In the life of an employee, the pay slip and the pension statement are two of the most important documents. They provide information about income, but also about the financial future. However, both documents are not very comprehensible to the average citizen, are far too opaque and, above all, are not complete, which often distorts the image of the employer and the German pension insurance. While the former supposedly pays far too little and has hardly any levies, everything is fine with the latter.

Why it is so important to make pay slips and pension notices transparent and honest is what this article will discuss.

Better comprehensibility promotes financial literacy

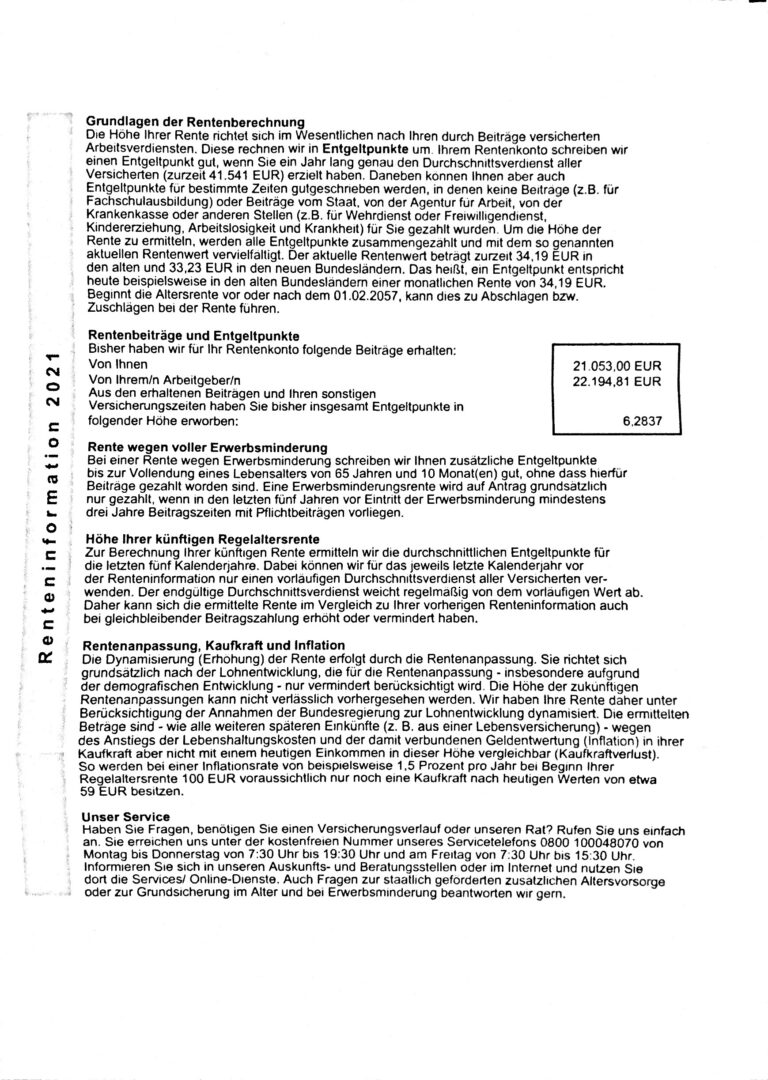

We have already gone into detail in this blog about the fact that the pension notice in particular is not very comprehensible and sometimes even omits detailed information. For example, the notice hides a clear indication that the sums listed are gross amounts from which health and long-term care insurance contributions and, if applicable, taxes are deducted. Only in the prose text it is referred to it without however descriptive payments to call.

A calculation on today’s basis would sharpen the consciousness with the contribution payers that everyone should provide additionally, in order not to have to accept later clear cutbacks or to slip with small income into age poverty. Instead, there is a lot of talk about possible pension increases, although these rates of increase are well below the rate of inflation. The situation is glossed over instead of clarified.

It’s a similar story with the monthly payroll. Although absolute figures are given here, which each employee pays to the social security funds and the state, this is also only half the truth. It would be better to mention the employer’s gross amount in order to make it clear that one’s own job costs the employer much more than stated. Both parties share the statutory social security contributions, which means that the employer’s gross pay is ultimately higher than the employee’s gross pay due to the ancillary wage costs.

For example, the employer also pays 9.3% into pension insurance, 1.3% into unemployment insurance, 7.3% into health insurance and 1.7% into long-term care insurance for his employee. In addition, there is a possible additional contribution for the statutory health insurance. An alleged gross wage of 3,000 euros results in a total burden of slightly more than 3,600 euros for the employer. In the end, the employee only receives just under 2,000 euros. This gives the impression that the employee’s own work only costs 3,000 euros and is worth 2,000 euros.

Transparency strengthens trust

Transparent calculation and disclosure of all important payments in the pay slip as well as the pension statement could not only improve people’s financial planning, but also strengthen trust in the social systems on top of that. If people get the feeling that the calculations are fair and comprehensible, they are more willing to invest in these systems and could be confident of being secured in old age or recognize when the state should make improvements – for example, with a stock pension or, after all, a generational capital.

Those who disclose everything honestly and transparently create mature citizens and improve personal responsibility for all. In the end, fewer citizens will be on the government’s payroll, and thus the community’s. Non-transparent pay slips and pension statements lead to errors in financial planning or to misunderstandings. People earn less than they should or do not receive the full pension to which they are entitled. More transparency can prevent such mistakes.

If everyone receives a transparent and clearly understood statement, it can promote gender equality in the workplace. When everyone understands how salaries are calculated, it becomes harder to hide discrimination and unequal pay. Transparency promotes individual accountability.

Conclusion

Transparency of pay stubs and pension notices is critical in building citizens’ trust in social systems, promoting financial literacy, and preventing errors. Governments and employers should therefore take care to make documents as clear and understandable as possible to ensure the financial security and well-being of citizens. Above all, they should not omit information or gloss over facts.