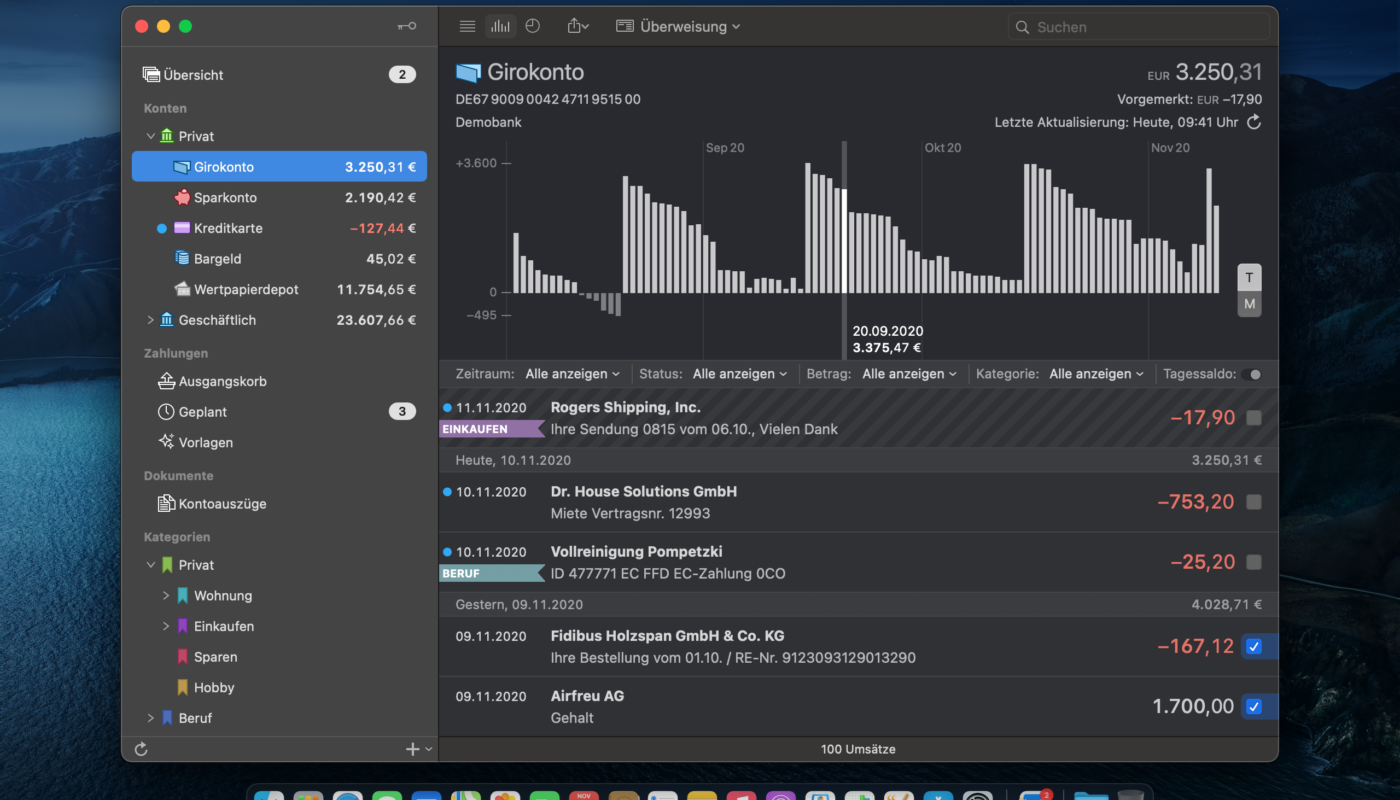

The most important rule for this we had already pointed out at the start of this blog: Keeping a budget book. If you don’t meticulously write down what you spend and how much you spend each month, you’ll never know how much money you’re throwing away on useless things, but you’ll also never discover additional savings potential for yourself. Only those who have an exact overview of their expenses have a real overview of their finances and can react in time. In doing so, it is important to include even the small expenses in a disciplined manner! This works conveniently via a smartphone app that synchronizes with the desktop application via the cloud.

Anyone who has done this for a while will quickly realize that it is mainly impulse purchases that cost us money and yet only give us pleasure in the very short term. It is therefore important to reduce these impulse purchases in everyday life, and in the best case to avoid them completely. The first mental trick, to simply face them, also requires discipline like keeping a budget book, but is quickly integrated into everyday life: Writing a shopping list.

Shopping lists prevent impulse buying

Before every purchase, we sit down calmly in front of the desk and write down which things we really need.This applies not only to consumer goods such as toothpaste, detergent or dishwasher tabs, but also to food shopping.When you think about what you want to eat in the next few days, you pick out the ingredients you need for it and put them on your shopping list.

Once you get to the supermarket, you then work through this list in its entirety, completely disregarding all the other goodies and deals in the store. You are not tempted to spend more money than you had actually planned. In front of the shelf, you then only compare the prices with the help of the price per kilo. Different package sizes make the comparison more difficult. Using cashback programs also saves money.

In addition, we should refrain from buying expensive ready-made meals or using the delivery service in the evening, but rather always cook ourselves. Instead of meeting friends regularly at the pub, we can invite them directly to our place. The beer is much cheaper there and cooking together is also much more fun! That saves a few more euros without having to restrict ourselves in everyday life!

Only buy something that replaces existing

Especially when buying clothes, the following applies: Only buy something if you banish something from your closet in return.

You only buy something if it replaces something old.On the one hand, this prevents overflowing closets, but also ensures that we reconsider our existing possessions. For more expensive purchases, it’s worth sleeping on it for 30 days. If we find that we still want a purchase 30 days after our initial consideration, then we should make the expenditure. Of course, this doesn’t work with things that are important to our daily lives that we need to replace because of a defect. The rule merely prevents us from, for example, prematurely buying a new smartphone or purchasing a new game console, even though we won’t be so happy with it in the end.

If we come across a product directly in the store and are unsure whether we really need it, we simply take it with us for ten minutes and continue looking around. If the product still appeals to us after those ten minutes, we may buy it.

Borrowing can be better than buying

We don’t have to buy a drill just for one-time use. If you only want to record your friend’s wedding on video and don’t have much else to do with video recording, you don’t need to buy your own video camera.For technical equipment in particular, there are now numerous services that provide insured products for a fee. And if in doubt, you always know someone who will lend you the product for a small fee.

Check expenses regularly

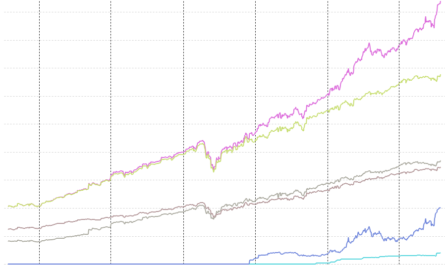

We regularly check our expenses via the budget book. But this also applies to expenses such as the telephone provider, the electricity tariff or insurance. Here we should also regularly check whether the offer still meets our needs or the market does not already make better offers that would make a change worthwhile from a financial point of view. Switching electricity providers often brings with it a nice financial bonus. However, the product for us remains the same in the end.

In addition, we should always check whether we still use our Netflix and Spotify subscriptions regularly, or perhaps even cancel them. The same applies to the smartphone plan. Do we really need 30 GB of data volume per month or has our usage behavior possibly changed? Is our rate really the cheapest?

From time to time, we should review all of our contracts.

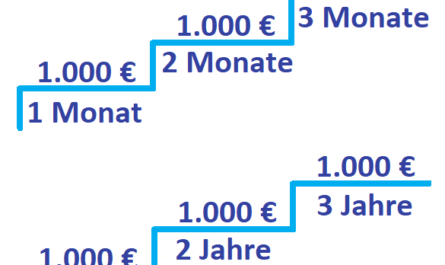

Never use credit for consumption

The most important thing in all of this: Never take out a loan for your own consumer spending! While it’s tempting to use 0% financing to get the latest TV, if you do this often, you’ll quickly reach the limits of your monthly cash flow and may have to shift payments to a costly loan to service them at all. That costs a lot of money in the long run.

Keyfacts:

- Keeping a budget book sharpens your eye for your own expenses

- a shopping list, which is worked off dully, prevents impulse purchases

- compare prices per kilo, avoid convenience foods and use cashback programs

- always cook for yourself and invite friends over instead of going to the bar

- It is better to borrow products that you use infrequently

- contracts, subscriptions and other services should be reviewed regularly

- never make consumer expenditures on credit!