When it comes to investing money, not everyone immediately dares to take the plunge and try the stock market right away with their hard-earned money. The fear of losses is often too great. There are, however, a few tricks that alleviate the fear of the capital markets, or which help to be able to try it out without having to invest your own money.

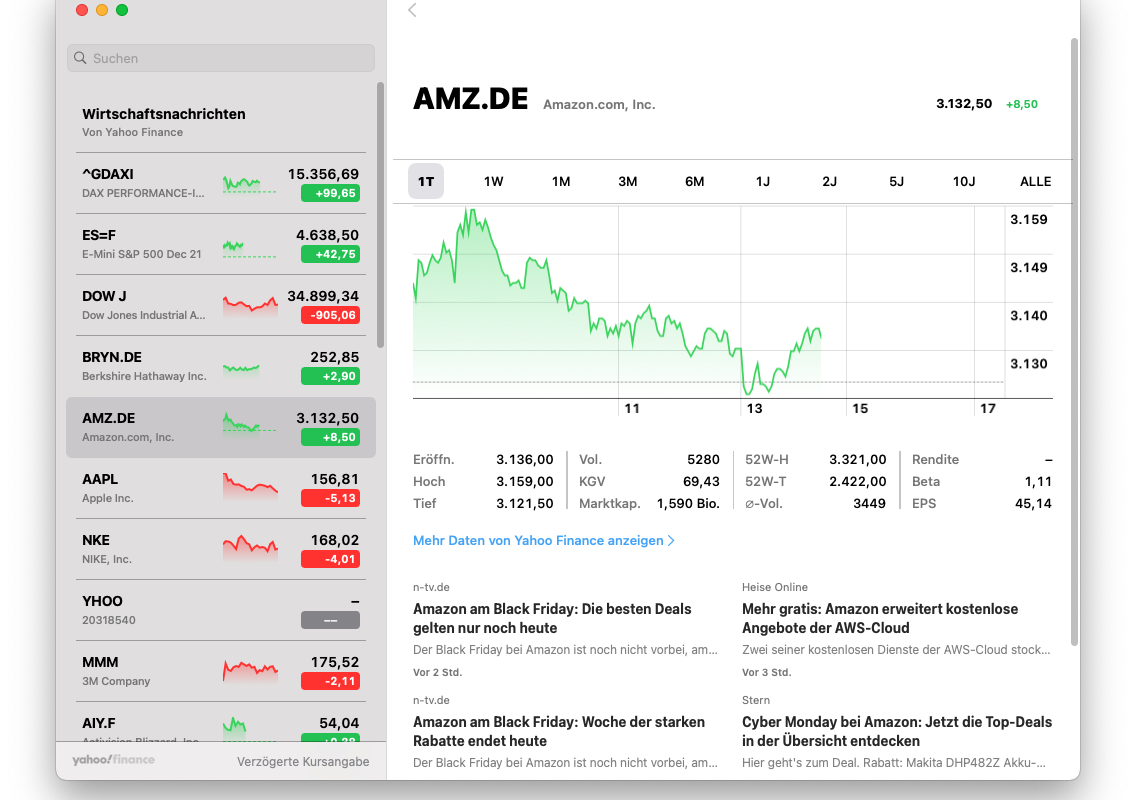

The easiest way is to set up a demo account or a watchlist, both of which are offered free of charge by many banks and brokers. The desired shares can be booked in any number in a virtual depot, so that one can see their development from time to time. You get a first feeling for what the daily fluctuations on the stock market mean. You gain your first experience in dealing with them. On the other hand, you can put all the shares that you plan to buy in the future on a watch list. This is also a good vehicle to be able to test the potential development without own money.

Community-Depot: Exchange with others

So-called community depots are much more exciting. Here, a third party asks his followers about their favorite shares and lets them vote on them at the end. Afterwards, these shares are bought with their own money. The community not only has a say in the composition of the portfolio, but is also regularly updated and informed about the performance.

An even more important advantage: In contrast to your own watchlist or the virtual demo depot, you are not left to your own devices. Within the community, there is usually a lot of discussion about stock selection, so that you can learn about the thought processes of others and draw your own conclusions. One learns from others, exchanges ideas and expands one’s personal wealth of experience, until at some point all fears for investing money on one’s own responsibility have disappeared.

For example, Torsten Tiedt and his YouTube channel Aktienfinder, which I already discussed in more detail in the presentation of my financial bubble, have such a community depot. However, his Starter Depot has already been successfully stocked and the project has been running for several months. It is over three years old.

The situation is different with insyt.finance. Here, they have only recently launched a corresponding project. Via Instagram, the four founders regularly search for the most exciting stocks from various industries and categories within their community. From all the stocks sent in, the two most frequently mentioned suggestions are then put to the vote in a poll.

Shifting risk and profit to others

The winner of this poll will then be bought by the financial start-up, creating a real stock portfolio with around 20 to 30 stocks and a nominal value of 25,000 euros. The community portfolio is designed for the long term and the team intends to provide its community with regular updates as to actual performance. But also in case of possible shifts in the weighting or in sales and re-buys, the team relies on a lively exchange.

Behind insyt.finance are Alex, Christoph, Roberto and Paula, who all studied at the University of Maastricht and are mainly involved in investments in the real estate and construction business, but of course also within the financial industry or have taken a technical and data-driven path. Together they have created an app that not only allows a portfolio analysis of one’s own portfolio of stocks and ETFs, but also provides many important statistics and data on stock and cryptocurrencies. Also integrated are an ETF finder, a news section, an investment planner, and an academy that includes many knowledge topics related to investing.

In my early days, I populated a demo account as well as created a watchlist. I still follow community projects with great interest. However, since it is now possible to invest in ETFs completely free of charge even with a small amount of money, I would always follow such a path in parallel. Three simple strategies and the appropriate brokers I had already presented in detail in separate articles.

Keyfacts:

- Demo depots, watch lists and community depots help to get started

- Community depots promote exchange among each other

- many YouTuber and blog operators create such depots

- In parallel, however, you should start with a small ETF savings plan.